Jupiter (JUP)

Jupiter (JUP)

$0.1605 -2.19% 24H

- 84Índice de Sentimento Social (SSI)-8.33% (24h)

- #23Classificação do Pulso de Mercado (MPR)+31

- 19Menção Social 24H-17.39% (24h)

- 58%Índice Bullish dos KOLs (24h)14 KOLs Ativos

- Resumo

- Sinais Bullish

- Sinais Bearish

Índice de Sentimento Social (SSI)

- Dados Gerais84SSI

- Tendência SSI (7D)Preço (7D)Distribuição de SentimentosExtremamente Bullish (16%)Bullish (42%)Neutro (42%)Insights de SSI

Classificação do Pulso de Mercado (MPR)

- Insight dos Alertas

Posts no X

Kantian FA_Analyst OnChain_Analyst A5.06K @kantianum

Kantian FA_Analyst OnChain_Analyst A5.06K @kantianum

Jupiter DeFi_Expert Media C610.10K @JupiterExchange

Jupiter DeFi_Expert Media C610.10K @JupiterExchange 0 0 87 Original >Tendência de JUP após o lançamentoBullish

0 0 87 Original >Tendência de JUP após o lançamentoBullish- Tendência de JUP após o lançamentoBullish

Marino FA_Analyst DeFi_Expert A20.13K @marinonchain

Marino FA_Analyst DeFi_Expert A20.13K @marinonchain ⚔️ SIONG Community_Lead Tokenomics_Expert S23.99K @sssionggg30 10 2.01K Original >Tendência de JUP após o lançamentoBullish

⚔️ SIONG Community_Lead Tokenomics_Expert S23.99K @sssionggg30 10 2.01K Original >Tendência de JUP após o lançamentoBullish- Tendência de JUP após o lançamentoExtremamente Bullish

- Tendência de JUP após o lançamentoNeutro

- Tendência de JUP após o lançamentoBullish

- Tendência de JUP após o lançamentoExtremamente Bullish

Kash (🐱, 🐐) DeFi_Expert Community_Lead A48.81K @kashdhanda

Kash (🐱, 🐐) DeFi_Expert Community_Lead A48.81K @kashdhanda wassieloyer D43.14K @wassielawyer87 42 10.39K Original >Tendência de JUP após o lançamentoNeutro

wassieloyer D43.14K @wassielawyer87 42 10.39K Original >Tendência de JUP após o lançamentoNeutro Jupiter DeFi_Expert Media C610.10K @JupiterExchange

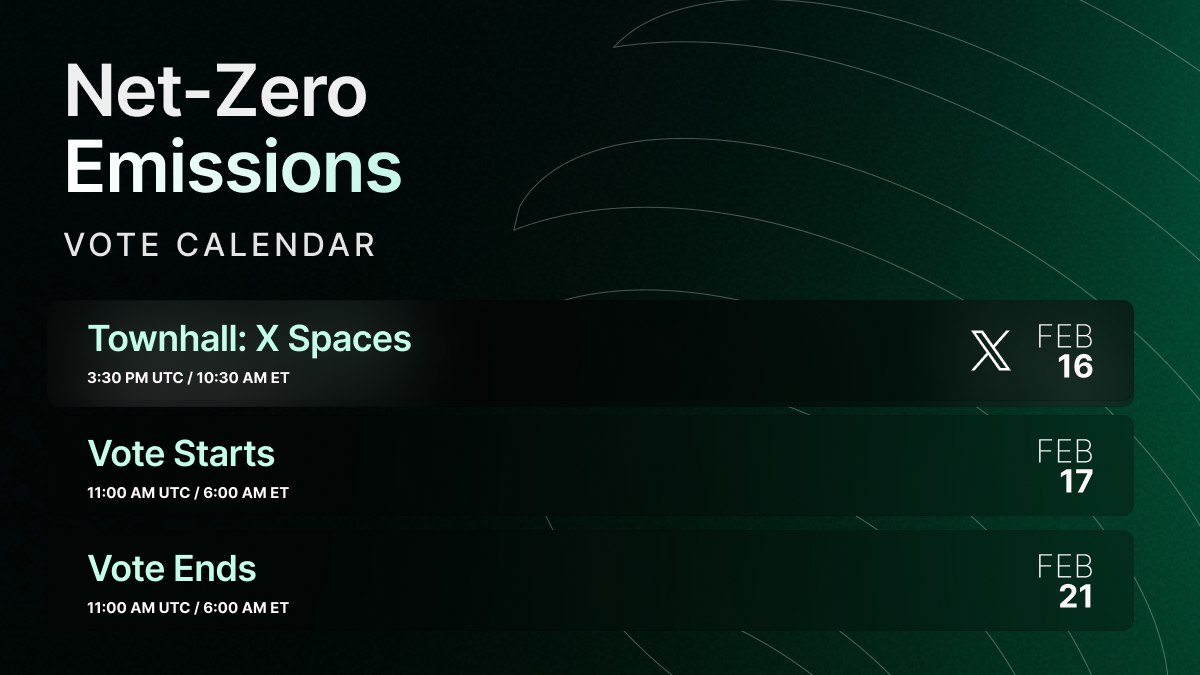

Jupiter DeFi_Expert Media C610.10K @JupiterExchange JupiterDAO D70.74K @jup_dao339 102 33.58K Original >Tendência de JUP após o lançamentoNeutro

JupiterDAO D70.74K @jup_dao339 102 33.58K Original >Tendência de JUP após o lançamentoNeutro Crypto Warehouse Media Educator S5.60K @GibCryptoNews

Crypto Warehouse Media Educator S5.60K @GibCryptoNews JupiterDAO D70.74K @jup_dao15 0 3.65K Original >Tendência de JUP após o lançamentoNeutro

JupiterDAO D70.74K @jup_dao15 0 3.65K Original >Tendência de JUP após o lançamentoNeutro