Cosmos (ATOM)

Cosmos (ATOM)

- 39Índice de Sentimento Social (SSI)+97.44% (24h)

- #124Classificação do Pulso de Mercado (MPR)+10

- 1Menção Social 24H0% (24h)

- 100%Índice Bullish dos KOLs (24h)1 KOLs Ativos

- ResumoATOM rose 8.64% today, social hot index surged nearly twofold, KOL says holding yields rewards, on-chain activity increased, and early sell value decreased.

- Sinais Bullish

- Price up 8.64%

- Social hype up 97%

- Reward holding mechanism

- On-chain activity growth

- Positive KOL outlook

- Sinais Bearish

- Early sell value decreasing

- Profit-taking risk

- Demand still unverified

- Market volatility persists

- Competing chain reward model

Índice de Sentimento Social (SSI)

- Dados Gerais39SSI

- Tendência SSI (7D)Preço (7D)Distribuição de SentimentosBullish (100%)Insights de SSIATOM social hot index moderate (38.5/100, ↑97%) driven by positive sentiment ↑120% and activity ↑42%, echoing the 8.64% price increase and KOL reward‑holding remarks.

Classificação do Pulso de Mercado (MPR)

- Insight dos AlertasATOM warning rank rose to #124 (+10), social anomaly score fell to 0/100 lowest, sentiment polarization remains moderate (50/100), no abnormal drivers observed.

Posts no X

Tanned.edge🦭 🧬⚛️🦣🦥⛽️🏕️🧪(Ø,G)🥷 DeFi_Expert Influencer B2.00K @crabetan

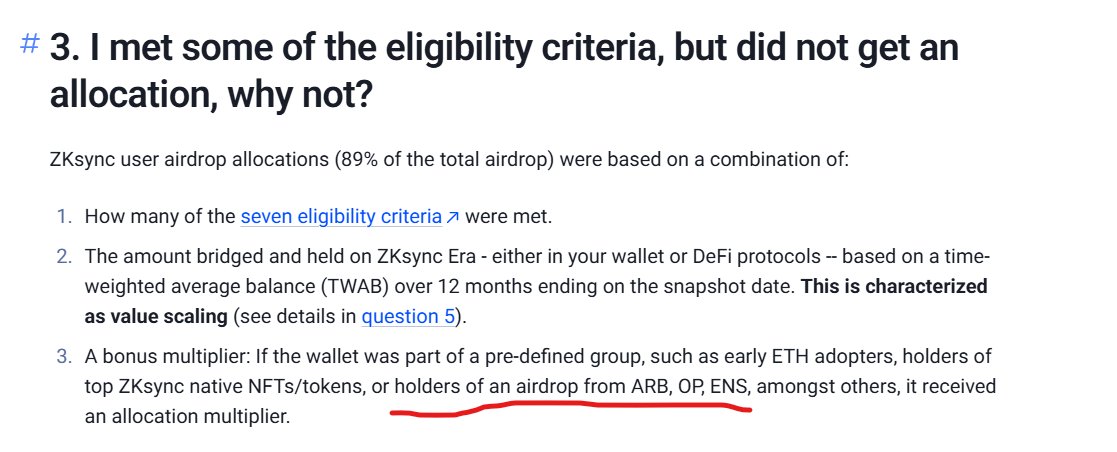

Tanned.edge🦭 🧬⚛️🦣🦥⛽️🏕️🧪(Ø,G)🥷 DeFi_Expert Influencer B2.00K @crabetanHodl & get rewarded $Atom gave Tia, Dym & Saga (Stake in 2022) $Tia -> Dym & Saga (stake in 2023) $Zk get rewarded by holding $arb or $OP (2024) $ESP did the same for Layer zero, Hyperlane, eigen, etc... Of course, $ value is lower if sold early but ON CHAIN matter You get it? https://t.co/KFyG3lkxU6

6 0 429 Original >Tendência de ATOM após o lançamentoBullishThe tweet encourages long‑term holding of ATOM, TIA, ZK etc to earn airdrop rewards and emphasizes the importance of on‑chain assets.

6 0 429 Original >Tendência de ATOM após o lançamentoBullishThe tweet encourages long‑term holding of ATOM, TIA, ZK etc to earn airdrop rewards and emphasizes the importance of on‑chain assets. Airdrops Educator FA_Analyst D146.14K @Airdrops_one

Airdrops Educator FA_Analyst D146.14K @Airdrops_oneWhere $ATOM Gets Paid (Part3): Router > Religion Forget "ecosystem token." Forget " $ATOM is the ETH of Cosmos." * @Ripple shipped an EVM sidechain on the Cosmos stack. Doesn't touch $ATOM. * @OndoFinance is building tokenized-markets rails on Cosmos. Doesn't touch $ATOM. * Telegram/TAC, @mantra_chain, @Lombard_Finance, @Figure - all on the stack. None route through the Hub. The stack is winning. The token? Not so much. More chains means more potential Hub traffic - but potential isn't revenue. You can't tax an SDK. You can toll a route. -- What "router" actually means The only way $ATOM captures value is if the Cosmos Hub becomes a router - infrastructure that sits in the middle of real cross-chain flows and charges for the service. Not a landlord. Not a brand. Not a mascot. A router. The question isn't "does Cosmos win?" It's: does the Hub handle traffic someone will pay for? Everything below is graded against that standard. -- Fee surfaces - graded honestly -- 1. IBC Eureka routing fees Eureka brought Ethereum onto IBC in April 2025. Solana, Base, and Arbitrum are on the 2026 roadmap. First time there's real cross-ecosystem volume to route. If the Hub becomes the preferred crossing - fast batching, reliable settlement, lower cost - it can toll that traffic. Catch: Eureka enables direct chain-to-chain links. You can route around the Hub. Verdict: Plausible - but the Hub has to earn its position through speed and cost, not assume it. If chains bypass it, this surface is zero. -- 2. Neutral settlement + compliance middleware Stablecoin/FX primitives, RWA settlement, compliance toolkits that enterprises plug into because the Hub is neutral - no competing commercial product on the other side. Most defensible fee surface. Enterprises pay for interop, compliance, and reliability as a service. The Hub has no competing commercial interest - that's its edge. Reality check: none of this is live yet. Primitives need to ship. Toolkits need to be production‑grade. Verdict: Best long‑run surface - but it's a build, not a brand. Earliest realistic: late 2026. Enterprise timelines are slow, mired in legal and compliance. This isn't agile development. -- 3. Cosmos-as-Red‑Hat (off‑chain revenue) SLAs, audits, LTS branches, managed upgrades. @cosmoslabs_io is reportedly closing enterprise deals. Most immediately real revenue stream in the ecosystem right now. The paradox: revenue goes to @cosmoslabs_io the company, not $ATOM the token. Red Hat made billions. Linux kernel contributors didn't. Unless there's explicit on‑chain routing - fee‑share, buybacks, staker rewards - this is a Cosmos Labs equity story. Verdict: Stack‑bullish. Token‑neutral until the wiring exists. -- 4. Interchain Security (ICS) Was designed to be the " $ATOM gets paid" mechanism: Hub validators secure external chains, earn a cut of fees. In practice, the highest‑profile chains self‑validated, consumer chains left or shut down, and the 2026 stack roadmap doesn't mention ICS at all. Development is in maintenance mode. Hub operations teams are scoping deprecation work. Verdict: Dead end. The market tested "shared security as a product" and said no. Reinforces why the router model - charge for routing, not for security - is the path forward. -- 5. PoA enterprise chains + Hub interop Native PoA lets banks and fintechs run permissioned chains without a staking token. These chains still need to connect outward - the Hub could be that gateway. Fastest‑growing use case. Slowest BD cycle. 6‑18 months per deal. No CT signal. Verdict: High‑fit, but 2027+ timeline. Don't expect hype. -- RWA is the near‑term toll road If any fee surface generates revenue first, it's probably here. Tokenized US Treasuries crossed ~$10B AUM - up from ~$5‑6B mid‑2025. Stablecoins at ~$250B. Citi estimates tokenized assets could reach $4‑5T by 2030. Institutions are already building on the Cosmos stack: ▫️ @OndoFinance - Ondo GM on Cosmos Stack. Bridges tokenized assets to public‑market liquidity. Moved ~$95M into BlackRock's BUIDL fund. ▫️ @Lombard_Finance - BTC as institutional collateral. Cosmos‑based Lombard Ledger. $1B TVL in first 3 months. ▫️ @Injective - digital‑securities infrastructure for institutional issuance and trading. ▫️ @ZIGChain - brokerage rails + blockchain settlement, partnered with Apex Group ($3.4T fund admin). ▫️ @provenancefdn / @Figure - leading non‑bank HELOC lender in the US, on Cosmos. ▫️ @progmat_en - Japan's largest regulated tokenization platform. Joint venture of MUFG, Mizuho, SMB. The pipeline is real. The revenue path to $ATOM is not - yet. If the Hub becomes the default router and settlement layer for this traffic, there's an obvious, chargeable service. If it doesn't, these remain proof that the stack wins while the token watches. -- What's wishful thinking ▫️ "SDK adoption tax." The SDK is permissive by design. You can't add rent to open source after the fact. ▫️ "Just add EVM." EVM compatibility is table stakes. @LayerZero_Labs just launched its own L1 with Citadel, DTCC, and ICE behind it. The moat is flows, not another VM. ▫️ "Narrative routing." If value‑routing to $ATOM depends on governance politics, nobody trusts it. It has to be automatic, measurable, auditable - or it's just vibes. -- The tokenomics RFP - the silence is the signal The tokenomics‑research RFP was the process meant to answer "how does $ATOM capture any of this?" Proposals were due in January 2026. As of mid‑February - little public update. Fair: good modeling takes time. Doing it right matters more than doing it fast. Also fair: the stack team ships at pace - v25.3.0 went live in January, Cosmos EVM is being adopted by Ripple and Telegram, IBC Eureka is connecting ecosystems. The one process meant to solve token value capture is quiet while everything around it accelerates. Every month that gap stays open, the market prices $ATOM accordingly. What a credible outcome looks like: ▫️ Fee mechanisms tied to shipped Hub services - not hypothetical ones ▫️ Explicit revenue routing with numbers: fees -> stakers, buybacks, or burns ▫️ Inflation that actually drops (target: low single‑digits, down from 7‑20%) ▫️ A vote and implementation timeline What governance theater looks like: ▫️ PDFs and "further research" -- What has to be true by end of 2026 ▫️ At least one Hub fee surface live with measurable revenue ▫️ Tokenomics redesign shipped on‑chain - not as a paper ▫️ Inflation below 5% ▫️ IBC Eureka beyond Ethereum - Solana, Base, or Arbitrum, at least one live ▫️ A named enterprise paying for Hub services with a visible route to $ATOM All five -> oh man! $ATOM starts looking like infrastructure equity with a token attached. Router > Religion becomes real. Three or more -> the router starts feeling real. Attainable, but a lot of work. Zero or one -> the stack keeps winning, $ATOM stays a spectator, and the bear case from Part 2 becomes the permanent state. That's the honest trade. ⚛️ Part 1: Cosmos Is Running the Linux Playbook. $ATOM Is the Open Question. https://t.co/PdTnkjxMQX Part 2: If Cosmos is “Linux,” where does $ATOM get paid? https://t.co/6BJixcVszk -- NFA. DYOR. Not a paid post. Sources: ▫️ Cosmos Stack 2026 Roadmap: https://t.co/8AokCfWqJ6 ▫️ ATOM Tokenomics RFP: https://t.co/RYUP3obipT ▫️ IBC Eureka walkthrough: https://t.co/ACVMrcOjZE ▫️ Real‑World Assets on Cosmos: https://t.co/aic3NiyjKV ▫️ LayerZero announces Zero L1: https://t.co/vEiWqQYm4o ▫️ Cosmos EVM: https://t.co/UZwxhccRYn

110 12 9.06K Original >Tendência de ATOM após o lançamentoBearishCosmos ecosystem successful, but ATOM token value capture path remains unclear and faces challenges.

110 12 9.06K Original >Tendência de ATOM após o lançamentoBearishCosmos ecosystem successful, but ATOM token value capture path remains unclear and faces challenges. f1go.eth FA_Analyst Tokenomics_Expert B6.73K @FigoETH

f1go.eth FA_Analyst Tokenomics_Expert B6.73K @FigoETHWhat Cosmos lacks and what is USP for blockchain tech. State level security. It's only ETH.

barry D5.51K @BPIV400

barry D5.51K @BPIV400Cosmos is more ready than ever for businesses that were considering or building L2s: - 10x throughout and stability improvements since June 2025 - EVM compatibility - trust-minimized connectivity to Ethereum and its L2s

36 6 1.21K Original >Tendência de ATOM após o lançamentoBullishCosmos (ATOM) is ready, offering 10x throughput and EVM compatibility, outlook is positive. CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.94K @IvanM10529875

CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.94K @IvanM10529875. @grok how does this affect $Atom Cosmos price https://t.co/76pDoMs6oW

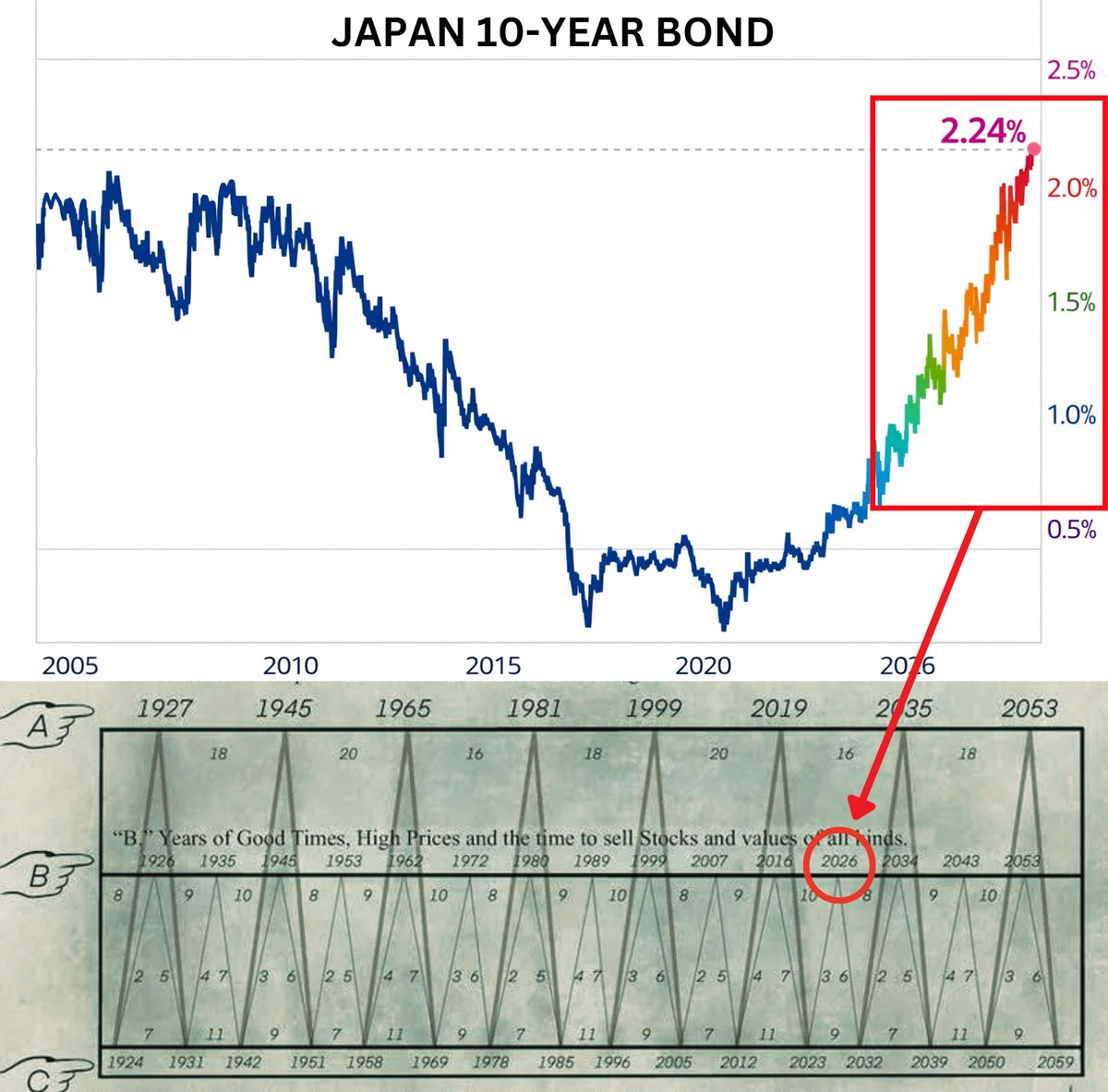

Wimar.X D280.92K @DefiWimar🚨 THE MARKET IS SCREAMING A WARNING!! Look at Japan government bonds right now. 10-YEAR: 2.24% 20-YEAR: 3.10% 30-YEAR: 3.51% 40-YEAR: 3.73% These numbers are completely NOT normal. Japan is the world’s biggest creditor nation, with net foreign assets around $3.7 TRILLION. Now add the next piece. Swap markets are pricing an ~80% chance Japan hikes rates to 1.00% by April. READ THAT AGAIN. Japan at 1.00% is the end of the cheap money hub. That one fact explains a lot. Because for decades, Japan was the funding engine. People borrowed cheap yen and pushed that money into US stocks, US credit, US tech, and crypto. When Japan rates reset higher, that engine starts breaking. And Japan is not small. So if Japan shifts even a small part of $3.7 TRILLION back home, it forces selling somewhere else. Now connect the dots. China has already been stepping back from US Treasuries. If Japan starts doing the same thing, even slowly, it becomes a real de-dollarization flow, not a headline. And when the bigges

9 1 1.23K Original >Tendência de ATOM após o lançamentoExtremamente BearishJapan rate hike warning ends global cheap money, may trigger crypto market sell‑off.

9 1 1.23K Original >Tendência de ATOM após o lançamentoExtremamente BearishJapan rate hike warning ends global cheap money, may trigger crypto market sell‑off. O.N.Y.E.M.A🕵🏽♂️ Community_Lead DeFi_Expert B5.41K @ioDeFi

O.N.Y.E.M.A🕵🏽♂️ Community_Lead DeFi_Expert B5.41K @ioDeFi Prof K of MANTRA (🕉️,🏠) D6.80K @Profoneur

Prof K of MANTRA (🕉️,🏠) D6.80K @ProfoneurLe @Cryptocito holding court at his first event in Hong Kong 🇭🇰 #ConsensusHK2026 https://t.co/cerMA3veK1

77 20 4.27K Original >Tendência de ATOM após o lançamentoBullishCryptocito is hosting the Cosmos Connect event at the ConsensusHK2026 in Hong Kong.

77 20 4.27K Original >Tendência de ATOM após o lançamentoBullishCryptocito is hosting the Cosmos Connect event at the ConsensusHK2026 in Hong Kong. CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.94K @IvanM10529875

CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.94K @IvanM10529875$Atom, 15m TF, Spot market Some limit orders above price, both on Binance and Coinbase. $2.05~2.1~2.14 🧐 https://t.co/zhKhElTdgF

24 0 941 Original >Tendência de ATOM após o lançamentoNeutroThere are limit orders above ATOM at $2.05, $2.1, and $2.14, so these resistance levels should be monitored.

24 0 941 Original >Tendência de ATOM após o lançamentoNeutroThere are limit orders above ATOM at $2.05, $2.1, and $2.14, so these resistance levels should be monitored. Airdrops Educator FA_Analyst D146.14K @Airdrops_one

Airdrops Educator FA_Analyst D146.14K @Airdrops_oneCosmos was right. For years the Cosmos pitch was basically: why rent when you can own? Run your own chain, control your own rules and costs, and still connect to everyone via IBC. Most of crypto shrugged - because as long as Ethereum L2s looked like the default path, sovereignty = ideology. Then @VitalikButerin post hit: L2 decentralization and interoperability have been slower than hoped, @ethereum L1 itself is scaling, and generic "Ethereum-but-cheaper" L2s need a new reason to exist.... That shift is exactly where Cosmos lives. (By ‘Cosmos’ here I mostly mean Cosmos Labs + the accounts shipping/pushing the stack.) -- Why Cosmos is swinging right now After Vitalik's post, you cannot ignore the fact that being an Ethereum L2 means building a business as a tenant on someone else's platform - and that risk gets real when the landlord opens a competing store on the ground floor. Cosmos' whole thesis is the opposite of tenanthood: own the chain, own the rules, connect outward. The moment the market starts thinking in "platform risk" terms, that pitch is no longer ideology and a lot more like risk management. So the team moved fast. Dropped a blog; @0xMagmar posted a "this reads like a troll but isn't" migration checklist: move an Ethereum L2 into a sovereign EVM L1 in days, not months. Users barely notice. "DM me, we'll do it for you." Clear and open invitation to every L2 team that's starting to question their setup. -- Cosmos is crossing off the old objection list To make that pitch real, Cosmos has been shipping what used to be the "yeah but..." list: ▫️ Cosmos EVM - keep Solidity + familiar tooling. Your contracts move over. Devs learn nothing new. ▫️ PoA mode - start with a smaller, permissioned validator set if you don't want to bootstrap a whole validator economy on day 1. Evolve later if you need to. ▫️ IBC upgrades - the promise is "sovereign but connected," with connectivity beyond just Cosmos chains becoming a first-class goal. Net: every "but Cosmos can't..." from two years ago is getting crossed off. -- Who's already voting with their feet I've been posting about this for a while - there's a broader pattern forming: more big players want their own rails instead of being tenants. Examples of that "go sovereign" direction: ▫️ @circle announced its own L1 ("Arc") built for stablecoin finance. ▫️ @HyperliquidX built its own chain. ▫️ @OndoFinance and @Figure are leaning into Cosmos-style sovereign setups. ▫️ @tempo - incubated by @stripe & @paradigm - is being built as a payments-focused L1. The specifics differ, and a lot of names and teams we don't know about yet, but the direction is consistent: sovereignty is back in fashion. -- So what did Vitalik actually say? ELI5: Ethereum's old plan was basically "L2s are like Ethereum franchises - same brand, same trust, just faster and cheaper." Vitalik said that framing doesn't fit anymore: 1. Decentralization + interoperability on L2s has been slower/harder than hoped 2. Ethereum L1 is scaling and could get meaningfully more capacity in 2026 And he told L2s to find a value-add other than "we scale Ethereum." This isn't "L2s are dead." It's "generic L2s can't coast on the scaling story forever." That's a big difference - but if 'Ethereum-but-cheaper' is all you've got, you should be nervous. -- What users should care about Users don’t care about "L1 vs L2" labels. They care if it’s fast, cheap, connected, and won’t rug them if the base platform changes its mind. This whole fight is about that last one. L2s borrow Ethereum’s security (great), but you’re still a tenant - subject to the landlord’s rules, fees, or competition. Sovereign chains own the stack and plug into others. Different risk, different upside. -- The $ATOM question - separate and unavoidable Cosmos "winning the moment" is not the same thing as $ATOM holders winning. If the thesis is "development funded in whole or part by $ATOM should benefit $ATOM," then the value-accrual path can't be vibes. It has to be explicit: fees, services, buybacks, revenue share, whatever the mechanism ends up being. Sovereign chains and @cosmoslabs_io can be a win for the stack - but $ATOM needs a clear contract for how it captures value from that stack. -- What I'm watching Cosmos wins this moment only if two things are true in production: 1. "Sovereign but connected" needs to feel boring and reliable. 2. Migrations have to be buttery smooth in production If they nail execution, this could pull real volume (and maybe finally some $ATOM demand via Hub services/fees). 🫡 Sources: https://t.co/WXY0bgaiOi https://t.co/T0nOjcjPfX https://t.co/UZwxhccRYn https://t.co/QIfhnA6r7k

126 16 8.12K Original >Tendência de ATOM após o lançamentoExtremamente BullishCosmos sovereign chain model wins, ATOM needs clear value capture.

126 16 8.12K Original >Tendência de ATOM após o lançamentoExtremamente BullishCosmos sovereign chain model wins, ATOM needs clear value capture. chainyoda FA_Analyst DeFi_Expert B43.16K @chainyoda

chainyoda FA_Analyst DeFi_Expert B43.16K @chainyodaBecause cosmos inflation is higher than real economy inflation, in a high interest rate environment, you cant stop cosmoses from asymptotically cosmosing towards 0 but when ZIRP returns like 2021, every Cosmosian will be wildly rich https://t.co/ynr22dPkSI

24 11 938 Original >Tendência de ATOM após o lançamentoBearishThe tweet warns that the Cosmos token may approach zero under high interest rates, but is expected to surge once a zero interest rate policy returns.

24 11 938 Original >Tendência de ATOM após o lançamentoBearishThe tweet warns that the Cosmos token may approach zero under high interest rates, but is expected to surge once a zero interest rate policy returns. Alex Crypto Researcher Influencer C6.72K @alex_crypto98

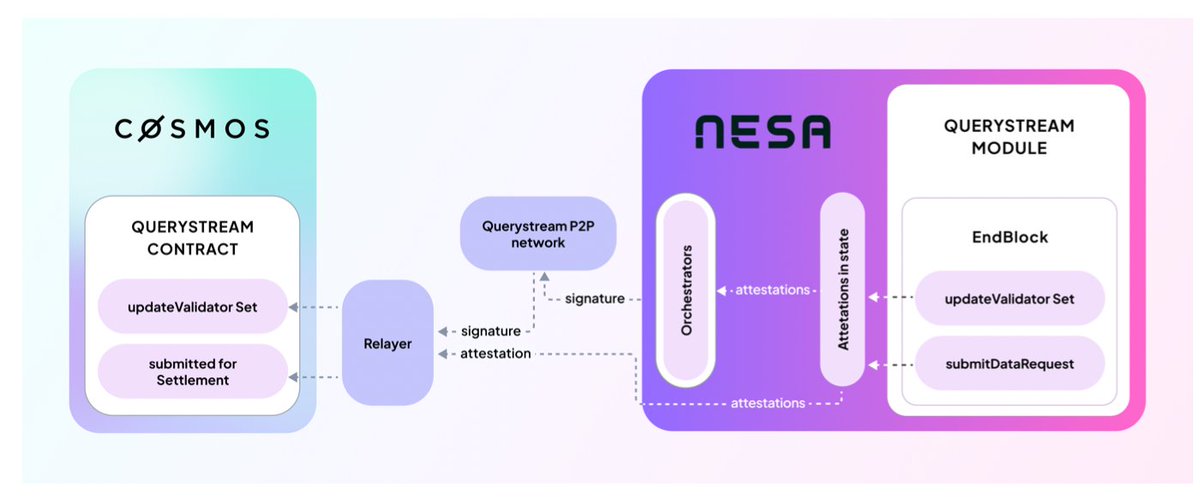

Alex Crypto Researcher Influencer C6.72K @alex_crypto98As a builder, the question is never “does it have a token,” it’s “what does it let me do reliably” On Nesa, PayForQuery turns AI execution into a first-class transaction with clear fee semantics You pay based on priority and payload size, so cost scales with what you actually consume queryStream gives you a path to move verified query outputs into settlement environments without trusting a single server The security budget is explicit: commit more to get more miners and more proof coverage That makes pricing and risk something you can reason about instead of guessing gNesa

10 7 101 Original >Tendência de ATOM após o lançamentoBullishNesa provides reliable AI execution and secure data streams on Cosmos, with transparent and controllable fees.

10 7 101 Original >Tendência de ATOM após o lançamentoBullishNesa provides reliable AI execution and secure data streams on Cosmos, with transparent and controllable fees. Cito Zone OnChain_Analyst Derivatives_Expert B8.54K @Cito_Zone

Cito Zone OnChain_Analyst Derivatives_Expert B8.54K @Cito_Zone🌌 IBC volumes are accelerating 🌌 🔸 IBC volume: $146.6M (+58.5% WoW) 🔸 Total IBC transfers: 188K (+19.7%) 🔸 Biggest IBC volume pair: Noble - dYdX ($33.2M) 🔸 Most active pair: Hub - Osmosis (15.8K) 🔸 Interchain WAU: 67.7K (-11%) 🔸 Cosmos chains' MC: $18.6B https://t.co/FzpLIxkSt7

40 2 1.52K Original >Tendência de ATOM após o lançamentoBullishCosmos IBC trading volume grew 58.5% week-over-week, total transfers increased 19.7%, ecosystem is active.

40 2 1.52K Original >Tendência de ATOM após o lançamentoBullishCosmos IBC trading volume grew 58.5% week-over-week, total transfers increased 19.7%, ecosystem is active.