免責事項:

データはX(旧Twitter)から取得されたもので、元の作成者の所有物です。参照のみを目的とし、投資の助言には該当しません。

Xへの投稿

C A L Media Influencer B12.97K @0x_KaELo

C A L Media Influencer B12.97K @0x_KaELo C A L Media Influencer B12.97K @0x_KaELo

C A L Media Influencer B12.97K @0x_KaELo 44 46 11.20K オリジナル >非常に強気

44 46 11.20K オリジナル >非常に強気- 強気

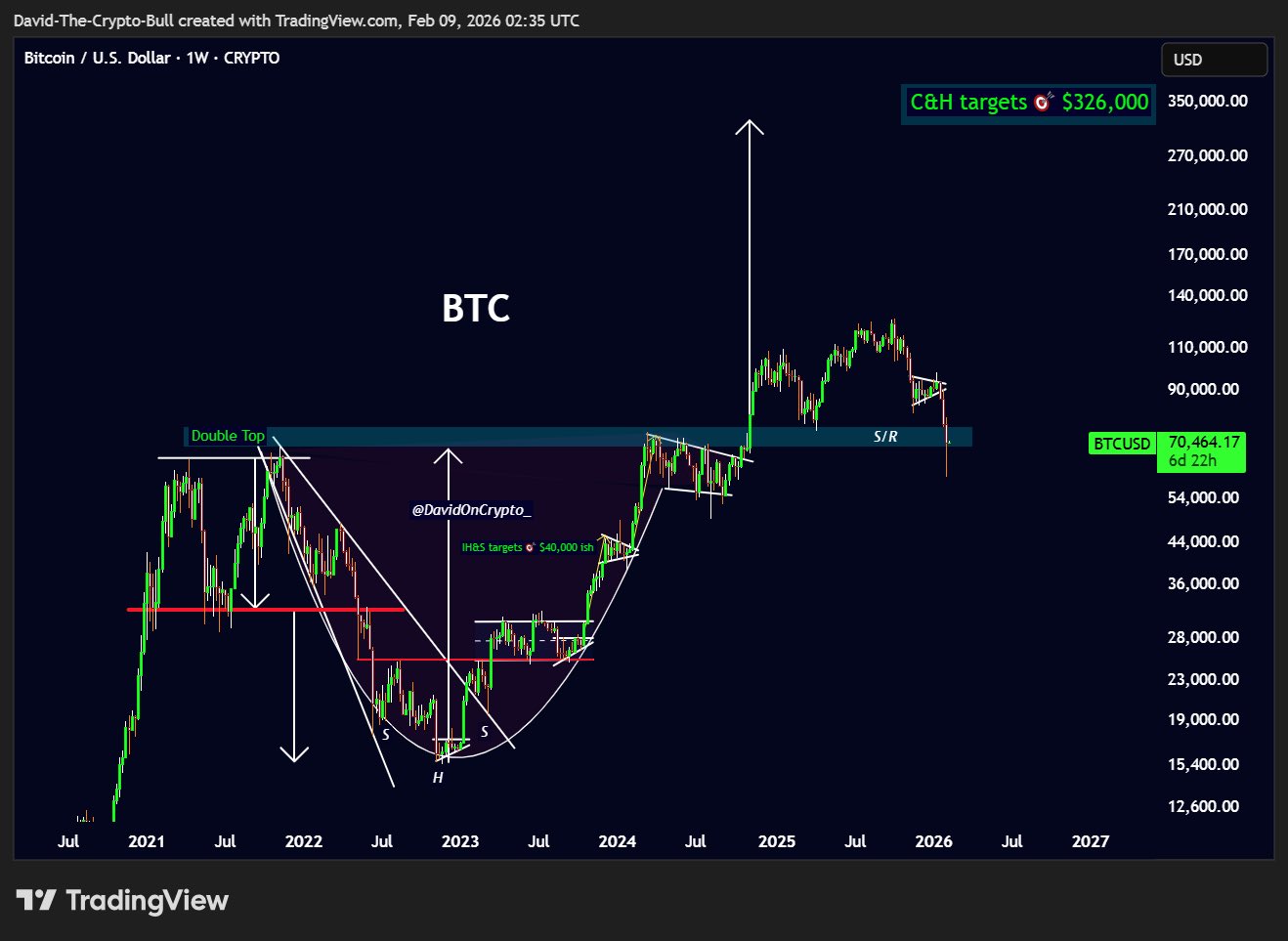

𝐃𝐚𝐯𝐢𝐝𝐎𝐧𝐂𝐫𝐲𝐩𝐭𝐨 📘 TA_Analyst Trader B7.68K @DavidOnCrypto_

𝐃𝐚𝐯𝐢𝐝𝐎𝐧𝐂𝐫𝐲𝐩𝐭𝐨 📘 TA_Analyst Trader B7.68K @DavidOnCrypto_ 𝐃𝐚𝐯𝐢𝐝𝐎𝐧𝐂𝐫𝐲𝐩𝐭𝐨 📘 TA_Analyst Trader B7.68K @DavidOnCrypto_9 0 1.54K オリジナル >リリース後のBTCのトレンド強気

𝐃𝐚𝐯𝐢𝐝𝐎𝐧𝐂𝐫𝐲𝐩𝐭𝐨 📘 TA_Analyst Trader B7.68K @DavidOnCrypto_9 0 1.54K オリジナル >リリース後のBTCのトレンド強気 MR SHIFT 🦁 Media Influencer B59.67K @KevinWSHPod

MR SHIFT 🦁 Media Influencer B59.67K @KevinWSHPod fiddy.dime - priv/acc 🦡 D28.02K @fiddybps128 14 616 オリジナル >強気

fiddy.dime - priv/acc 🦡 D28.02K @fiddybps128 14 616 オリジナル >強気 𝐃𝐚𝐯𝐢𝐝𝐎𝐧𝐂𝐫𝐲𝐩𝐭𝐨 📘 TA_Analyst Trader B7.68K @DavidOnCrypto_

𝐃𝐚𝐯𝐢𝐝𝐎𝐧𝐂𝐫𝐲𝐩𝐭𝐨 📘 TA_Analyst Trader B7.68K @DavidOnCrypto_ 𝐃𝐚𝐯𝐢𝐝𝐎𝐧𝐂𝐫𝐲𝐩𝐭𝐨 📘 TA_Analyst Trader B7.68K @DavidOnCrypto_

𝐃𝐚𝐯𝐢𝐝𝐎𝐧𝐂𝐫𝐲𝐩𝐭𝐨 📘 TA_Analyst Trader B7.68K @DavidOnCrypto_ 31 0 3.00K オリジナル >リリース後のBTCのトレンド非常に強気

31 0 3.00K オリジナル >リリース後のBTCのトレンド非常に強気 CryptoMaMa Educator Tokenomics_Expert C141.44K @1CryptoMama

CryptoMaMa Educator Tokenomics_Expert C141.44K @1CryptoMama CryptoMaMa Educator Tokenomics_Expert C141.44K @1CryptoMama

CryptoMaMa Educator Tokenomics_Expert C141.44K @1CryptoMama 5 4 67 オリジナル >弱気

5 4 67 オリジナル >弱気- 弱気

- 非常に強気

- リリース後のAAVEのトレンド強気

- リリース後のBTCのトレンド中立

Xからの24時間ソーシャルセンチメント

4,973分析された投稿-34.81%2,470調査対象のKOL+0.04%市場のセンチメントは強気に傾いています- コインSSI変動率SSIインサイト

- コインMPR変動率

USTC#1 Social mentions surged-

USTC#1 Social mentions surged- GIGGLE#2 Social mentions surged-

GIGGLE#2 Social mentions surged- ON#3 Social mentions surged-

ON#3 Social mentions surged- MEME#4 Social mentions surged-

MEME#4 Social mentions surged- MANA#5 Social mentions surged-

MANA#5 Social mentions surged-

アラートの概要