Disclaimer:

Data from X (Twitter), Property of original creators. For reference only, not investment advice.

X Posts

- Bullish

- Bullish

- Neutral

Satoshi Flipper TA_Analyst Trader C240.02K @SatoshiFlipper

Satoshi Flipper TA_Analyst Trader C240.02K @SatoshiFlipper VirtualBacon TA_Analyst Trader C232.84K @virtualbacon25 9 476 Original >Trend of BTC after releaseBullish

VirtualBacon TA_Analyst Trader C232.84K @virtualbacon25 9 476 Original >Trend of BTC after releaseBullish- Trend of BTC after releaseBearish

Tony | thebitcoinway.com Educator Security_Expert B7.18K @V4BTC

Tony | thebitcoinway.com Educator Security_Expert B7.18K @V4BTC Mi$T€R¥o 👻 D320 @Mister405041 0 28 Original >Trend of BTC after releaseBullish

Mi$T€R¥o 👻 D320 @Mister405041 0 28 Original >Trend of BTC after releaseBullish TokenPulse BTC / 《海外の仮想通貨ニュースを最速で毎日お届け!》 Media OnChain_Analyst D20.57K @TokenPulseJP

TokenPulse BTC / 《海外の仮想通貨ニュースを最速で毎日お届け!》 Media OnChain_Analyst D20.57K @TokenPulseJP Cointelegraph Media Influencer C2.90M @Cointelegraph

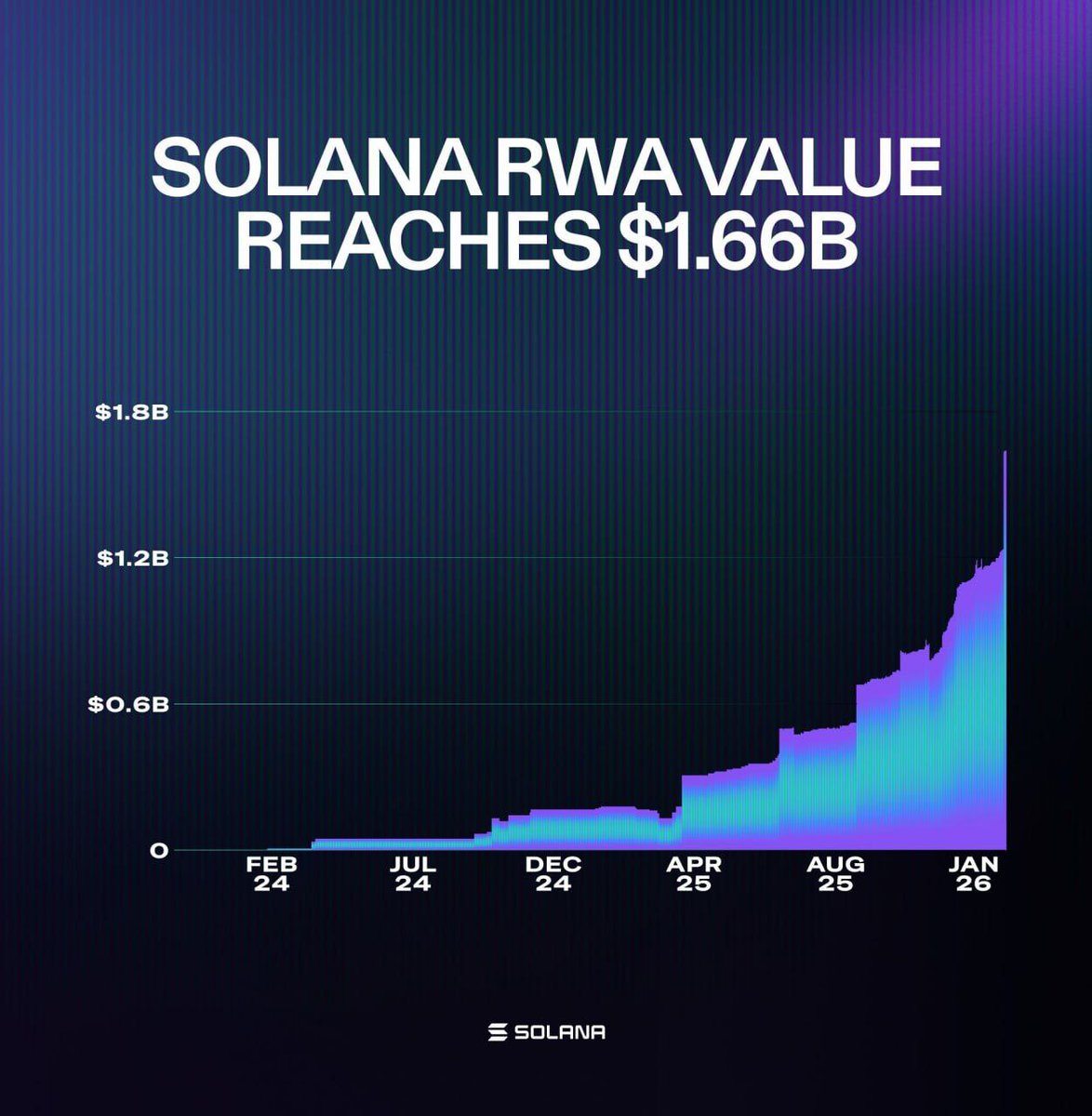

Cointelegraph Media Influencer C2.90M @Cointelegraph 1 0 13 Original >Trend of SOL after releaseExtremely Bullish

1 0 13 Original >Trend of SOL after releaseExtremely Bullish Greenpeace.BNB.probablynothing.LUNC OnChain_Analyst Community_Lead S6.20K @Greenpeace06_09

Greenpeace.BNB.probablynothing.LUNC OnChain_Analyst Community_Lead S6.20K @Greenpeace06_09

Greenpeace.BNB.probablynothing.LUNC OnChain_Analyst Community_Lead S6.20K @Greenpeace06_09

Greenpeace.BNB.probablynothing.LUNC OnChain_Analyst Community_Lead S6.20K @Greenpeace06_09

4 1 44 Original >Bullish

4 1 44 Original >Bullish- Bullish

- Trend of ZEC after releaseBullish

24h Social Sentiment from X

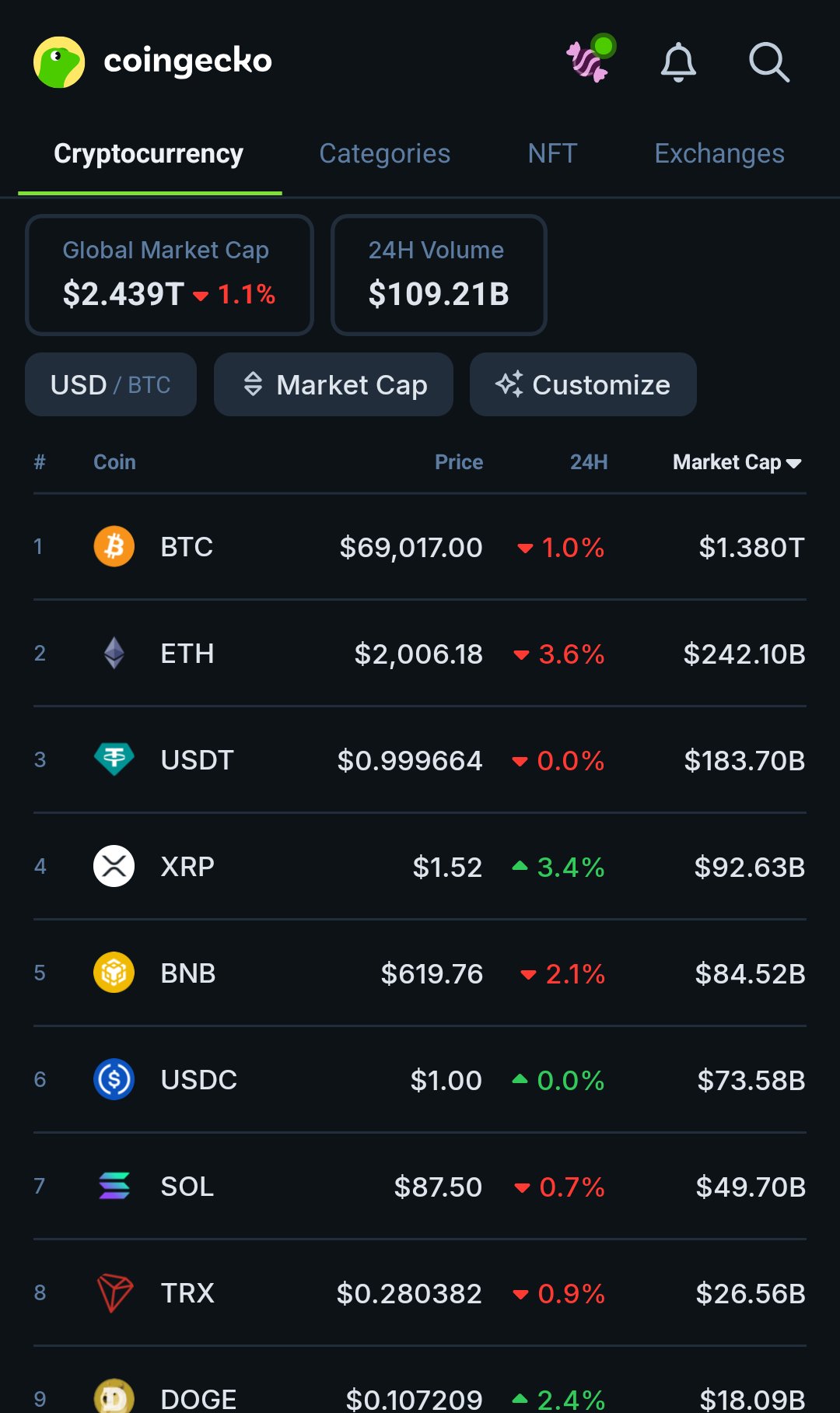

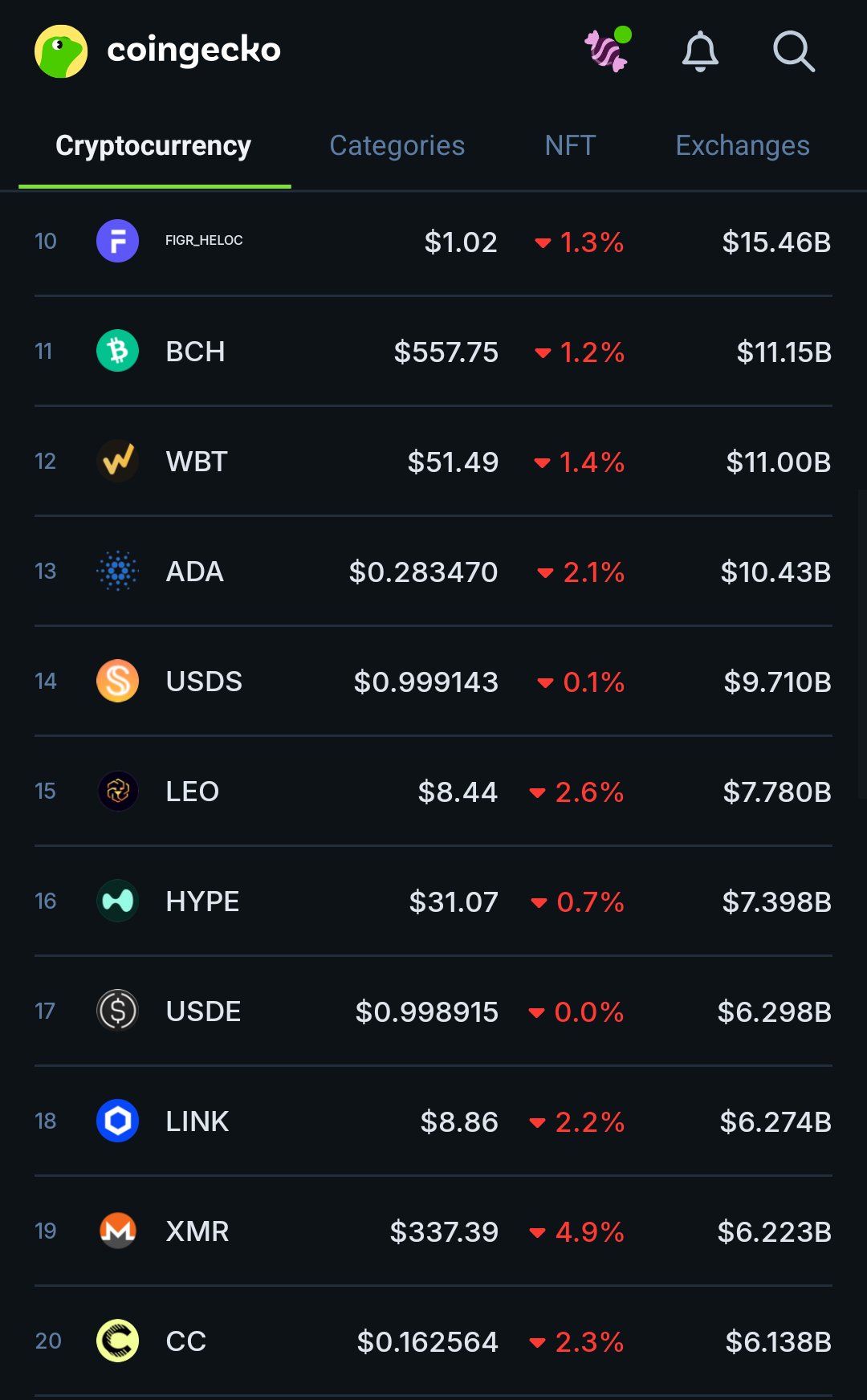

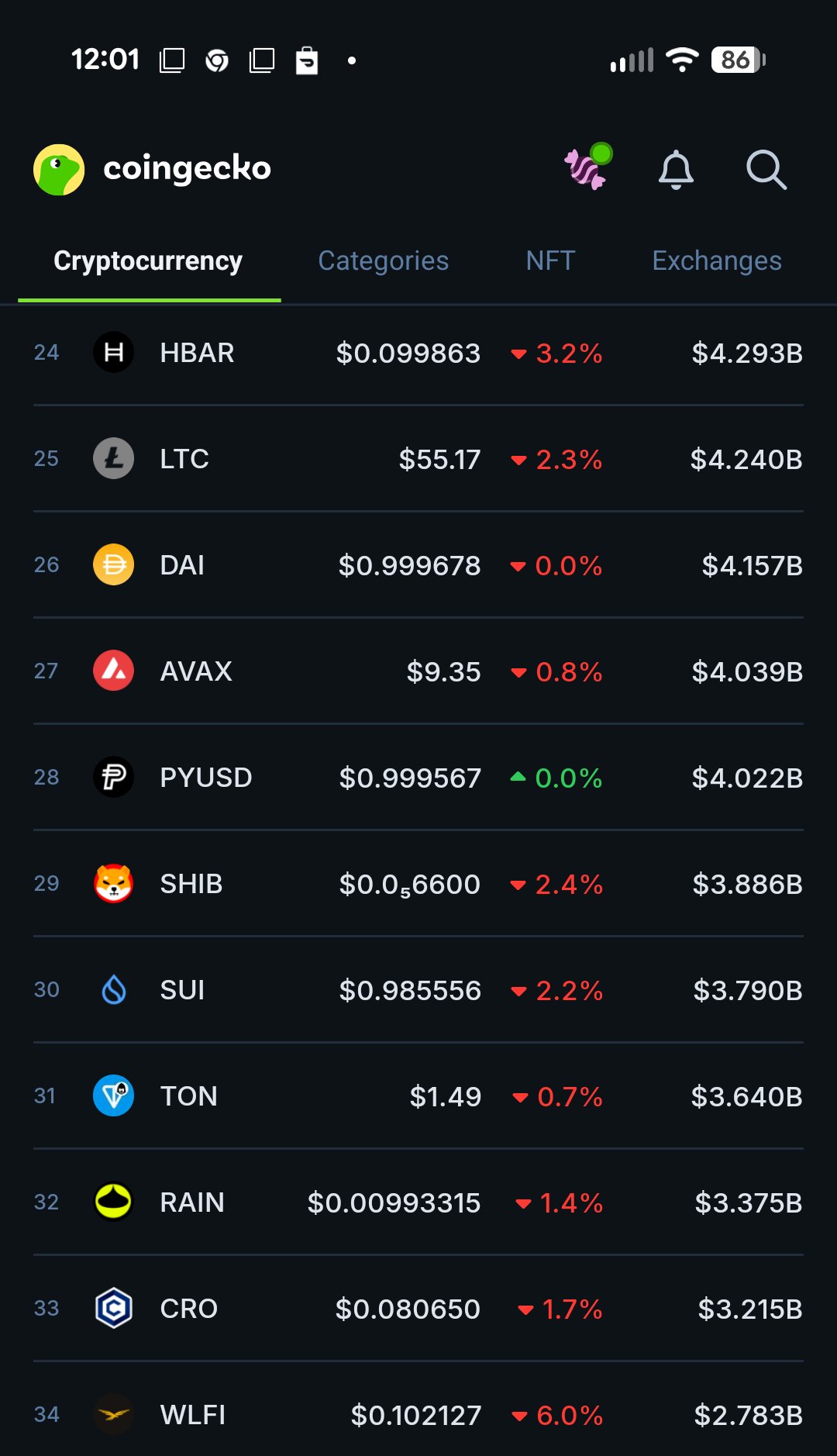

4,626Analyzed Posts-28.09%2,466Surveyed KOLs+0.04%Market sentiment leans Bullish- CoinsSSIChangeSSI Insights

- CoinsMPRChange

USTC#1 Social mentions surged-

USTC#1 Social mentions surged- GIGGLE#2 Social mentions surged-

GIGGLE#2 Social mentions surged- ON#3 Social mentions surged-

ON#3 Social mentions surged- MEME#4 Social mentions surge-

MEME#4 Social mentions surge- BTR#5 Social mentions surged-

BTR#5 Social mentions surged-

Alert Summary