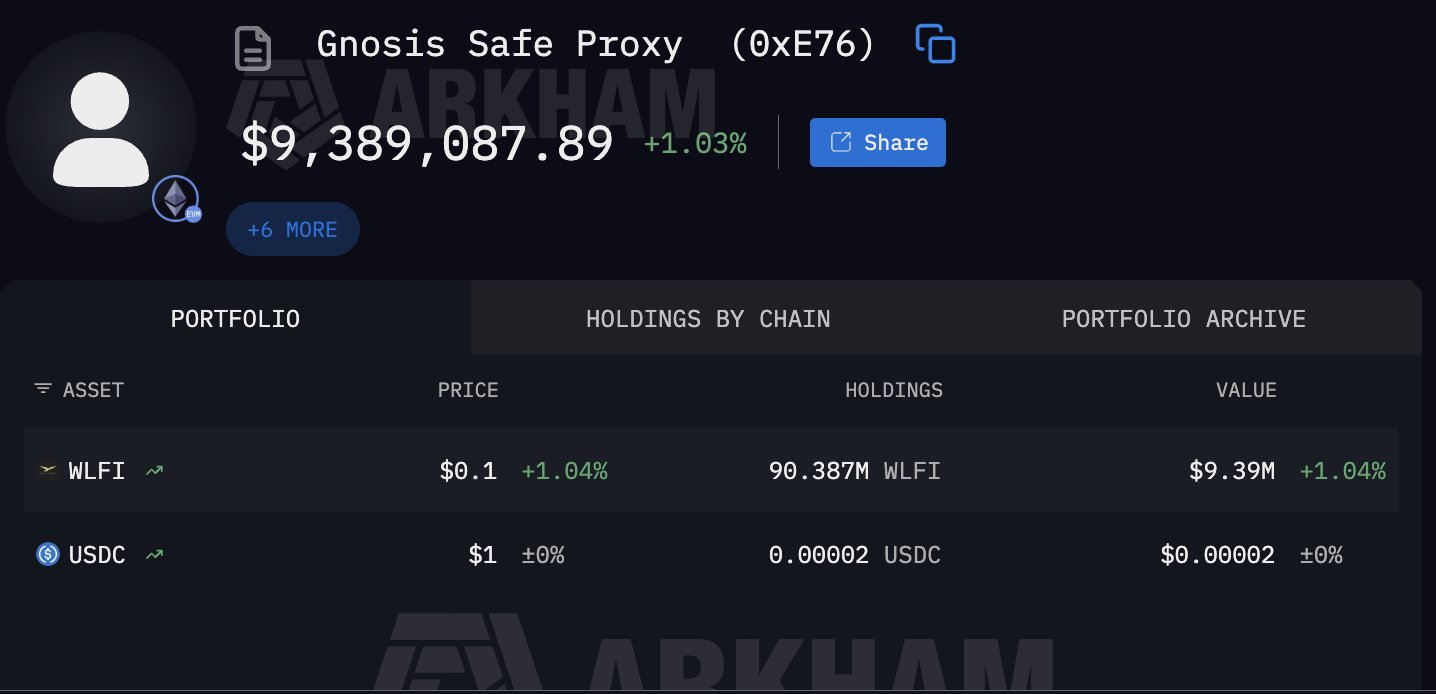

Recently at my hometown, I unintentionally chatted with a few older cousins about the crypto world. They are pure outsiders, only knowing Sun Cut, Trump Coin, and Trump's stablecoin, which is WLFI's USD1 – a very representative outsider perspective. Also, last time a on-chain whale bought WLFI; looking at recent on-chain data, that whale bought only WLFI, with a position of about $9 million.

So I think it’s necessary to talk about WLFI and USD1.

You can understand WLFI as:

A group of people who best understand “how to monetize attention”, coming to build a compliance-wrapped, more TradFi-like stablecoin/financial distributor.

What’s most valuable isn’t the technology but the entry point – who can, in the shortest time, turn the hidden demand for dollars, exchange channels, yield products, and narrative hype into a closed loop.

WLFI’s approach is also straightforward:

First push USD1 to become a “usable stablecoin”, then use USD1 to feed the ecosystem, liquidity, and growth, and finally bring the “equity/token” of WLFI to the forefront.

What’s the relationship between WLFI and USD1?

In plain words:

WLFI is the power layer (governance + ecosystem)

USD1 is the blood layer (stablecoin + liquidity)

The official structure confirms this:

WLFI is the native token of World Liberty Financial

USD1 is the stablecoin they issue

In other words, WLFI decides the direction, USD1 decides where the money flows. This structure is similar to early pairs such as:

BNB + BUSD

MKR + DAI

CRV + crvUSD

WLFI is more like the “equity layer” built around this pipeline. Its early fundraising/sales and community structure were disclosed in the media, belonging to “issue the token first, then fulfill the narrative with the product”.

The deep significance of Binance’s financial product activity for USD1 / WLFI:

What you see as “USD1 doing financial products on Binance with high yields” is on the surface a perk, but at its core a strategy. This is hugely important for USD1: the hardest part of a stablecoin is not “issuance”, it’s “habit formation”. Why do people use USDT/USDC? Not because they love the logo, but because they’re usable everywhere, instantly redeemable, pools are deep, and you don’t have to think.

If USD1 truly achieves scale within Binance’s ecosystem, WLFI will no longer be “empty storytelling”, but has the chance to become an “equity token that grows with the stablecoin”, turning the narrative from a PPT to a cash flow statement.

Where is WLFI’s investment value?

The core point is that WLFI’s value heavily depends on the scaling progress of USD1.

If you ask me the probability of USD1 challenging USDT/USDC, I would say: it doesn’t need to directly defeat USDT/USDC. It just needs to become the default option in certain channels with “better yields + smoother path”, then gradually chip away from the edges.

And WLFI’s investment logic essentially bets on one thing: US

World Liberty Financial (WLFI)

World Liberty Financial (WLFI) BITWU.ETH 🔆 FA_Analyst OnChain_Analyst C358.52K @Bitwux

BITWU.ETH 🔆 FA_Analyst OnChain_Analyst C358.52K @Bitwux 庞教主.edge🦭 D77.79K @kiki520_eth

庞教主.edge🦭 D77.79K @kiki520_eth 17 15 6.86K Gốc >Xu hướng của WLFI sau khi phát hànhTăng giá

17 15 6.86K Gốc >Xu hướng của WLFI sau khi phát hànhTăng giá