🧨 Lunar New Year holiday: First‑gen "personal finance" share:

If you’re like me, you just want to lounge on the sofa during the holidays, trade and tinker as little as possible, yet still catch the yields — Kamino is now the closest solution on Solana to "institutional‑grade passive investing" 🔒

Before diving into Kamino’s recent major updates,

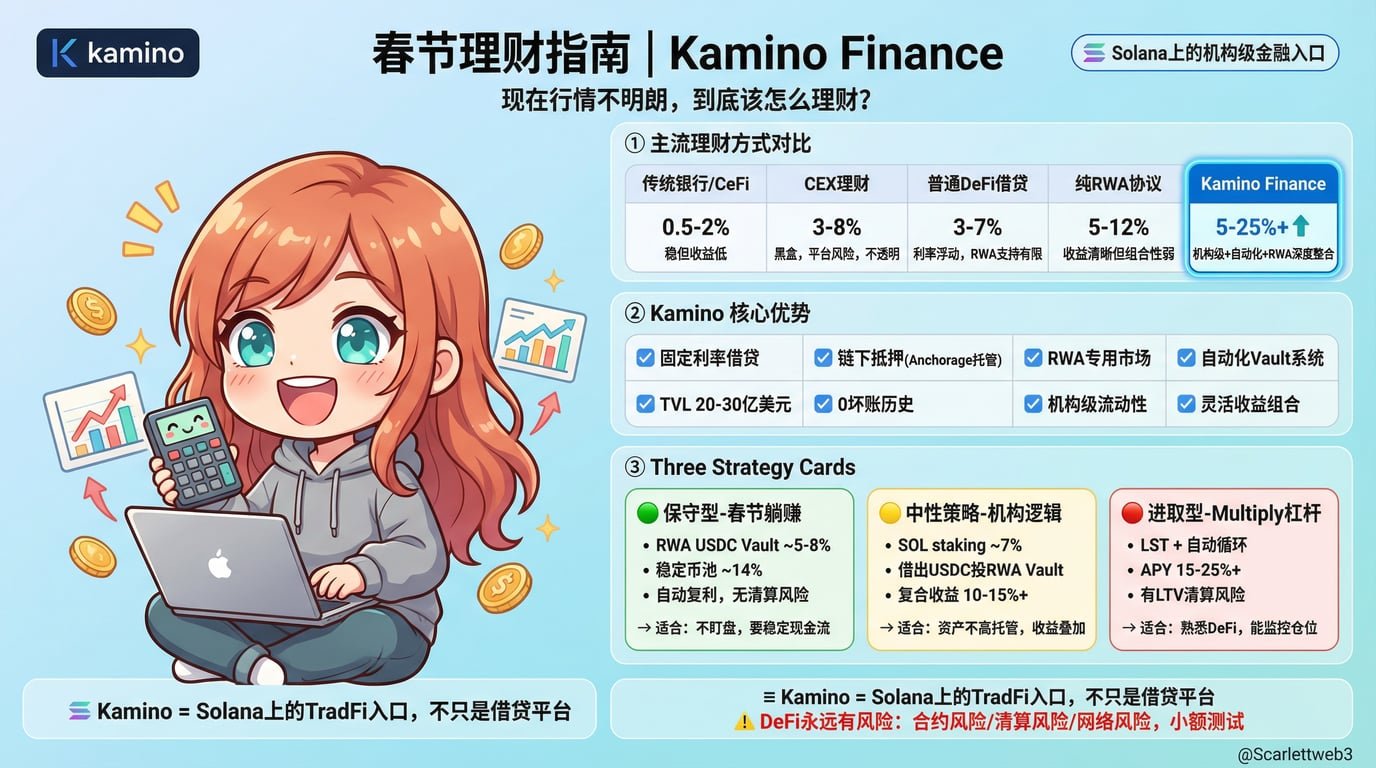

bookmark this or save the image – the picture summarises:

1️⃣ Mainstream finance vs CEX vs generic DeFi vs Kamino

Yield comparison across tracks %

2️⃣ Three recommended strategies include:

Conservative & Neutral (institutional logic) & Aggressive

Beginner users can first watch this First‑gen Kamino video

(What is Kamino, my three go‑to strategies)

https://t.co/AR5X4QBpGl

TL;DR: If you plan to operate less during the Spring Festival,

consider moving assets into Kamino to earn APY + incentive subsidies.

————

1. Full rundown of Kamino’s recent major updates:

Institutional‑grade + RWA era officially launched 👇

Many still think of @kamino as “the biggest lending protocol on Solana,” but starting December 2025,

Kamino’s role shifts from a "lending protocol" to:

An institutional‑grade financial infrastructure on Solana + a core RWA hub

The upgrade was publicly disclosed during Hong Kong Consensus.

@cheryldchan announced six updates, the most impressive being:

👉 Partnership with Pantera Capital’s DAT

👉 Compliance custody via Anchorage Digital

In plain terms:

Assets stay in a custodial account while still participating in on‑chain lending.

♻️ Old flow: assets → withdraw → on‑chain → collateralized loan

♻️ New flow: assets remain in Anchorage custody, mapped through a compliant structure → used as on‑chain collateral → borrowed on Kamino

—Legally the assets stay with the custodial bank, but economically they can engage in on‑chain finance.

It solves a decade‑long DeFi problem: institutions have capital but can’t enter.

Now pensions, family offices, listed companies, large funds can legally and compliantly join, with auditability, custody, and risk control.

A true TradFi ↔ DeFi bridge.

This upgrade opens huge upside for the crypto space!

2. The other six institutional‑grade heavyweight updates:

1️⃣ Fixed Rates – previously DeFi suffered from floating rates. Kamino now allows locking term + borrowing cost, a prerequisite for institutional on‑chain adoption.

2️⃣ Borrow Intents – order‑book style lending. Users post loan terms (amount, rate, duration); counterparties fill the order, suitable for large, customized loans.

3️⃣ Private Credit – custom institutional credit lines for high‑value assets like BTC‑backed collateral.

4️⃣ RWA‑only market – real estate, funds, bonds, etc., can be borrowed/lent or traded on Kamino’s RWA market.

5️⃣ Kamino SDK / BuildKit – new SDK lets other dApps and wallets embed Kamino’s yield modules, making Kamino a composable DeFi layer.

3. Highlights of this Kamino wave:

1️⃣ Solves unpredictable DeFi rates.

2️⃣ Bridges off‑chain asset collateral.

3️⃣ Introduces real‑world asset (RWA) yields.

Kamino is no longer just a “high‑APY lending platform”; it’s an on‑chain financial system usable by institutions.

Back to business, updates are one thing; the Spring Festival (less action, more passive earn) is another.

4. Kamino now fits passive strategies perfectly (see graphic):

😳 Conservative (for users not monitoring during the holiday)

▪️ USDC deposited into RWA / stablecoin vault

▪️ APY 5%–14%

▪️ Auto‑compounding, no loop‑leverage liquidation risk

😎 Neutral (pure institutional logic)

▪️ SOL / staked SOL as collateral

▪️ Borrow USDC

▪️ Re‑invest into RWA vault, earning staking + lending spread + RWA yield

😠 Aggressive (for the bold, watch LTV risk)

▪️ Multiply vault leveraged loop

▪️ LST stacking

▪️ 15%–25%+ APY

5. If you use OneKey wallet,

remember to join the OneKey user Spring Festival special event @OneKeyCN

During the event, using Kamino in the OneKey app to borrow USDC yields KMNO token rewards:

▪️ Up to $20,000 USD equivalent KMNO per week

▪️ Roughly 500,000 KMNO at $0.04 each

▪️ Period: Jan 27 – Feb 26

▪️ Daily 12:00–13:00 (UTC+8) auto‑distribution

Result: base APY + token subsidy double earnings.

@kamino now:

▪️ TVL remains Solana lending #1

▪️ Zero bad‑debt history

▪️ Continuous inflow of institutional capital

▪️ Deep RWA integration

▪️ Fixed rates + off‑chain collateral structures

Chinese market awareness lags, but institutions are already on board~

@Solana_zh @solana #defi #理财

Solana (SOL)

Solana (SOL) Axel Bitblaze 🪓 TA_Analyst Media C125.45K @Axel_bitblaze69

Axel Bitblaze 🪓 TA_Analyst Media C125.45K @Axel_bitblaze69 Axel Bitblaze 🪓 TA_Analyst Media C125.45K @Axel_bitblaze6960 19 7.11K Original >Trend of SOL after releaseBullish

Axel Bitblaze 🪓 TA_Analyst Media C125.45K @Axel_bitblaze6960 19 7.11K Original >Trend of SOL after releaseBullish Cypress Demanincor TA_Analyst Founder B47.79K @CDemanincor

Cypress Demanincor TA_Analyst Founder B47.79K @CDemanincor Franklin Templeton Digital Assets Researcher Media S44.94K @FTDA_US10 0 553 Original >Trend of SOL after releaseBullish

Franklin Templeton Digital Assets Researcher Media S44.94K @FTDA_US10 0 553 Original >Trend of SOL after releaseBullish BlockchainBaller TA_Analyst OnChain_Analyst B30.75K @bl_ockchain

BlockchainBaller TA_Analyst OnChain_Analyst B30.75K @bl_ockchain Solana Sensei D243.17K @SolanaSensei

Solana Sensei D243.17K @SolanaSensei 164 72 3.03K Original >Trend of SOL after releaseBullish

164 72 3.03K Original >Trend of SOL after releaseBullish Jingle Bell 初号机 OnChain_Analyst Community_Lead S41.40K @ScarlettWeb3

Jingle Bell 初号机 OnChain_Analyst Community_Lead S41.40K @ScarlettWeb3

Jingle Bell 初号机 OnChain_Analyst Community_Lead S41.40K @ScarlettWeb323 23 2.17K Original >Trend of SOL after releaseExtremely Bullish

Jingle Bell 初号机 OnChain_Analyst Community_Lead S41.40K @ScarlettWeb323 23 2.17K Original >Trend of SOL after releaseExtremely Bullish