Lombard (BARD)

Lombard (BARD)

- 61社交熱度指數(SSI)- (24h)

- #62市場預警排名(MPR)0

- 124小時社交提及量- (24h)

- 0%24小時KOL看好比例1位活躍KOL

- 概要BARD down 1.44%, community focused on Kudoswap reward delay, lack of new partnership news, price under pressure.

- 看漲訊號暫無資料

- 看跌訊號

- Reward distribution delay

- Lack of partnership updates

- Price drop 1.44%

- Community anxiety sentiment

- Liquidity no improvement

社交熱度指數(SSI)

- 總體資料61SSI

- 社交熱度趨勢(7D)價格(7D)情緒分佈中性 (100%)社交熱度洞察BARD social heat moderate (60.5/100) maintained, activity score full (40/40) support, sentiment positive only 20/30, KOL low 0.5/30, impacted by reward delay and lack of partnerships.

市場預警排名(MPR)

- 預警解讀BARD warning rank #62, social anomaly high (89.22/100) significant, sentiment polarization 0, KOL attention only 0.5/100, linked to community anxiety caused by reward delay.

相關推文

Leafswan FA_Analyst Influencer C70.32K @leaf_swan

Leafswan FA_Analyst Influencer C70.32K @leaf_swanThis is almost a month later… @SIXR_cricket rewards from kaito and @KudoswapAI are still silent? Or anyone got news about this? https://t.co/dcM8YdczDj

greb Influencer Tokenomics_Expert C57.57K @grebbycrypto

greb Influencer Tokenomics_Expert C57.57K @grebbycrypto3rd project to immediately publicly support their infofi creators: @SIXR_cricket again, big props to the team for responding early & concisely. looking forward to supporting some cricket homies project whose announcement I'm waiting for the most rn: @Lombard_Finance. $BARD is basically one of the strongest performing tokens in all of Q4 and their campaign was structured in a weird way where they take like 6 snapshots but tokens are only given out at end of March will the team come through?

21 12 747 閱讀原文 >釋出後BARD走勢中性Project reward distribution is delayed and activities are limited, but $BARD is performing strongly.

21 12 747 閱讀原文 >釋出後BARD走勢中性Project reward distribution is delayed and activities are limited, but $BARD is performing strongly. 무두서일기.MOODOO📚 Media Educator B13.53K @MOODOO_Diary

무두서일기.MOODOO📚 Media Educator B13.53K @MOODOO_DiaryLegend @Lombard_Finance Alone, breaking away from the primordial village BTC-Fi King 👑 https://t.co/FMvtwnqMHG

20 10 348 閱讀原文 >釋出後BARD走勢極度看漲BARD price rose by nearly 9% today, showing a strong rebound momentum, and the author’s sentiment is positive.

20 10 348 閱讀原文 >釋出後BARD走勢極度看漲BARD price rose by nearly 9% today, showing a strong rebound momentum, and the author’s sentiment is positive. Mav🛸 Trader Influencer B5.66K @OG_Mavrickks

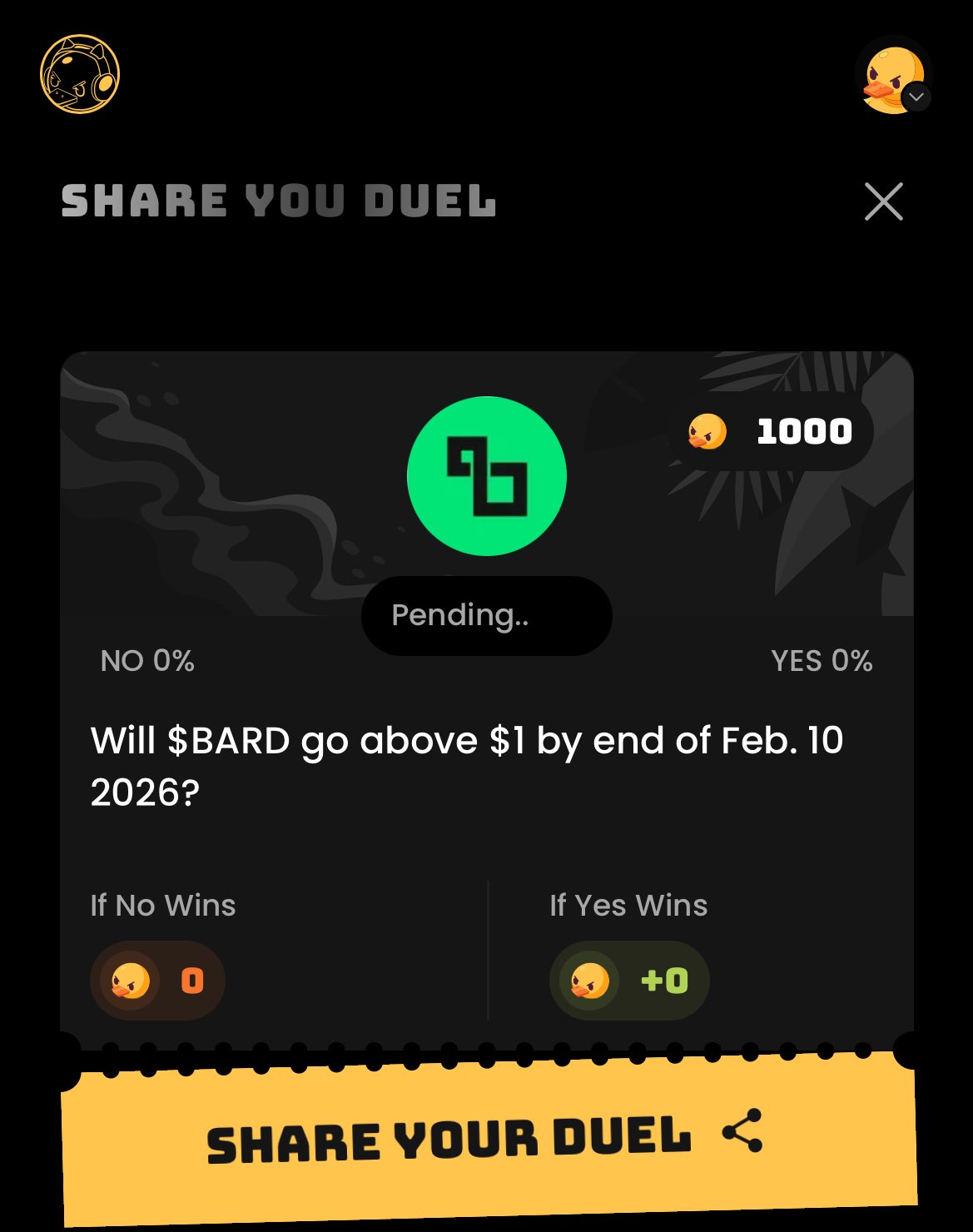

Mav🛸 Trader Influencer B5.66K @OG_Mavrickks11 hours to the end of @duel_duck season 2 mentionboard. my DD score has finally reflected but it’s a little late, I’ll be going all in for season 3 so wish me luck. also created a duel for the price of BARD, would love to know your predictions guys. the prediction market never dies and @duel_duck will be on top of it. get in on https://t.co/kjPeZ7AzmD good luck 🍀

27 13 959 閱讀原文 >釋出後BARD走勢看漲The author actively participates in the Duel Duck prediction platform and created a duel on whether BARD's price will break $1 before February 10, 2026.

27 13 959 閱讀原文 >釋出後BARD走勢看漲The author actively participates in the Duel Duck prediction platform and created a duel on whether BARD's price will break $1 before February 10, 2026. CryptoJournaal 🇳🇱 Media Educator D23.76K @CryptoJournaal

CryptoJournaal 🇳🇱 Media Educator D23.76K @CryptoJournaal#Roadmap 🇳🇱 #LombardFinance ( $BARD ) — Complete Roadmap 🧵 From a mission to activate sleeping Bitcoin to building full Bitcoin Capital Markets: #LombardFinance has rapidly evolved into a fundamental infrastructure layer for Bitcoin on‑chain finance. Here is the full journey: Past → Present → Future #CryptoRoadmap 📜 Past: Development & Launch LombardFinance was founded with one clear objective: to transform Bitcoin from a passive store of value into productive, programmable capital within the on‑chain economy. Key milestones: 🔹 Fundamental Research Phase The founding team defines the core principles of non‑custodial Bitcoin yield, decentralized security, and institutional infrastructure. The focus is on Bitcoin staking without sacrificing ownership, safety, or trust assumptions. 🔹 Introduction of LBTC Launch of LBTC (Lombard Bitcoin), a yield‑bearing liquid‑staked Bitcoin token that is 1:1 backed by BTC. LBTC is secured by a decentralized consortium of institutional parties, avoiding single points of failure found in traditional wrappers. 🔹 Protocol Launch & Native Yield Rollout of the Lombard protocol emphasizing native Bitcoin yield through mechanisms such as Babylon staking. BTC holders earn returns while their capital remains liquid and deployable. 🔹 Early DeFi Integrations LBTC is integrated into leading DeFi protocols for lending, trading and collateral use‑cases. Early cross‑chain expansion positions LBTC as a multi‑chain Bitcoin primitive. 🔹 Security & Trust Infrastructure Implementation of Proof‑of‑Reserves, audits and compliance layers to meet institutional standards and build trust among both retail and professional users. 🔹 Community & Ecosystem Formation The first developers, partners and users adopt LBTC and lay the foundation for a broader Bitcoin DeFi ecosystem built on Lombard infrastructure. Impact: The shift from passive Bitcoin holdings to a safe, liquid, yield‑generating on‑chain asset, laying the foundation for Bitcoin Capital Markets. #LombardFinanceGeschiedenis ⚡ Present: Current Status & Developments LombardFinance today operates as a mature Bitcoin‑infrastructure protocol and positions LBTC as a core component within BTCFi. Ecosystem Expansion: LBTC is widely used in DeFi for lending, trading and structured products. Integrations with wallets, exchanges and protocols on multiple chains provide easy access to Bitcoin yield and liquidity. Capital Markets Infrastructure: The protocol expands beyond liquid staking and develops Bitcoin Capital Markets middleware, including vaults, tokenized products and curated DeFi marketplaces for both retail and institutional users. Governance & $BARD Utility: The $BARD token is live as a native governance and security asset. Through staking and the Liquid Bitcoin Foundation, token holders vote on validator selection, protocol fees, roadmap priorities and ecosystem grants. Developer Enablement: Bitcoin Connect and the Lombard SDK provide developers with standardized tools to build native Bitcoin products without managing custody, validators or cross‑chain infrastructure. Institutional Positioning: Strategic integrations and asset acquisitions strengthen Lombard’s cross‑chain Bitcoin infrastructure and underline Lombard’s role as a reliable gateway to Bitcoin on‑chain finance. #LombardFinanceNu #BitcoinDeFi 🚀 Future: Planned Roadmap (Long‑term Vision) The future of LombardFinance follows a multi‑phase strategy designed to accelerate adoption and capital efficiency within the Bitcoin economy. Key Roadmap Directions: 🔹 Scaling Bitcoin Capital Markets Expansion of liquid Bitcoin markets via cross‑chain primitives, basic trade vaults, tokenized yield strategies and institutional financial products. 🔹 Growth of Developer & Infrastructure Tools Further rollout of the Lombard SDK and Bitcoin Connect to additional chains, wallets and exchanges to accelerate developer adoption and ecosystem growth. 🔹 Permissionless Bitcoin Products Launch of new permissionless Bitcoin wrappers and tokenized BTC instruments, maintaining decentralization and security. 🔹 Deeper Financial Integration Connecting Bitcoin with real‑world finance rails and advanced DeFi protocols to position BTC as core collateral within the global on‑chain economy. 🔹 Enable the Bitcoin Economy Long‑term focus on open standards and modular infrastructure that makes Bitcoin programmable at scale, allowing builders to innovate freely without central dependencies. Impact: Establishing Bitcoin as productive, permissionless capital within DeFi and beyond, with Lombard as a full‑stack gateway for Bitcoin Capital Markets. Risks & Opportunities: Technical complexity, ecosystem coordination and cross‑chain security remain challenges. Strong governance, institutional security design and active developer participation ensure long‑term resilience. #LombardFinanceToekomst #BTCFi ✅ Conclusion LombardFinance has evolved from a Bitcoin liquid staking protocol to a complete infrastructure layer for Bitcoin Capital Markets. By activating Bitcoin via LBTC and aligning governance and security with $BARD, Lombard enables a future where Bitcoin flows freely as non‑sovereign, permissionless capital within the on‑chain economy. For anyone who believes Bitcoin is the foundation of decentralized finance, LombardFinance represents a long‑term infrastructure project built for scale, security and sustainability. #RoadmapConclusion 🛒 Want to trade $BARD on #WEEX? WEEX is a global #Exchange where you can easily start crypto and futures trading: ✅ Access to 1,700+ #Altcoins ✅ Up to $30,000 USDT in #Bonuses for new users ✅ User‑friendly app & web platform ✅ Reliable exchange with millions of traders worldwide 👉 Sign up now via the link below and claim your welcome bonus! 🔗 https://t.co/CVAuP5WkUn #CryptoJournaal #AltcoinPedia #Bitcoin #Crypto #Exchange #Futures Want to learn more about #LombardFinance ( $BARD )? Check the official channels and documentation below: 🔹Discord: https://t.co/EwsRmT7PfF 🔹GitHub: https://t.co/hUxxYuuRuh 🔹Telegram: https://t.co/vcEO2FM5Mv 🔹Website: https://t.co/Ue9mMi59VQ 🔹X (Twitter): https://t.co/7tmrI2WETP ⚠️ Important note: 🔹 This post is purely for educational purposes and not financial advice! 🔹 Invest only what you are willing to lose! ----------------- 👇Follow us👇 ----------------- 🚨 Follow @CryptoJournaal – the place for independent crypto information: 📰 News | 📊 Facts | 🧠 Backgrounds | 🎓 Education 💬 No sponsored tokens 📜 Fully MiCAR‑compliant 🔍 Knowledge over hype always 📲 Join via: 💬 Telegram: https://t.co/i976fBvtv0 👥 CryptoJournaal-AltcoinPedia Community: https://t.co/3yFdzLLS2O 🐦 X profile: https://t.co/fd2bI2MInh #Altcoins #Bitcoin #CryptoNieuws #CryptoEducatie #CryptoKoersen

1 0 154 閱讀原文 >釋出後BARD走勢極度看漲LombardFinance releases roadmap aiming to activate Bitcoin capital markets.

1 0 154 閱讀原文 >釋出後BARD走勢極度看漲LombardFinance releases roadmap aiming to activate Bitcoin capital markets. spacebyte ⛓ OnChain_Analyst DeFi_Expert A24.40K @_thespacebyte

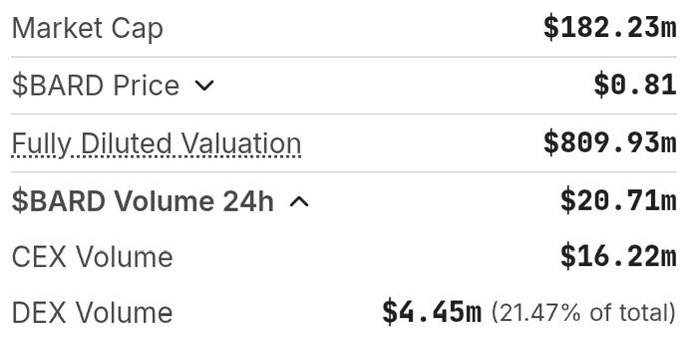

spacebyte ⛓ OnChain_Analyst DeFi_Expert A24.40K @_thespacebyteVolume is real, and it is not just CEX In the last 24 hours, $BARD traded $20.71M in total volume. That figure alone is unremarkable without context. The composition is what matters. Of that volume, $4.45M, or 21.47%, occurred on DEXs. The remaining $16.22M flowed through centralized venues. This split is analytically useful for two reasons. First, a 21% onchain share is high enough to rule out purely synthetic activity. Tokens that exist mainly as speculative instruments tend to show single-digit DEX participation, often under 5%. Here, more than one-fifth of trading requires wallet interaction, gas costs, and direct exposure to onchain execution risk. That is intent, not convenience. Second, the volume-to-valuation relationship stays coherent at these levels. With market cap at $182.23M and 24h volume at $20.71M, $BARD is turning over roughly 11.4% of its market cap per day. That is active, but not disorderly. It suggests continuous participation rather than episodic spikes. A few ratios to note here: • DEX volume / market cap: $4.45M on $182.23M ≈ 2.4% daily onchain turnover • Total volume / market cap: $20.71M on $182.23M ≈ 11.4% daily turnover • DEX share of volume: 21.47%, materially above noise threshold These numbers point to a token that is actively priced both offchain and onchain, without being dominated by either. That balance matters when you are trying to do comparative work across governance tokens, especially in $BTC-adjacent DeFi where onchain participation is still selective. The venue mix also aligns with @Lombard_Finance's broader profile. The product lives onchain, but much of the speculative discovery still happens offchain. That mismatch is normal early in a protocol’s lifecycle and often precedes repricing events, not necessarily upward, but structural. Over time, either onchain volume rises to meet relevance, or offchain volume fades as attention moves elsewhere. At $0.81, with FDV at $809.93M and annualized fees of $6.5M, $BARD’s volume profile allows clean analytical comparisons without the distortion of one-venue dominance. That is the real value of this data point. When volume is only on CEXs, you learn who is trading. When a fifth of it is onchain, you start learning who is participating.

67 40 7.74K 閱讀原文 >釋出後BARD走勢看漲BARD's DEX trading volume accounts for 21%, indicating genuine on-chain participation, and the volume distribution is healthy.

67 40 7.74K 閱讀原文 >釋出後BARD走勢看漲BARD's DEX trading volume accounts for 21%, indicating genuine on-chain participation, and the volume distribution is healthy. A•R•A ꐠ DeFi_Expert Influencer B4.05K @ARA_onX

A•R•A ꐠ DeFi_Expert Influencer B4.05K @ARA_onXSend me my flowers 🌹😌

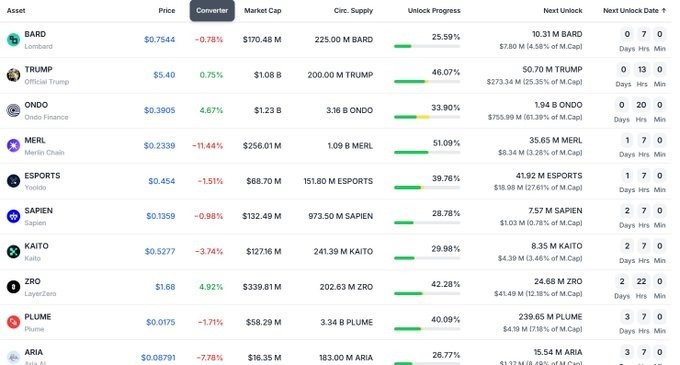

A•R•A ꐠ DeFi_Expert Influencer B4.05K @ARA_onX

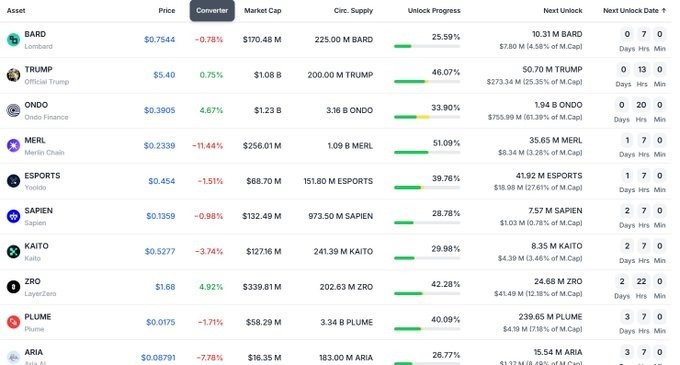

A•R•A ꐠ DeFi_Expert Influencer B4.05K @ARA_onXIf you can take risks, you can make some money here. There's a common trend of token dumping during unlock, might not be straight to zero but even a -10 or 20% dump can make you good money via leverage trading. Imo, short the first three (coz they are unlocking sooner), then rotate to others over time. I am also doing it so you're not alone. NFA, Goodluck to us ❤️

10 3 477 閱讀原文 >釋出後BARD走勢看跌The author suggests shorting BARD, TRUMP, ONDO and other tokens that are about to unlock to profit.

10 3 477 閱讀原文 >釋出後BARD走勢看跌The author suggests shorting BARD, TRUMP, ONDO and other tokens that are about to unlock to profit. 레오.마스터 | MemeMax⚡️ TA_Analyst Influencer C11.75K @ezeroho8245

레오.마스터 | MemeMax⚡️ TA_Analyst Influencer C11.75K @ezeroho8245Lombard @Lombard_Finance Amid this, the BARD coin is up 4% Indeed, solid altcoins thrive in a crisis. (This is not investment advice. Investment is each one's responsibility) https://t.co/Ukgoxx3OyJ

8 5 221 閱讀原文 >釋出後BARD走勢看漲BARD is up 4% and is considered a high-quality altcoin that performs strongly in crises.

8 5 221 閱讀原文 >釋出後BARD走勢看漲BARD is up 4% and is considered a high-quality altcoin that performs strongly in crises. greb Influencer Tokenomics_Expert C57.57K @grebbycrypto

greb Influencer Tokenomics_Expert C57.57K @grebbycrypto3rd project to immediately publicly support their infofi creators: @SIXR_cricket again, big props to the team for responding early & concisely. looking forward to supporting some cricket homies project whose announcement I'm waiting for the most rn: @Lombard_Finance. $BARD is basically one of the strongest performing tokens in all of Q4 and their campaign was structured in a weird way where they take like 6 snapshots but tokens are only given out at end of March will the team come through?

217 115 8.79K 閱讀原文 >釋出後BARD走勢看漲Project reward distribution is delayed and activities are limited, but $BARD is performing strongly.

217 115 8.79K 閱讀原文 >釋出後BARD走勢看漲Project reward distribution is delayed and activities are limited, but $BARD is performing strongly. A•R•A ꐠ DeFi_Expert Influencer B4.05K @ARA_onX

A•R•A ꐠ DeFi_Expert Influencer B4.05K @ARA_onXIf you can take risks, you can make some money here. There's a common trend of token dumping during unlock, might not be straight to zero but even a -10 or 20% dump can make you good money via leverage trading. Imo, short the first three (coz they are unlocking sooner), then rotate to others over time. I am also doing it so you're not alone. NFA, Goodluck to us ❤️

24 11 1.79K 閱讀原文 >釋出後BARD走勢看跌The author suggests shorting BARD, TRUMP, ONDO and other tokens that are about to unlock to profit.

24 11 1.79K 閱讀原文 >釋出後BARD走勢看跌The author suggests shorting BARD, TRUMP, ONDO and other tokens that are about to unlock to profit.- 釋出後BARD走勢極度看跌BARD is alleged to be a scam, its price plunged 84% before and fell another 46% recently.