Solana (SOL)

Solana (SOL)

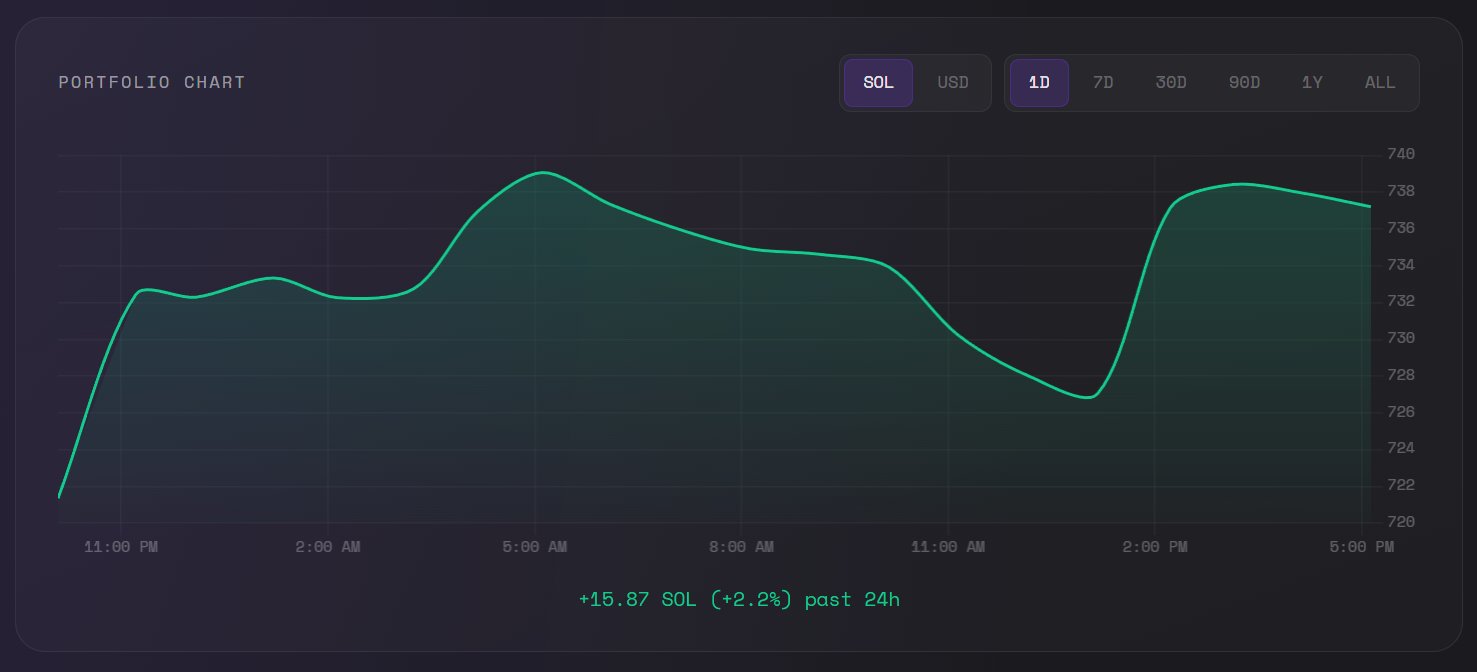

$84.61 -5.76% 24H

- 61Індекс соціальних настроїв (SSI)-4.71% (24h)

- #93Рейтинг пульсу ринку (MPR)-11

- 9424-годинні згадки в соціальних мережах-16.07% (24h)

- 62%24-годинний коефіцієнт бичачого настрою KOL56 Активних KOL

- Підсумок

- Бичачі сигнали

- Ведмежі сигнали

Індекс соціальних настроїв (SSI)

- Загальні дані61SSI

- Тенденція SSI (7 днів)Ціна (7 днів)Розподіл настроївНадзвичайно бичачий (19%)Бичачий (43%)Нейтральні (15%)Ведмежий (21%)Надзвичайно ведмежий (2%)Аналітика SSI

Рейтинг пульсу ринку (MPR)

- Аналітика сповіщень

Дописи з платформи X

- Тенденція SOL після випускуБичачий

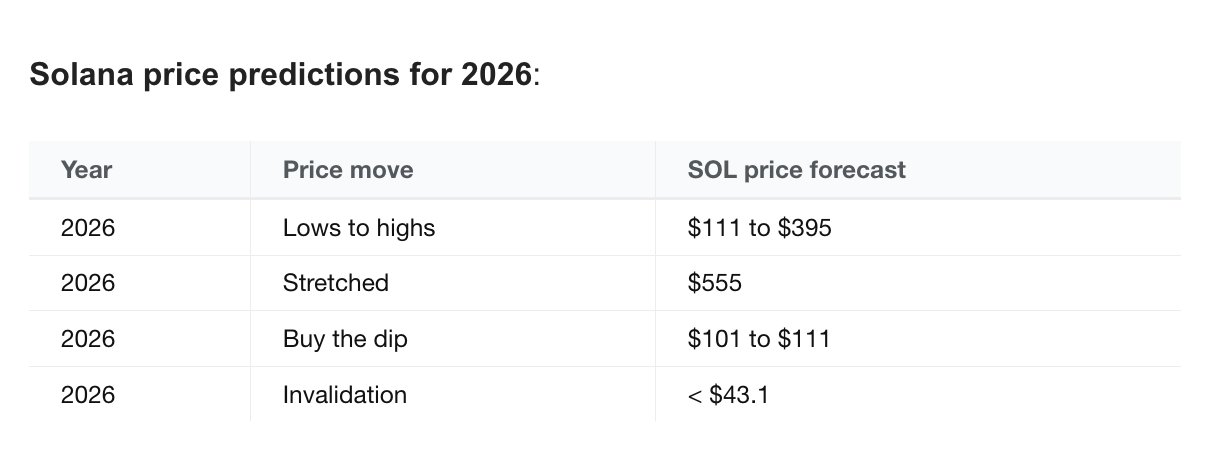

InvestingHaven TA_Analyst Influencer D6.80K @InvestingHaven

InvestingHaven TA_Analyst Influencer D6.80K @InvestingHaven

InvestingHaven TA_Analyst Influencer D6.80K @InvestingHaven1 2 32 Оригінал >Тенденція SOL після випускуБичачий

InvestingHaven TA_Analyst Influencer D6.80K @InvestingHaven1 2 32 Оригінал >Тенденція SOL після випускуБичачий Jingle Bell 初号机 OnChain_Analyst Community_Lead S41.40K @ScarlettWeb3

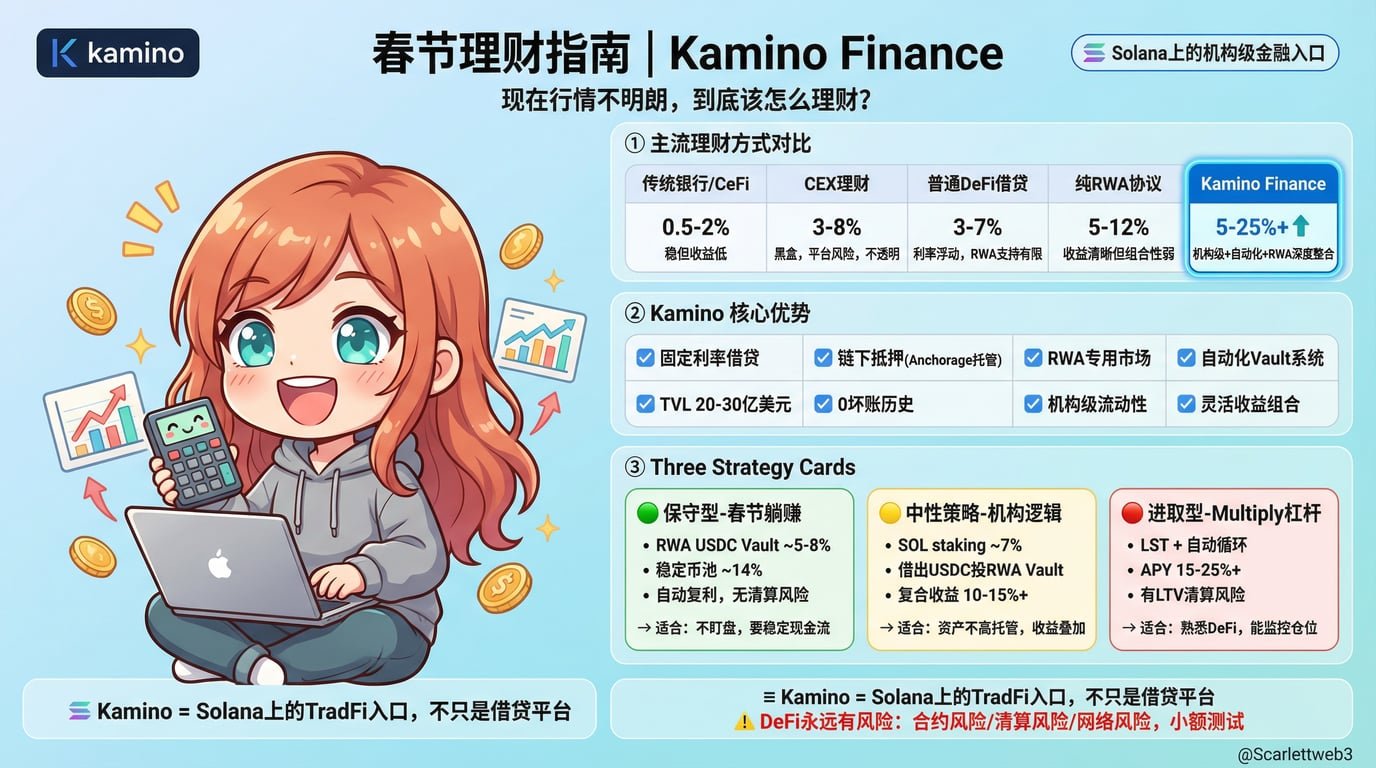

Jingle Bell 初号机 OnChain_Analyst Community_Lead S41.40K @ScarlettWeb3 Jingle Bell 初号机 OnChain_Analyst Community_Lead S41.40K @ScarlettWeb3

Jingle Bell 初号机 OnChain_Analyst Community_Lead S41.40K @ScarlettWeb3 81 51 8.92K Оригінал >Тенденція SOL після випускуНадзвичайно бичачий

81 51 8.92K Оригінал >Тенденція SOL після випускуНадзвичайно бичачий- Тенденція SOL після випускуНадзвичайно бичачий

- Тенденція SOL після випускуБичачий

- Тенденція SOL після випускуНадзвичайно бичачий

- Тенденція SOL після випускуНейтральні

- Тенденція SOL після випускуБичачий

- Тенденція SOL після випускуНадзвичайно бичачий

Chart Davidson TA_Analyst Trader B4.41K @ChartDavidson

Chart Davidson TA_Analyst Trader B4.41K @ChartDavidson brotato 🥔 D1.71K @cryptobrotato

brotato 🥔 D1.71K @cryptobrotato 5 0 151 Оригінал >Тенденція SOL після випускуБичачий

5 0 151 Оригінал >Тенденція SOL після випускуБичачий