Hyperliquid (HYPE)

Hyperliquid (HYPE)

$30.905 -1.51% 24H

- 63社交熱度指數(SSI)-2.53% (24h)

- #104市場預警排名(MPR)+15

- 3324小時社交提及量-22.73% (24h)

- 72%24小時KOL看好比例22位活躍KOL

- 概要

- 看漲訊號

- 看跌訊號

社交熱度指數(SSI)

- 總體資料63SSI

- 社交熱度趨勢(7D)價格(7D)情緒分佈極度看漲 (24%)看漲 (48%)中性 (15%)看跌 (13%)社交熱度洞察

市場預警排名(MPR)

- 預警解讀

相關推文

- 釋出後HYPE走勢看漲

GLC OnChain_Analyst FA_Analyst B9.27K @GLC_Research

GLC OnChain_Analyst FA_Analyst B9.27K @GLC_Research Hyperliquid Research Collective (HRC) D1.36K @HyperliquidR65 5 3.41K 閱讀原文 >釋出後HYPE走勢看漲

Hyperliquid Research Collective (HRC) D1.36K @HyperliquidR65 5 3.41K 閱讀原文 >釋出後HYPE走勢看漲- 釋出後HYPE走勢中性

Tobias Reisner FA_Analyst Influencer B16.53K @reisnertobias

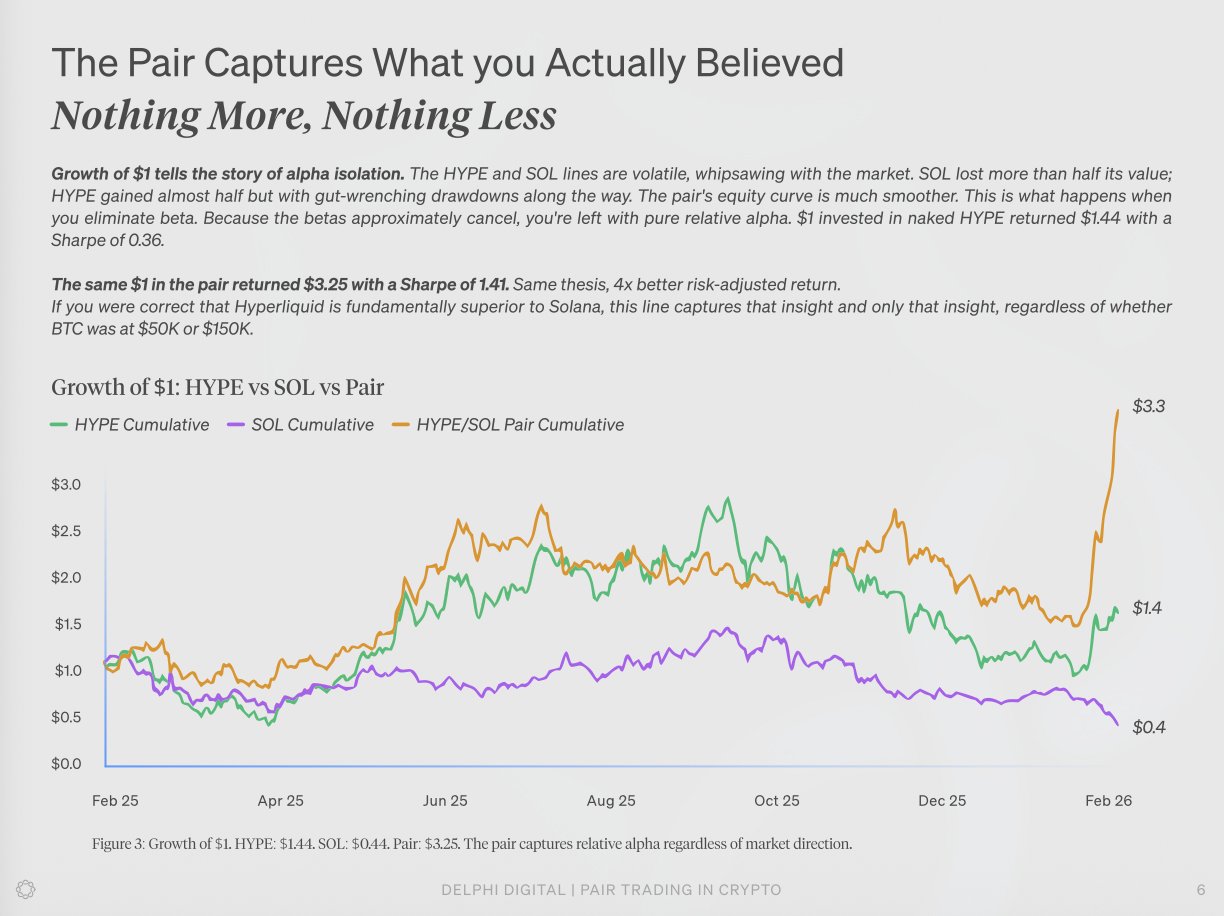

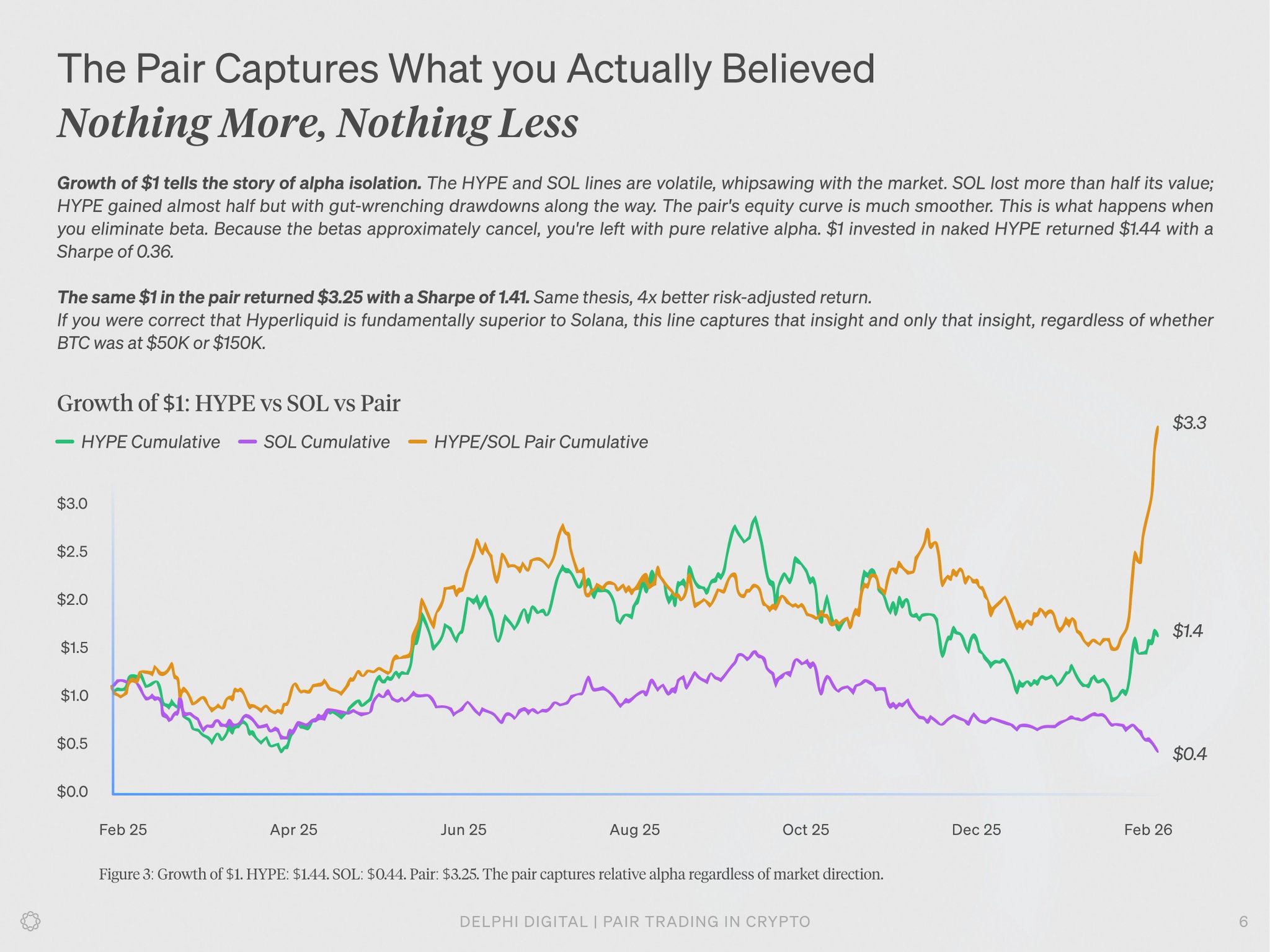

Tobias Reisner FA_Analyst Influencer B16.53K @reisnertobias Delphi Digital FA_Analyst Researcher D217.76K @Delphi_Digital

Delphi Digital FA_Analyst Researcher D217.76K @Delphi_Digital 6 2 590 閱讀原文 >釋出後HYPE走勢看漲

6 2 590 閱讀原文 >釋出後HYPE走勢看漲- 釋出後HYPE走勢看漲

Sovereign Trader DeFi_Expert A3.80K @Sovereign_Web3

Sovereign Trader DeFi_Expert A3.80K @Sovereign_Web3

Sovereign Trader DeFi_Expert A3.80K @Sovereign_Web3

Sovereign Trader DeFi_Expert A3.80K @Sovereign_Web3 3 0 306 閱讀原文 >釋出後HYPE走勢看漲

3 0 306 閱讀原文 >釋出後HYPE走勢看漲- 釋出後HYPE走勢看跌

- 釋出後HYPE走勢中性

𝕋𝕖𝕞𝕞𝕪🦇🔊 DeFi_Expert Educator C41.53K @Only1temmy

𝕋𝕖𝕞𝕞𝕪🦇🔊 DeFi_Expert Educator C41.53K @Only1temmy 𝕋𝕖𝕞𝕞𝕪🦇🔊 DeFi_Expert Educator C41.53K @Only1temmy

𝕋𝕖𝕞𝕞𝕪🦇🔊 DeFi_Expert Educator C41.53K @Only1temmy 51 14 4.88K 閱讀原文 >釋出後HYPE走勢看漲

51 14 4.88K 閱讀原文 >釋出後HYPE走勢看漲 Delphi Digital FA_Analyst Researcher D217.76K @Delphi_Digital

Delphi Digital FA_Analyst Researcher D217.76K @Delphi_Digital

Delphi Digital FA_Analyst Researcher D217.76K @Delphi_Digital19 4 2.27K 閱讀原文 >釋出後HYPE走勢看漲

Delphi Digital FA_Analyst Researcher D217.76K @Delphi_Digital19 4 2.27K 閱讀原文 >釋出後HYPE走勢看漲