Cosmos (ATOM)

Cosmos (ATOM)

- 72Social Sentiment Index (SSI)+74.39% (24h)

- #50Marktimpuls-Ranking (MPR)+21

- 524-St. in Social Media+400.00% (24h)

- 80%24 Std-Bullisch-Verhältnis4 aktive Meinungsbildner

- ZusammenfassungATOM holding rate hits a new high of 61.5%, governance upgrade proposal launched, social heat up 74%, price slightly retreated to $2.10, technical support formed.

- Bullische Signale

- Staking ratio hits new high

- Governance upgrade proposal launched

- Social heat +74%

- Downward channel support rebound

- Sphinx testnet launching soon

- Bärische Signale

- Price down 1.64%

- Active addresses decreasing

- Gini coefficient high

- Unique addresses declining

- Channel still descending

Social Sentiment Index (SSI)

- Daten insgesamt72SSI

- SSI-Trend (7-Tage)Preis (7 Tage)StimmungsverteilungExtrem bullisch (20%)Bullisch (60%)Extrem bärisch (20%)SSI EinblickeATOM social heat is high (71.5/100, +74.4%), social activity up 300% and KOL attention +1100% driven, sentiment dropped to 19.5/30 (-35%), corresponding to a record‑high holding and governance upgrade proposal launch.

Marktimpuls-Ranking (MPR)

- WarnungseinblickATOM warning rank rose to #50 (↑21), social anomaly reached 100/100 (+746.6%) and KOL attention shift ↑500%, sentiment polarization only 9.65/100 (-90.3%), linked to record‑high holdings and governance proposal launch.

Beiträge auf X

CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.94K @IvanM10529875

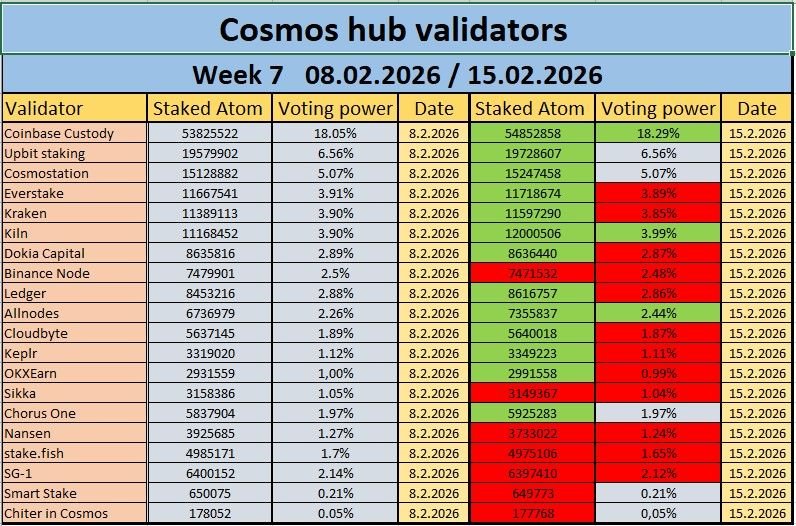

CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.94K @IvanM10529875Top $Atom validator delegation ⚛️ https://t.co/KHWnTXJ43v https://t.co/PJ3J44Vyxh

CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.94K @IvanM10529875

CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.94K @IvanM10529875Top $Atom validator delegation ⚛️ https://t.co/DlF5i6TYjI https://t.co/BBWOxbURvs

1 0 108 Original >Trend von ATOM nach VeröffentlichungBullischCosmos Hub validator delegation data is positive, indicating a healthy and highly engaged ATOM network.

1 0 108 Original >Trend von ATOM nach VeröffentlichungBullischCosmos Hub validator delegation data is positive, indicating a healthy and highly engaged ATOM network. bill morgan FA_Analyst OnChain_Analyst A27.00K @Belisarius2020

bill morgan FA_Analyst OnChain_Analyst A27.00K @Belisarius2020🎶 What’s love but a second hand emotion🎶

Cosmos Airdrops 🪂 D118.14K @Cosmos_Airdrops

Cosmos Airdrops 🪂 D118.14K @Cosmos_Airdrops$ATOM price on Valentine's Day 💔 2020: $5.08 2021: $20.20 2022: $26.77 2023: $13.30 2024: $10.28 2025: $4.95 2026: $2.16 It’s a tough love. https://t.co/s35hYHS8pj

1 1 1.14K Original >Trend von ATOM nach VeröffentlichungExtrem bärischATOM price has been continuously falling since 2022, and the tweet predicts it will continue to drop sharply in the coming years.

1 1 1.14K Original >Trend von ATOM nach VeröffentlichungExtrem bärischATOM price has been continuously falling since 2022, and the tweet predicts it will continue to drop sharply in the coming years. Jonathan Carter Technical Analyst Trader A9.04K @JohncyCrypto

Jonathan Carter Technical Analyst Trader A9.04K @JohncyCrypto#ATOM Descending Channel Support Bounce🧐 Cosmos is bouncing from the lower boundary of a descending channel formation on the weekly timeframe👀 Price action is holding above this key support zone, which could serve as a strong foundation for a reversal💁♂️ Target levels: $2.80 → $5.55 → $8.00 → $10.50 → $14.50🎯 Stop-loss: $1.65⛔️

20 0 826 Original >Trend von ATOM nach VeröffentlichungExtrem bullischATOM is bouncing off the descending channel support level, with a strong reversal potential and a target price up to $14.50.

20 0 826 Original >Trend von ATOM nach VeröffentlichungExtrem bullischATOM is bouncing off the descending channel support level, with a strong reversal potential and a target price up to $14.50. Airdrops Educator FA_Analyst D146.14K @Airdrops_one

Airdrops Educator FA_Analyst D146.14K @Airdrops_oneSphinx Protocol - Incentivized Testnet 🛠️ Coming Q1 2026 👇 What is @SphinxProtocol: ▫️L1 built on @cosmos SDK (CometBFT consensus + CosmWasm) for institutional commodity derivatives - futures, options, perps on oil, gas, electricity, etc. 24/7 trading. EVM compatible. Testnet opportunity: ▫️Complete TaskOn quests to earn "Papyrus" role -> +4% points multiplier for incentivized testnet. FCFS ➡️ https://t.co/8gfJulx3fa 🫡

17 2 2.15K Original >Trend von ATOM nach VeröffentlichungBullischSphinx Protocol announces an incentivized testnet, built on the Cosmos SDK, focusing on institutional commodity derivatives.

17 2 2.15K Original >Trend von ATOM nach VeröffentlichungBullischSphinx Protocol announces an incentivized testnet, built on the Cosmos SDK, focusing on institutional commodity derivatives. CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.94K @IvanM10529875

CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.94K @IvanM10529875Cosmos Hub ( $ATOM ) Network Snapshot – February 14, 2026 ⚛️📈 Fresh on-chain pulse from the @cosmos Hub. Price holding steady around $2.20, staking ratio climbing to new highs, and governance heating up with a major upgrade proposal live. Here’s the full breakdown: 1. Core Network & Market Stats - Total Supply: 493,302,764 $ATOM - Circulating Supply: 493,295,851 $ATOM - Current Price: $2.20 - Market Cap / FDV: $1.09B – $1.10B - Block Time: 5.87 seconds - 24h Transactions: 24,287 successful (82 failed) - Staking APR / APY: 14.77% / 15.9% (30-day avg ~14.93%) - Percent Staked: 61.50% (new ATH territory) - Total Staked: 303.19M $ATOM (~$667M) 2. Growth & Activity - Unique Addresses: 1,475,139 (↓125 in 24h | ↓6,257 in 7d) - Unique Delegators: 1,131,275 (+36 in 24h) - 24h Active Addresses: 7,884 - 30-day Rolling Active Addresses: 946,860 - Total Stake Change: +0.1457% (24h) | +0.5755% (7d) | +3.5574% (30d) 3. Decentralization Metrics - Gini Coefficient: 0.781 (still concentrated) - Nakamoto Coefficient: 4 (top 4 control >50%) - Top 100 Delegators’ Stake Share: 56.64% - Active Validators: 180 - Validators Below Avg Voting Power: 144 - Inactive Validator Stake: 2.6M $ATOM (~0.87% | ~$5.8M) 4. Undelegation & Liquidity Signals - Unbonding Period: 21 days - Pending Undelegations: ~509K (1d) | ~1.6M (7d) | ~7.2M $ATOM (all) - Pending Count: 7,461 - Undelegation as % of Total Supply: 1.47% - As % of Not Staked Supply: 3.81% 5. Liquid Staking (Last 24h) - Total Liquid Staked: ~6.13M $ATOM (↓370K) - Stride: ~3.49M $ATOM (dominant, ↓379K) - Drop: ~2.62M $ATOM (+1.2K) - Quicksilver: ~18.5K $ATOM → Net outflows continue, but Drop showing slight resilience. 6. Token Burn Activity - Total Burned to Date: 50,147 $ATOM (~$217K at current price) - Last 30 Days: 1,311 $ATOM - Last 7 Days: 324 $ATOM - Today: 34 $ATOM - Largest Burn Day: 153 $ATOM (Dec 4, 2025) → Steady deflationary pressure building. 7. Top Validators by Voting Power 1. Coinbase01 – 18.25% (~54.9M $ATOM) | 20% commission 2. Upbit Staking – 6.61% (~19.9M) | 100% commission 3. Cosmostation – 5.07% (~15.2M) | 5–20% 4. Kiln – 3.99% (~12.0M) | 8–20% 5. Everstake – 3.90% (~11.7M) | 8–20% 6. Kraken01 – 3.86% (~11.6M) | 10–20% 7. DokiaCapital – 2.87% (~8.6M) | 15% 8. Ledger by Chorus One – 2.87% (~8.6M) | 7.5% 9. Blockdaemon – 2.71% (~8.2M) | 10% 10. Binance Node – 2.49% (~7.5M) | 5% 8. Governance Proposals Live - #1024: Gaia v26.0.0 Upgrade – In Voting | 4,733 votes | 89 validators | 34.76% Yes | 1d 20h left 🌐Link: https://t.co/Fw0Qvyg227 - #1023: Recover IBC Client for Bostrom – Rejected 9. Weekly Pulse (Feb 1–7) - Price: $2.00 (+3.1%) - Active Addresses: 84,860 - Transactions: 220,653 - Burned: 366.6 $ATOM - Stake: 301.4M (+0.8%) - Undelegations: 7,850 (124.6K $ATOM) - Gini / Nakamoto: 0.779 / 4 10. Top Addresses (by balance) 1. bonded_tokens_pool – 299.9M $ATOM (60.8%) 2. distribution – 25.3M $ATOM 3. cosmos1p3ucd... – 22.5M $ATOM ... (many large wallets & pools) Quick Takeaway $ATOM at $2.20, MC $1.09B, staking at 61.5% (highest in months), APR still juicy ~15%. Burn is ticking higher, liquid staking seeing outflows, but Nakamoto at 4 remains a decentralization watchpoint. Major Gaia v26 upgrade voting now – could be a catalyst. Sourse: @SmartStake Is Cosmos finally waking up? Or still in accumulation? Drop your thoughts 👇 #CosmosHub #ATOM #CosmosEcosystem #CryptoStaking #DeFi #Blockchain #TokenBurn #LiquidStaking #Web3 #OnChain

31 3 1.22K Original >Trend von ATOM nach VeröffentlichungBullischATOM price remains steady at $2.20, staking ratio hits a new high, and the upgrade vote could act as a catalyst. Cryptosailor FA_Analyst Influencer B2.19K @robertdavid010

Cryptosailor FA_Analyst Influencer B2.19K @robertdavid010People underestimating Cosmos tech. All the degens just crying about token price, when they are the ones who pressured to sacrifice sustainability for short term price action and more crypto casino projects. Long term vision is the key during this tech revolution!

Chiter in Cosmos ⚛️ D701 @Chiter_inCosmos

Chiter in Cosmos ⚛️ D701 @Chiter_inCosmos🏆 Big performance upgrade in @cosmos! ✅ @cosmoslabs_io ran serious load testing on the entire stack. Key results: 🔷 Real transactions up to 2000 tx/s 🔷 Stable 1800 tx/s (previously the network started choking at 400–600) 🔷 Block times under 2 seconds (used to hit 6–8 seconds under load) 🚀 Cosmos is now much faster and more stable under heavy traffic. Next goal: 500 ms blocks and 5000 tx/s — that’s already a level where big DeFi, RWA, and financial apps can run smoothly. ⚛️ Validator @Chiter_inCosmos is very happy with this progress — we’re closely following the news and development of the ecosystem, and we see @cosmoshub really speeding up and getting ready for mass adoption! 🎯 Full details in the original article: https://t.co/Srlz7EH3qC #CryptoNews #Cosmos #Web3 #Defi $Atom #RWA #IBC #CosmosHub #ATOM

3 0 81 Original >Trend von ATOM nach VeröffentlichungExtrem bullischCosmos performance leaps, 1800 tx/s, 2‑second blocks, moving toward massive adoption.

3 0 81 Original >Trend von ATOM nach VeröffentlichungExtrem bullischCosmos performance leaps, 1800 tx/s, 2‑second blocks, moving toward massive adoption. Tanned.edge🦭 🧬⚛️🦣🦥⛽️🏕️🧪(Ø,G)🥷 DeFi_Expert Influencer B2.00K @crabetan

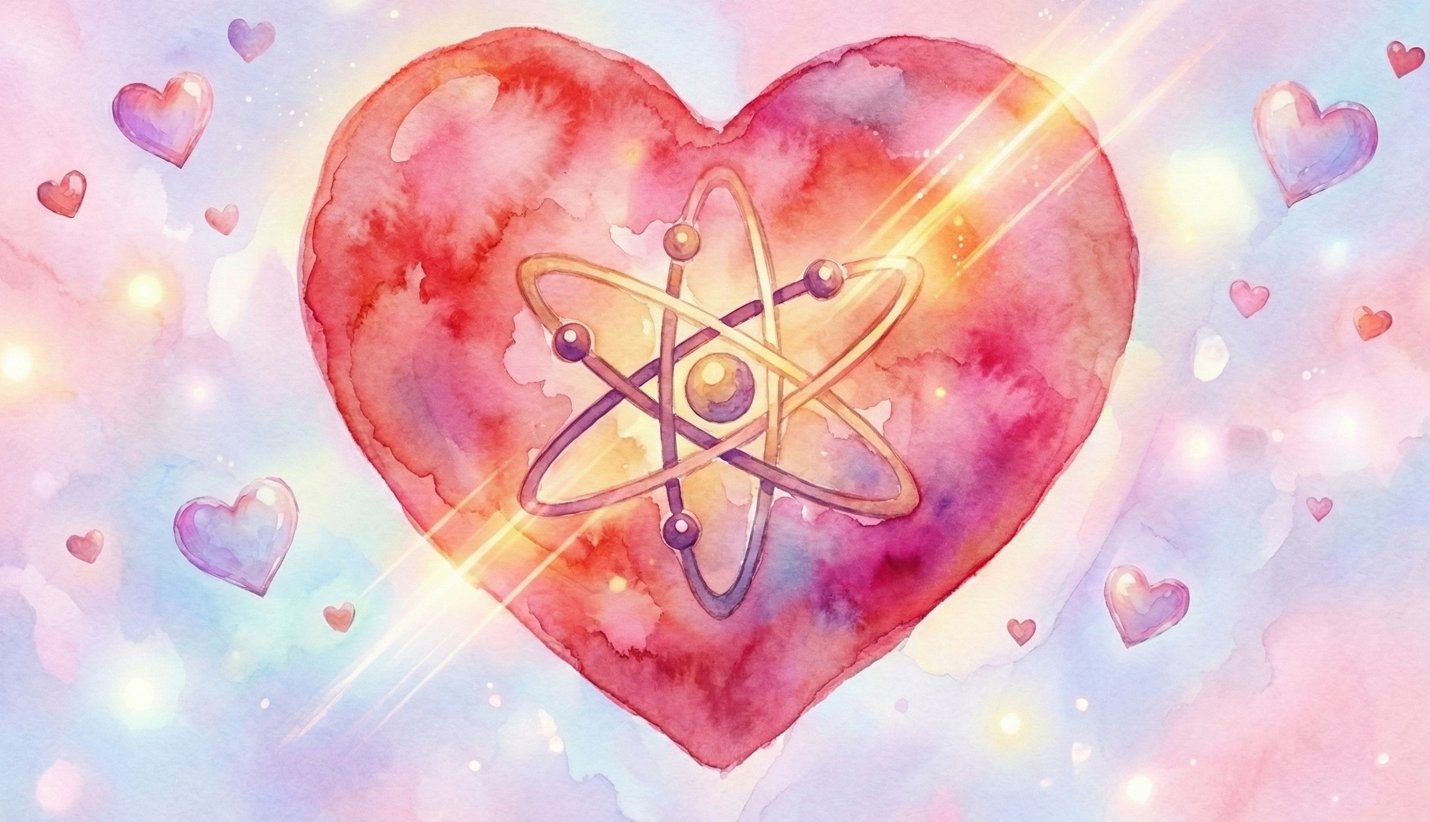

Tanned.edge🦭 🧬⚛️🦣🦥⛽️🏕️🧪(Ø,G)🥷 DeFi_Expert Influencer B2.00K @crabetanHodl & get rewarded $Atom gave Tia, Dym & Saga (Stake in 2022) $Tia -> Dym & Saga (stake in 2023) $Zk get rewarded by holding $arb or $OP (2024) $ESP did the same for Layer zero, Hyperlane, eigen, etc... Of course, $ value is lower if sold early but ON CHAIN matter You get it? https://t.co/KFyG3lkxU6

6 0 643 Original >Trend von ATOM nach VeröffentlichungBullischThe tweet encourages long‑term holding of ATOM, TIA, ZK etc to earn airdrop rewards and emphasizes the importance of on‑chain assets.

6 0 643 Original >Trend von ATOM nach VeröffentlichungBullischThe tweet encourages long‑term holding of ATOM, TIA, ZK etc to earn airdrop rewards and emphasizes the importance of on‑chain assets. Airdrops Educator FA_Analyst D146.14K @Airdrops_one

Airdrops Educator FA_Analyst D146.14K @Airdrops_oneWhere $ATOM Gets Paid (Part3): Router > Religion Forget "ecosystem token." Forget " $ATOM is the ETH of Cosmos." * @Ripple shipped an EVM sidechain on the Cosmos stack. Doesn't touch $ATOM. * @OndoFinance is building tokenized-markets rails on Cosmos. Doesn't touch $ATOM. * Telegram/TAC, @mantra_chain, @Lombard_Finance, @Figure - all on the stack. None route through the Hub. The stack is winning. The token? Not so much. More chains means more potential Hub traffic - but potential isn't revenue. You can't tax an SDK. You can toll a route. -- What "router" actually means The only way $ATOM captures value is if the Cosmos Hub becomes a router - infrastructure that sits in the middle of real cross-chain flows and charges for the service. Not a landlord. Not a brand. Not a mascot. A router. The question isn't "does Cosmos win?" It's: does the Hub handle traffic someone will pay for? Everything below is graded against that standard. -- Fee surfaces - graded honestly -- 1. IBC Eureka routing fees Eureka brought Ethereum onto IBC in April 2025. Solana, Base, and Arbitrum are on the 2026 roadmap. First time there's real cross-ecosystem volume to route. If the Hub becomes the preferred crossing - fast batching, reliable settlement, lower cost - it can toll that traffic. Catch: Eureka enables direct chain-to-chain links. You can route around the Hub. Verdict: Plausible - but the Hub has to earn its position through speed and cost, not assume it. If chains bypass it, this surface is zero. -- 2. Neutral settlement + compliance middleware Stablecoin/FX primitives, RWA settlement, compliance toolkits that enterprises plug into because the Hub is neutral - no competing commercial product on the other side. Most defensible fee surface. Enterprises pay for interop, compliance, and reliability as a service. The Hub has no competing commercial interest - that's its edge. Reality check: none of this is live yet. Primitives need to ship. Toolkits need to be production‑grade. Verdict: Best long‑run surface - but it's a build, not a brand. Earliest realistic: late 2026. Enterprise timelines are slow, mired in legal and compliance. This isn't agile development. -- 3. Cosmos-as-Red‑Hat (off‑chain revenue) SLAs, audits, LTS branches, managed upgrades. @cosmoslabs_io is reportedly closing enterprise deals. Most immediately real revenue stream in the ecosystem right now. The paradox: revenue goes to @cosmoslabs_io the company, not $ATOM the token. Red Hat made billions. Linux kernel contributors didn't. Unless there's explicit on‑chain routing - fee‑share, buybacks, staker rewards - this is a Cosmos Labs equity story. Verdict: Stack‑bullish. Token‑neutral until the wiring exists. -- 4. Interchain Security (ICS) Was designed to be the " $ATOM gets paid" mechanism: Hub validators secure external chains, earn a cut of fees. In practice, the highest‑profile chains self‑validated, consumer chains left or shut down, and the 2026 stack roadmap doesn't mention ICS at all. Development is in maintenance mode. Hub operations teams are scoping deprecation work. Verdict: Dead end. The market tested "shared security as a product" and said no. Reinforces why the router model - charge for routing, not for security - is the path forward. -- 5. PoA enterprise chains + Hub interop Native PoA lets banks and fintechs run permissioned chains without a staking token. These chains still need to connect outward - the Hub could be that gateway. Fastest‑growing use case. Slowest BD cycle. 6‑18 months per deal. No CT signal. Verdict: High‑fit, but 2027+ timeline. Don't expect hype. -- RWA is the near‑term toll road If any fee surface generates revenue first, it's probably here. Tokenized US Treasuries crossed ~$10B AUM - up from ~$5‑6B mid‑2025. Stablecoins at ~$250B. Citi estimates tokenized assets could reach $4‑5T by 2030. Institutions are already building on the Cosmos stack: ▫️ @OndoFinance - Ondo GM on Cosmos Stack. Bridges tokenized assets to public‑market liquidity. Moved ~$95M into BlackRock's BUIDL fund. ▫️ @Lombard_Finance - BTC as institutional collateral. Cosmos‑based Lombard Ledger. $1B TVL in first 3 months. ▫️ @Injective - digital‑securities infrastructure for institutional issuance and trading. ▫️ @ZIGChain - brokerage rails + blockchain settlement, partnered with Apex Group ($3.4T fund admin). ▫️ @provenancefdn / @Figure - leading non‑bank HELOC lender in the US, on Cosmos. ▫️ @progmat_en - Japan's largest regulated tokenization platform. Joint venture of MUFG, Mizuho, SMB. The pipeline is real. The revenue path to $ATOM is not - yet. If the Hub becomes the default router and settlement layer for this traffic, there's an obvious, chargeable service. If it doesn't, these remain proof that the stack wins while the token watches. -- What's wishful thinking ▫️ "SDK adoption tax." The SDK is permissive by design. You can't add rent to open source after the fact. ▫️ "Just add EVM." EVM compatibility is table stakes. @LayerZero_Labs just launched its own L1 with Citadel, DTCC, and ICE behind it. The moat is flows, not another VM. ▫️ "Narrative routing." If value‑routing to $ATOM depends on governance politics, nobody trusts it. It has to be automatic, measurable, auditable - or it's just vibes. -- The tokenomics RFP - the silence is the signal The tokenomics‑research RFP was the process meant to answer "how does $ATOM capture any of this?" Proposals were due in January 2026. As of mid‑February - little public update. Fair: good modeling takes time. Doing it right matters more than doing it fast. Also fair: the stack team ships at pace - v25.3.0 went live in January, Cosmos EVM is being adopted by Ripple and Telegram, IBC Eureka is connecting ecosystems. The one process meant to solve token value capture is quiet while everything around it accelerates. Every month that gap stays open, the market prices $ATOM accordingly. What a credible outcome looks like: ▫️ Fee mechanisms tied to shipped Hub services - not hypothetical ones ▫️ Explicit revenue routing with numbers: fees -> stakers, buybacks, or burns ▫️ Inflation that actually drops (target: low single‑digits, down from 7‑20%) ▫️ A vote and implementation timeline What governance theater looks like: ▫️ PDFs and "further research" -- What has to be true by end of 2026 ▫️ At least one Hub fee surface live with measurable revenue ▫️ Tokenomics redesign shipped on‑chain - not as a paper ▫️ Inflation below 5% ▫️ IBC Eureka beyond Ethereum - Solana, Base, or Arbitrum, at least one live ▫️ A named enterprise paying for Hub services with a visible route to $ATOM All five -> oh man! $ATOM starts looking like infrastructure equity with a token attached. Router > Religion becomes real. Three or more -> the router starts feeling real. Attainable, but a lot of work. Zero or one -> the stack keeps winning, $ATOM stays a spectator, and the bear case from Part 2 becomes the permanent state. That's the honest trade. ⚛️ Part 1: Cosmos Is Running the Linux Playbook. $ATOM Is the Open Question. https://t.co/PdTnkjxMQX Part 2: If Cosmos is “Linux,” where does $ATOM get paid? https://t.co/6BJixcVszk -- NFA. DYOR. Not a paid post. Sources: ▫️ Cosmos Stack 2026 Roadmap: https://t.co/8AokCfWqJ6 ▫️ ATOM Tokenomics RFP: https://t.co/RYUP3obipT ▫️ IBC Eureka walkthrough: https://t.co/ACVMrcOjZE ▫️ Real‑World Assets on Cosmos: https://t.co/aic3NiyjKV ▫️ LayerZero announces Zero L1: https://t.co/vEiWqQYm4o ▫️ Cosmos EVM: https://t.co/UZwxhccRYn

127 13 13.72K Original >Trend von ATOM nach VeröffentlichungBärischCosmos ecosystem successful, but ATOM token value capture path remains unclear and faces challenges.

127 13 13.72K Original >Trend von ATOM nach VeröffentlichungBärischCosmos ecosystem successful, but ATOM token value capture path remains unclear and faces challenges. f1go.eth FA_Analyst Tokenomics_Expert B6.73K @FigoETH

f1go.eth FA_Analyst Tokenomics_Expert B6.73K @FigoETHWhat Cosmos lacks and what is USP for blockchain tech. State level security. It's only ETH.

barry D5.51K @BPIV400

barry D5.51K @BPIV400Cosmos is more ready than ever for businesses that were considering or building L2s: - 10x throughout and stability improvements since June 2025 - EVM compatibility - trust-minimized connectivity to Ethereum and its L2s

36 6 1.21K Original >Trend von ATOM nach VeröffentlichungBullischCosmos (ATOM) is ready, offering 10x throughput and EVM compatibility, outlook is positive. CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.94K @IvanM10529875

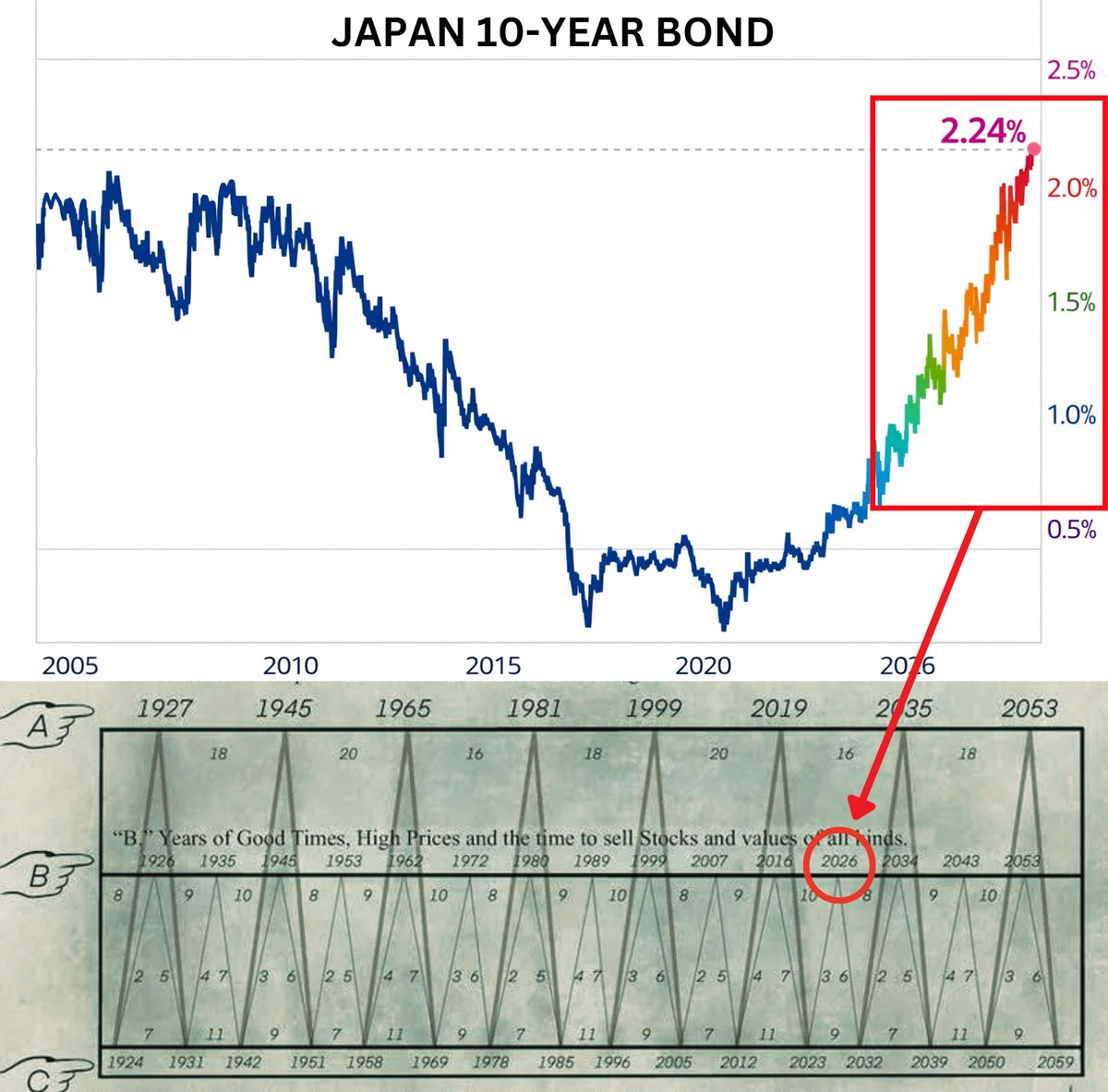

CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.94K @IvanM10529875. @grok how does this affect $Atom Cosmos price https://t.co/76pDoMs6oW

Wimar.X D280.92K @DefiWimar🚨 THE MARKET IS SCREAMING A WARNING!! Look at Japan government bonds right now. 10-YEAR: 2.24% 20-YEAR: 3.10% 30-YEAR: 3.51% 40-YEAR: 3.73% These numbers are completely NOT normal. Japan is the world’s biggest creditor nation, with net foreign assets around $3.7 TRILLION. Now add the next piece. Swap markets are pricing an ~80% chance Japan hikes rates to 1.00% by April. READ THAT AGAIN. Japan at 1.00% is the end of the cheap money hub. That one fact explains a lot. Because for decades, Japan was the funding engine. People borrowed cheap yen and pushed that money into US stocks, US credit, US tech, and crypto. When Japan rates reset higher, that engine starts breaking. And Japan is not small. So if Japan shifts even a small part of $3.7 TRILLION back home, it forces selling somewhere else. Now connect the dots. China has already been stepping back from US Treasuries. If Japan starts doing the same thing, even slowly, it becomes a real de-dollarization flow, not a headline. And when the bigges

9 1 1.24K Original >Trend von ATOM nach VeröffentlichungExtrem bärischJapan rate hike warning ends global cheap money, may trigger crypto market sell‑off.

9 1 1.24K Original >Trend von ATOM nach VeröffentlichungExtrem bärischJapan rate hike warning ends global cheap money, may trigger crypto market sell‑off.