Tuyên bố miễn trừ:

Dữ liệu từ X (Twitter), thuộc sở hữu của những nhà sáng tạo gốc. Chỉ mang tính tham khảo, không phải là lời khuyên đầu tư.

Bài đăng trên X

- Tăng giá

- Xu hướng của ETH sau khi phát hànhTăng giá

- Tăng giá

- Trung tính

- Trung tính

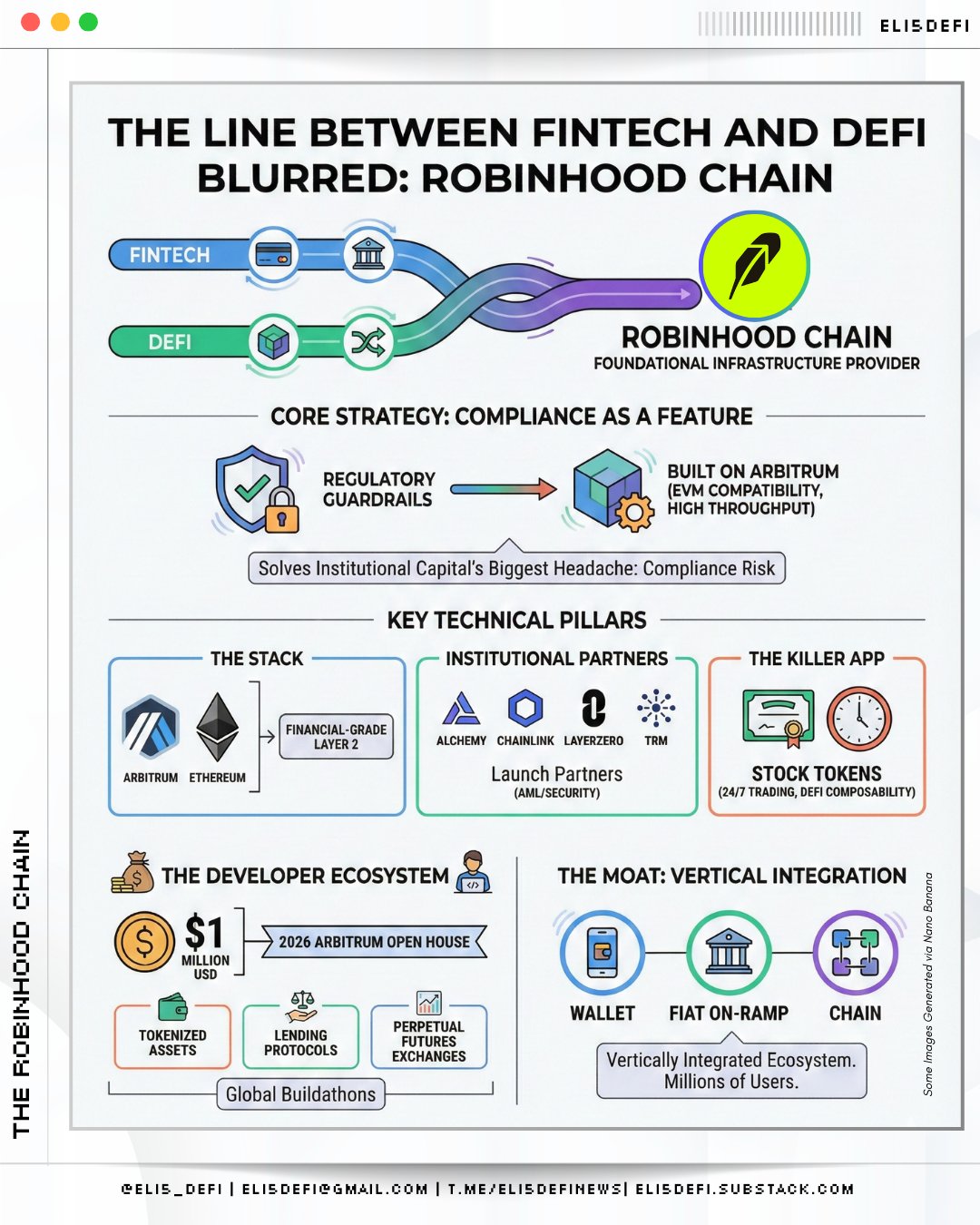

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi 11 8 165 Gốc >Xu hướng của ARB sau khi phát hànhCực kỳ lạc quan

11 8 165 Gốc >Xu hướng của ARB sau khi phát hànhCực kỳ lạc quan Mr Brondor Influencer Educator D9.98K @MrBrondorDeFi

Mr Brondor Influencer Educator D9.98K @MrBrondorDeFi Bull Theory Trader Regulatory_Expert S80.36K @BullTheoryio

Bull Theory Trader Regulatory_Expert S80.36K @BullTheoryio 0 0 8 Gốc >Xu hướng của BTC sau khi phát hànhTrung tính

0 0 8 Gốc >Xu hướng của BTC sau khi phát hànhTrung tính- Xu hướng của HYPE sau khi phát hànhTăng giá

- Xu hướng của ATOM sau khi phát hànhCực kỳ lạc quan

- Xu hướng của ARB sau khi phát hànhCực kỳ lạc quan

Tâm Lý Social 24h từ X

4,970Các bài đăng đã được phân tích-34.85%2,470Các KOL đã được khảo sát+0.04%Tâm lý thị trường nghiêng về Tăng giá- CoinSSIBiến độngThông tin chuyên sâu SSI

- CoinMPRBiến động

USTC#1 Social mentions surged-

USTC#1 Social mentions surged- GIGGLE#2 Social mentions surged-

GIGGLE#2 Social mentions surged- ON#3 Social mentions surged-

ON#3 Social mentions surged- MEME#4 Social mentions surged-

MEME#4 Social mentions surged- MANA#5 Social mentions surged-

MANA#5 Social mentions surged-

Tóm tắt thông báo