Injective Protocol (INJ)

Injective Protocol (INJ)

- 42社交熱度指數(SSI)+39.53% (24h)

- #110市場預警排名(MPR)+8

- 524小時社交提及量+20.00% (24h)

- 40%24小時KOL看好比例3位活躍KOL

- 概要INJ price fell 4% but social heat rose 39%, weekly up 13% reaching the $3 target, staking rate at 56% with an 8% annualized yield, and an EVM upgrade proposal under development.

- 看漲訊號

- Weekly up 13%

- Reached $3 target

- Staking 56% + 8% annualized

- EVM upgrade proposal

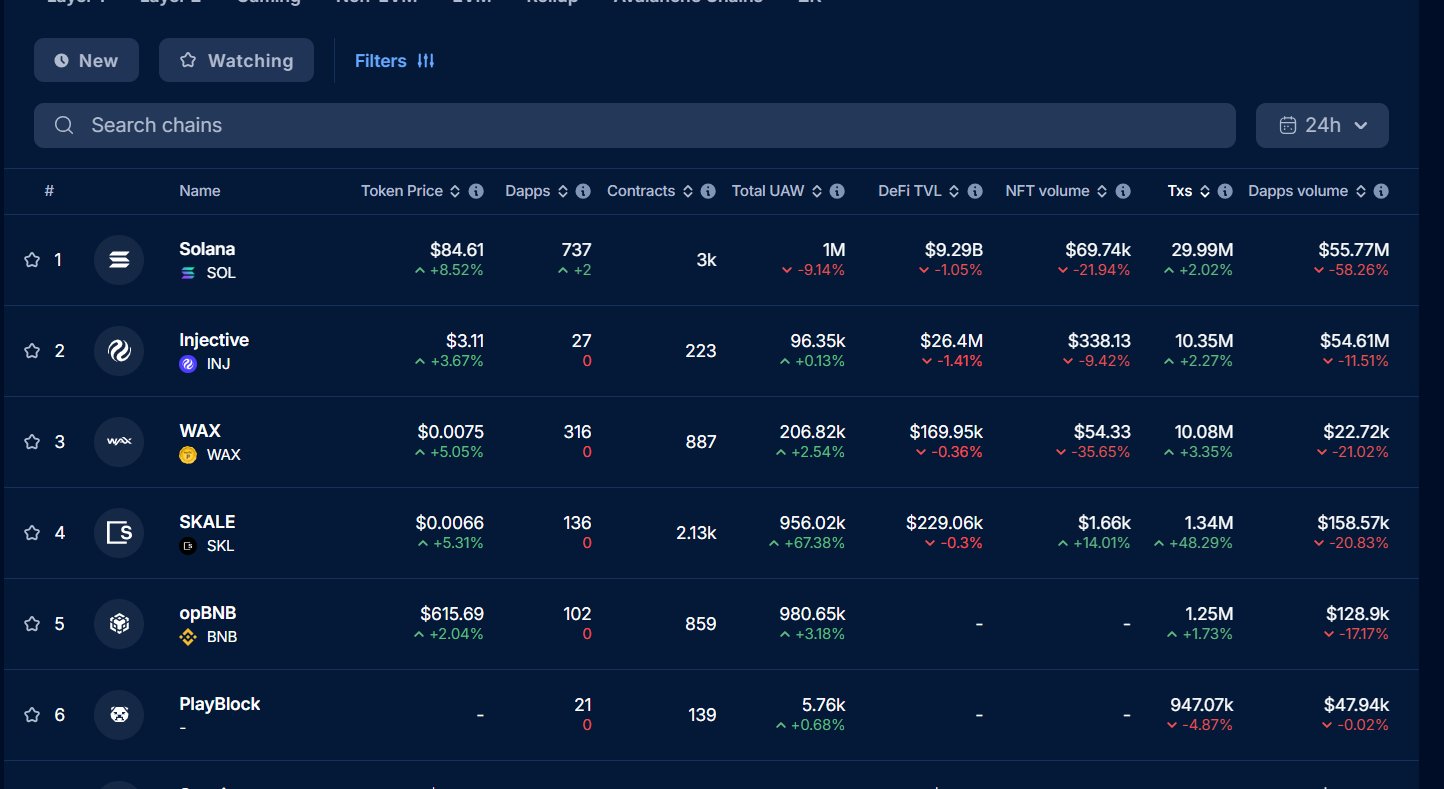

- Ranked 8th in L1 revenue

- 看跌訊號

- 24h down 4.17%

- Key resistance rejected

- Active addresses only 9.7k

- Profit-taking pressure

- Social heat surge possibly speculation

社交熱度指數(SSI)

- 總體資料42SSI

- 社交熱度趨勢(7D)價格(7D)情緒分佈看漲 (40%)中性 (40%)極度看跌 (20%)社交熱度洞察INJ social heat is moderate (42.25/100, ↑39.5%), driven mainly by a KOL attention surge (+166.7%). Coupled with a weekly rise of 13% reaching the $3 target and an EVM upgrade proposal, sentiment improved positively by 20%.

市場預警排名(MPR)

- 預警解讀INJ warning rank rose to #110 (+8), social anomaly score 14.09 ↑29.7% and sentiment polarization 3.89 ↑365% indicate speculative mood. KOL attention shift +140% is linked to a 24h drop of 4% and key resistance being rejected.

相關推文

CryptoBullet TA_Analyst Trader A174.86K @CryptoBullet1

CryptoBullet TA_Analyst Trader A174.86K @CryptoBullet1$INJ 1W update My $3 target reached ✅ https://t.co/OBq95OGLIE

CryptoBullet TA_Analyst Trader A174.86K @CryptoBullet1

CryptoBullet TA_Analyst Trader A174.86K @CryptoBullet1$INJ 1W chart #Injective is also cooked. Imo this is the most likely scenario. March 2024 was the Cycle Top. By the end of 2025 we should have a nice Bounce (X) (Dead Cat Bounce) to $25 and then another painful ABC down to $3-4 📉 https://t.co/FKbLdyzvWX

104 25 13.90K 閱讀原文 >釋出後INJ走勢極度看跌INJ已达作者3美元目标,预计经历死猫反弹至25美元后,将再次跌回3-4美元。

104 25 13.90K 閱讀原文 >釋出後INJ走勢極度看跌INJ已达作者3美元目标,预计经历死猫反弹至25美元后,将再次跌回3-4美元。 CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.93K @IvanM10529875

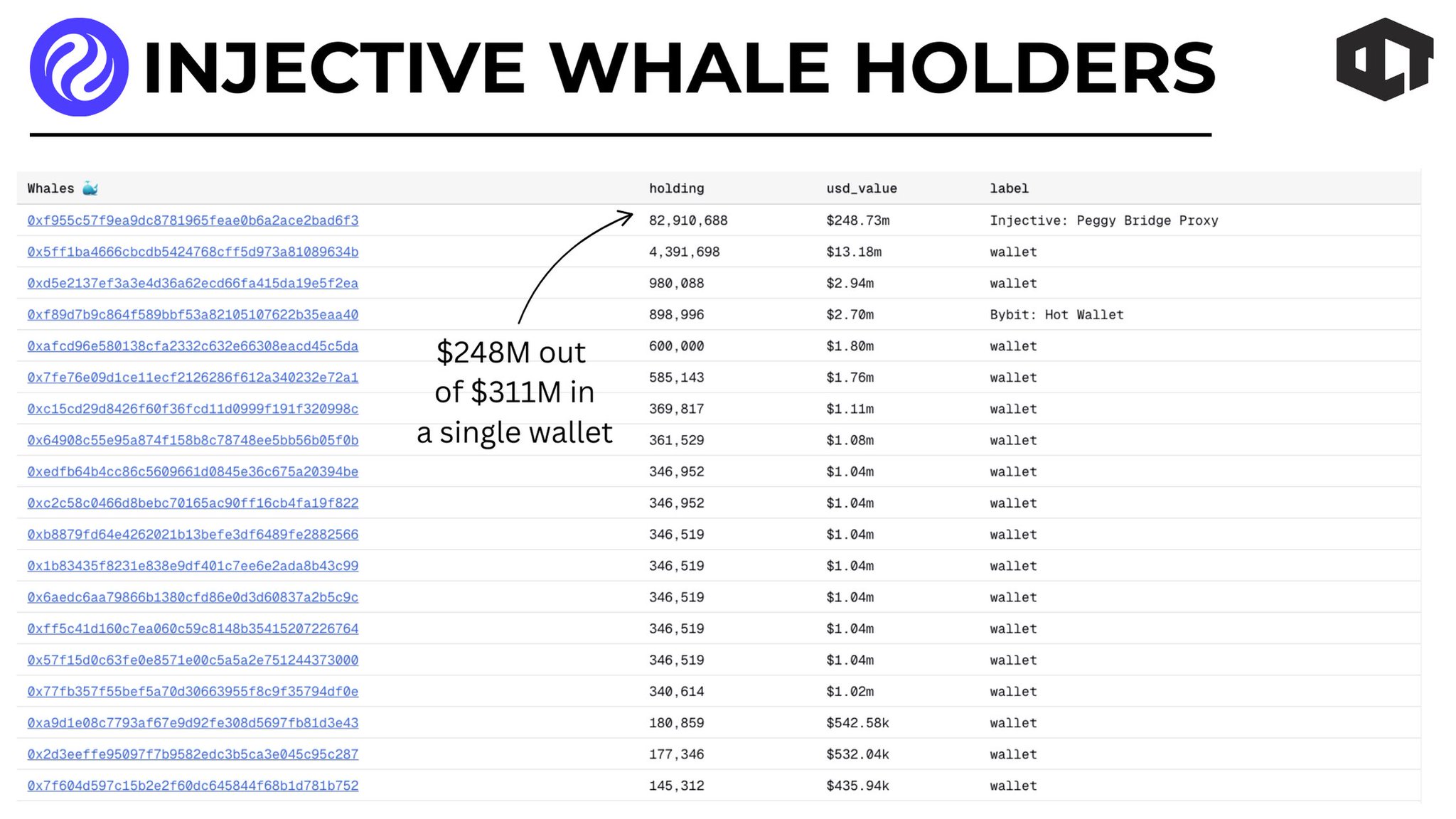

CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.93K @IvanM10529875Injective (INJ) vs. Osmosis (OSMO) 📊🔍 Good day, esteemed audience! Today, I am pleased to present a formal comparative analysis of two prominent networks within the Cosmos ecosystem: @injective ( $INJ ) and @osmosis ( $OSMO ).Our focus will encompass key metrics, including market indicators, network activity, staking, validators, and beyond. Each section features a concise table for swift comparison, followed by an insightful commentary. The objective is to illuminate the strengths and potential challenges of each network, thereby facilitating informed decisions in investments or development initiatives. Let us proceed! 🚀 1. Market Metrics 💼📈 These indicators reflect the overall valuation and liquidity of the tokens. Metric Injective Osmosis |----------------------|-----------------|----------------| ! Market Cap (USD) $322M $86M | FDV Market Cap $322M $386M | Total Supply 100M 762.8M | Circulating Supply 100M 762.8M | Price (USD) $3.20 $0.04 | Max Supply - 1.0B | BTC Price 0.0000462 0.0000054 | Market Cap Rank 133 664 Injective demonstrates greater stability through its elevated market capitalization and token price, positioning it as a more mature asset. Conversely, Osmosis exhibits substantial fully diluted valuation (FDV) potential, attributable to its expansive maximum supply. Notably, INJ's superior ranking in leading indices underscores enhanced market visibility. 📊💰 2. Network Activity ⚡👥 Emphasizing user engagement and transaction volumes as proxies for real-world utility. | Metric Injective Osmosis |--------------------------|-----------------|------------ | Addresses (>0 balance) 62,844 105,803 | 24h Active Addresses 9,994 3,262 | Change in Holders (1d) -27 -31 | Emptied Wallets (1d) 176 386 | 24h Transactions 1,446,102 53,547 | 7d Transactions 1,139,306 378,159 | 30d Transactions 5,381,182 2,113,371 | Net New Address (1d) -27 -31 | Net New Address (7d) +58 +23 | Net New Address (30d) -595 -14 Osmosis boasts a broader cohort of active addresses, indicative of a more distributed user base. However, Injective unequivocally leads in transactional throughput, surpassing 1.4 million daily transactions—a testament to its velocity and scale. Both networks exhibit marginal attrition in new addresses over the 30-day horizon, warranting strategic user acquisition efforts. 🔄📱 3. Address Statistics 📍🔢 Delving into portfolio dynamics and transactional evolution. | Metric Injective Osmosis |--------------------------|-----------------|------------- | Emptied Wallets (1d) 176 386 | 24h Transactions 1,446,102 53,547 | 7d Transactions 1,139,306 378,159 | 30d Transactions 5,381,182 2,113,371 | Net New Address (1d) -27 -31 | Net New Address (7d) +58 +23 | Net New Address (30d) -595 -14 | Address % Change (1d) 0% 0% | Address % Change (7d) +0.01% 0% | | Address % Change (30d) -0.09% 0% Injective's commanding transactional volume underscores its dynamism within the ecosystem. While Osmosis experiences higher daily wallet attrition, its comparatively subdued net address decline over 30 days signals underlying resilience. These patterns highlight opportunities for retention-focused innovations. 🛡️📈 4. Staking Metrics 🔒💎 Assessing locked token volumes and yield attractiveness. | Metric Injective Osmosis |--------------------------|-----------------|------------- | Total Stake (USD) $179.4M $10M | Percent Staked 56.10% 34% | Staking APR 8.13% 4.19% | Average APR (30d) 8.5% 4.94% | Stake % Change (1d) +0% +0.03% | Stake % Change (7d) +0.2% +0.26% | Stake % Change (30d) -3.94% -1.66% | Unbonded Stake (USD) $2M Sourse: @SmartStake

2 0 144 閱讀原文 >釋出後INJ走勢中性INJ market cap and trading volume lead OSMO, bullish on INJ CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.93K @IvanM10529875

CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.93K @IvanM10529875Injective ($INJ) Network Snapshot – February 15, 2026 ⚛️🚀 Fresh on-chain update for @injective – the high-speed #Cosmos L1 for DeFi & trading. Price stable ~$3.20, staking at 56% with 8%+ APR, and EVM upgrade proposal live. Time for a deep dive! 📊🔥 1. Core Network & Market Stats - Total Supply: 100M $INJ (fixed) - Circulating Supply: 100M $INJ - Current Price: $3.20 - Market Cap / FDV: $322M - Block Time: 0.63 seconds (blazing fast!) - 24h Transactions: 1.41M successful (7,456 failed) - Staking APR / APY: 8.11% / 8.3% (30-day avg ~8.51%) - Percent Staked: 56.10% - Total Staked: 56.07M $INJ (~$179M) 2. Growth & Activity Metrics - Unique Addresses: 626,584 (↓27 in 24h | +58 in 7d) - Unique Delegators: 231,299 (↓2 in 24h) - 24h Active Addresses: 9,695 - 30-day Rolling Active Addresses: 1,268,591 - Transactions (24h): 1.41M - Total Stake Change: +0.001% (24h) | +0.19% (7d) | +3.39% (30d) 3. Staking & Decentralization - Gini Coefficient: 0.248 (fairly distributed) - Nakamoto Coefficient: 6 (solid for 50 validators) - Top 100 Delegators’ Stake Share: 87.4% (some concentration) - Active Validators: 50 - Validators Below Avg Voting Power: 35 - Last Active Validator Stake: 9,748 $INJ (~$31K) 4. Undelegation Stats - Unbonding Period: 21 days - Pending Undelegations: ~28.1K (1d) | ~3.7M (7d) | ~4.2M $INJ (all) - Pending Count: 1,891 - As % of Total Supply: 4.21% - As % of Not Staked Supply: 9.59% 5. Liquid Staking (Last 24 Hours) - Total Liquid Staked: ~3.18M $INJ (+26K net) - TruFin: ~1.58M $INJ (leader, +282) - Hydro Protocol: ~1.55M $INJ (↓2.2K) - Stride: ~22.3K $INJ (↑0.9K) - DojoSwap: ~13.4K $INJ (↑0.96K) - Black Panther: ~11.5K $INJ (↑6.8K) → Healthy inflows, TruFin/Hydro dominate ~97% of LST. 6. Token Burn Activity - Total Burned to Date: 6.91M $INJ (~$30.4M at current price) - Last 30 Days: 431K $INJ - Last 7 Days: 43K $INJ - Today: Minimal (0 recent burns shown) - Largest Single-Day Burn: 43K $INJ (Jan 21, 2026) → Deflationary mechanism active, but low fees limit pace. 7. Top Validators by Voting Power 1. Zilliqa – 8.85% (~4.9M $INJ) | 5–20% commission 2. Informal Systems – 6.68% (~3.6M) | 5–42% 3. Binance Staking – 5.44% (~3.0M) | 7–100% 4. Kraken – 5.09% (~2.8M) | 10% 5. SCV-Security Staking Rebate – 4.89% (~2.7M) | 5–20% 6. Everstake – 4.76% (~2.6M) | 10% 7. Figment – 3.88% (~2.2M) | 5–25% 8. Cointelegraph Decentralized – 3.61% (~2.0M) | 10% 9. Core ONE – 3.53% (~2.0M) | 5–20% 10. Chorus One – 2.65% (~1.5M) | 7.5–100% ... Injective Foundation at 2.65% (100% comm). 8. Governance Proposals - #619: Real-Time EVM Mainnet Upgrade – In Voting| 170 votes | 7 validators | 23.46% Yes | 3d 6h left 🌐Link: https://t.co/01GHLv9PRz - #618: OLP Reward Disbursement – Epoch 54 – Passed (40.86% Yes) - #617: INJ Supply Squeeze – Passed - #616: dApps LTV Update on Injective Exchange – Passed 9. Foundation Delegation Program - Assessment Window #13 (Jan-Feb 2026): Active - Start: 01/01/2026 | End: 02/28/2026 - Validators Meeting Requirements: 10 - Not Meeting: 15 → Ongoing incentives for validator performance. 10. Recent Large Transactions (>10K $INJ) - Mix of undelegates (e.g., 20K to Trust Nodes), sends (11K–24K between wallets). - Notable: 24K send, multiple 14K–21K transfers, delegations to Allnodes/Coinbase01. 11. Weekly Recap (Feb 8–14) - Price: $3.29 (↓0.3%) - Active Addresses: 644,536 - Transactions: 13.06M - Burned: 0 $INJ - Stake: 56M (+0.2%) - Undelegatione: 1,899 (110K $INJ) - Gini / Nakamoto: 0.425 / 6 → Staking growth resilient amid stable markets. Summary Injective thriving with 56% staked, 8%+ APR, and 1.4M daily tx on 0.63s blocks. EVM upgrade could unlock more DeFi magic. MC $322M, burn at 6.9M total. Decentralization strong (Nakamoto 6), but watch validator jails. Sourse: @SmartStake Bullish on $INJ's speed & EVM future? 🚀💬 #Injective #INJ #CosmosEcosystem #DeFi #EVM #CryptoStaking #Blockchain #LiquidStaking #Web3 #OnChain

14 1 256 閱讀原文 >釋出後INJ走勢看漲INJ holds high positions, APR 8%+, EVM upgrade will speed up, expected to keep rising Aleksander.TraderX TA_Analyst Trader A1.33K @alekstraderx

Aleksander.TraderX TA_Analyst Trader A1.33K @alekstraderx$INJ Rejected our key resistance zone✅ - Not really chasing anything new here just yet! Will keep updating this every day next week! Remember, the secret to stay alive in trading is good risk management! https://t.co/qjdP4wb4uO

5 0 52 閱讀原文 >釋出後INJ走勢中性INJ failed to break through the key resistance level, the author emphasizes risk management and recommends a wait-and-see approach.

5 0 52 閱讀原文 >釋出後INJ走勢中性INJ failed to break through the key resistance level, the author emphasizes risk management and recommends a wait-and-see approach. Aleksander.TraderX TA_Analyst Trader A1.33K @alekstraderx

Aleksander.TraderX TA_Analyst Trader A1.33K @alekstraderx$INJ Up over 13% from our poi this week! That’s fantastic!!! Would for sure book some profits here:) https://t.co/UPWX0l6qvL

Aleksander.TraderX TA_Analyst Trader A1.33K @alekstraderx

Aleksander.TraderX TA_Analyst Trader A1.33K @alekstraderx$INJ Bounce or die from this golden pocket a little lower! - 2.9$ - Golden pocket This zone is key for $INJ to stay above! If not, we will most likely bleed all the way down to previous week low. https://t.co/6JmmNhGD9L

9 0 317 閱讀原文 >釋出後INJ走勢看漲INJ rebounds from a key support level, up 13%; the author suggests taking profits and watching the $2.9 support.

9 0 317 閱讀原文 >釋出後INJ走勢看漲INJ rebounds from a key support level, up 13%; the author suggests taking profits and watching the $2.9 support. IKAY 🥷👷♂️🔥 Media Community_Lead B2.90K @Great_Ikay

IKAY 🥷👷♂️🔥 Media Community_Lead B2.90K @Great_Ikay $INJ Memecoins D1.01K @memes_on_inj

$INJ Memecoins D1.01K @memes_on_injForget roses, buy memes Happy Valentine’s Day, Injective memecoin believers Valentine’s Day is temporary, Injective memes are forever. $INJ | @injective https://t.co/4gOp7lOYyu

13 2 256 閱讀原文 >釋出後INJ走勢極度看漲The tweet encourages investors to buy the Injective memecoin on Valentine's Day, stating its value lasts longer than traditional gifts.

13 2 256 閱讀原文 >釋出後INJ走勢極度看漲The tweet encourages investors to buy the Injective memecoin on Valentine's Day, stating its value lasts longer than traditional gifts. Anarcho Economy TA_Analyst Trader B4.14K @Anarchoeconomy

Anarcho Economy TA_Analyst Trader B4.14K @Anarchoeconomy Our Crypto Talk Media Influencer C76.65K @ourcryptotalk

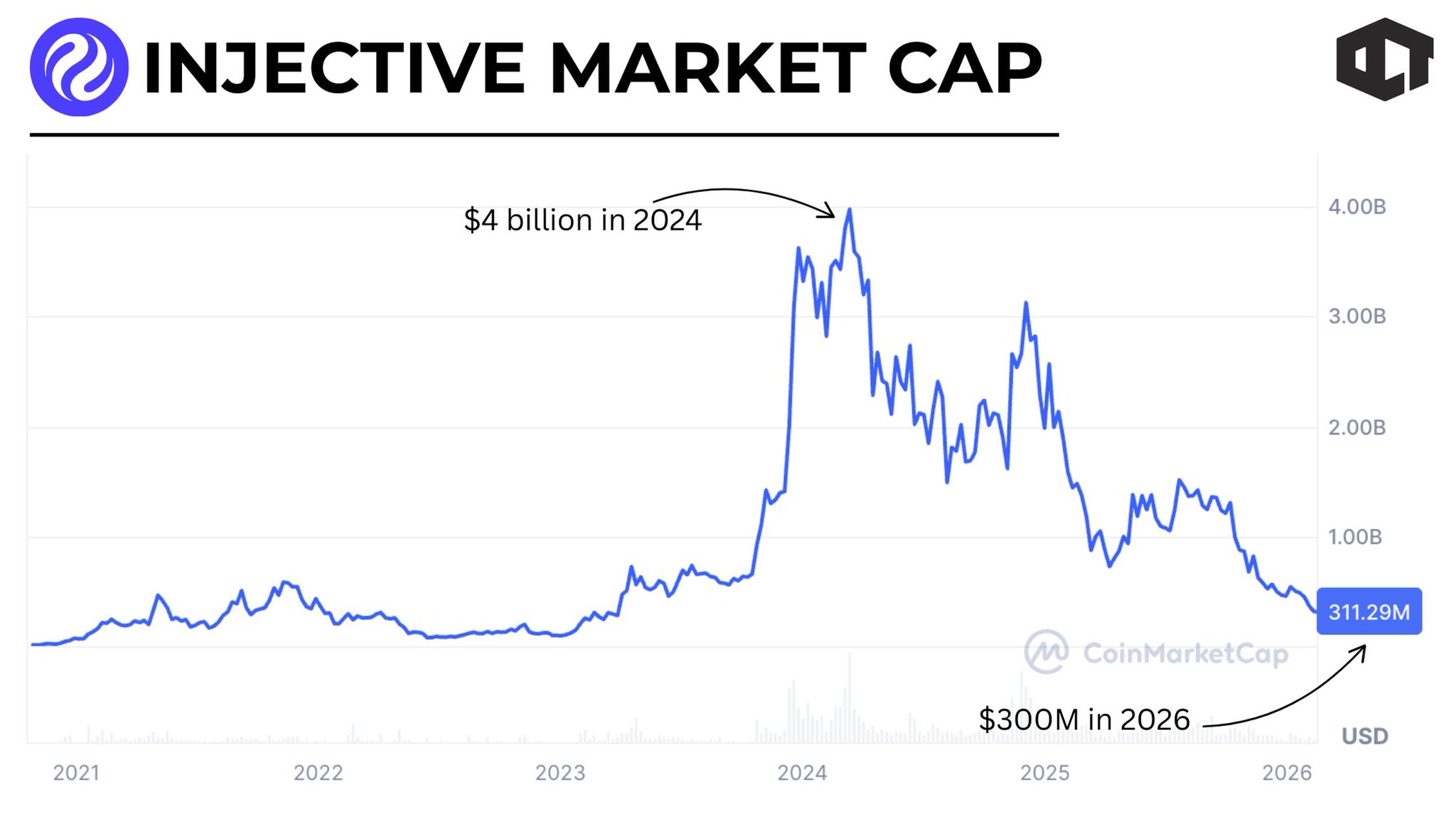

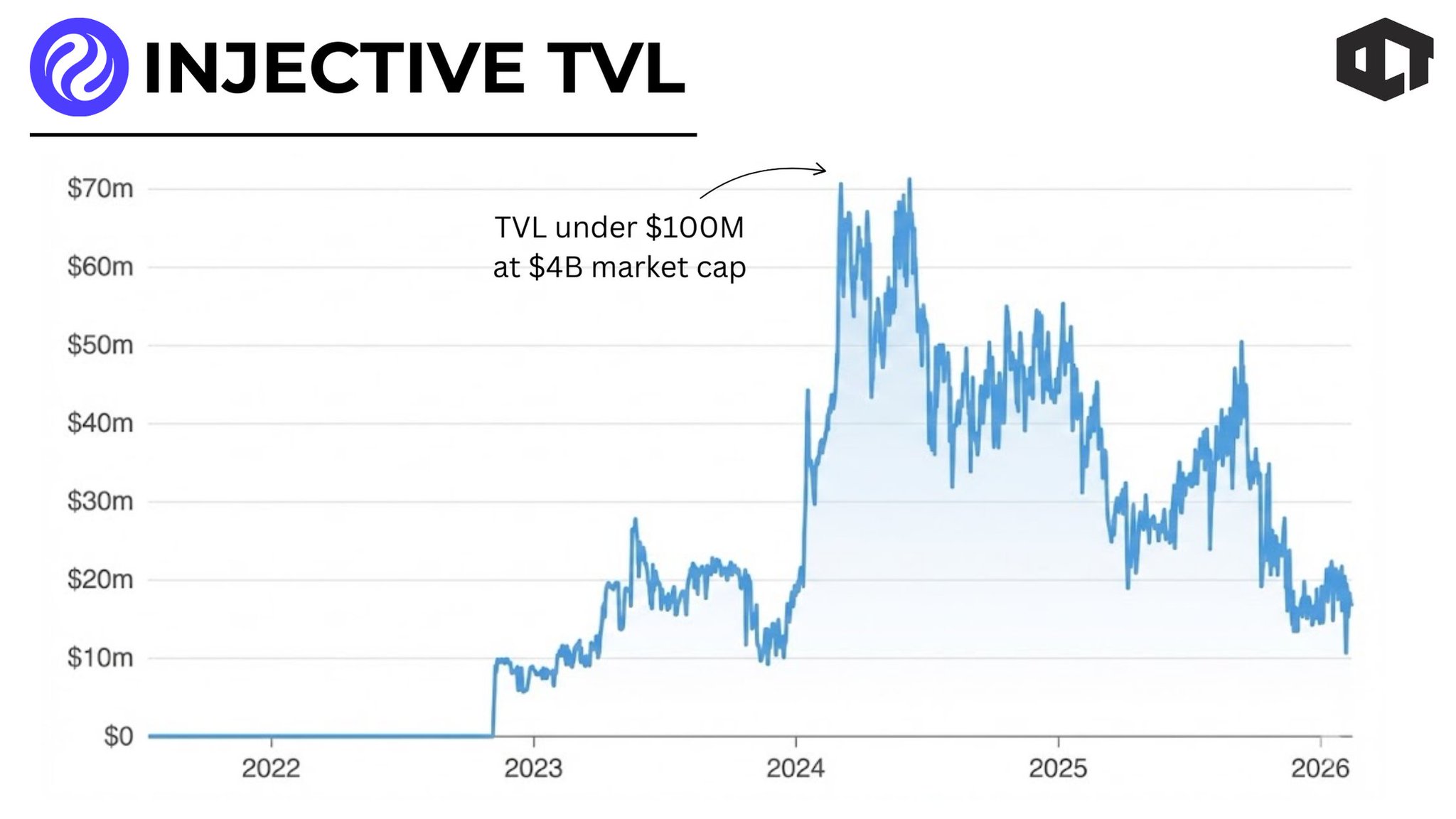

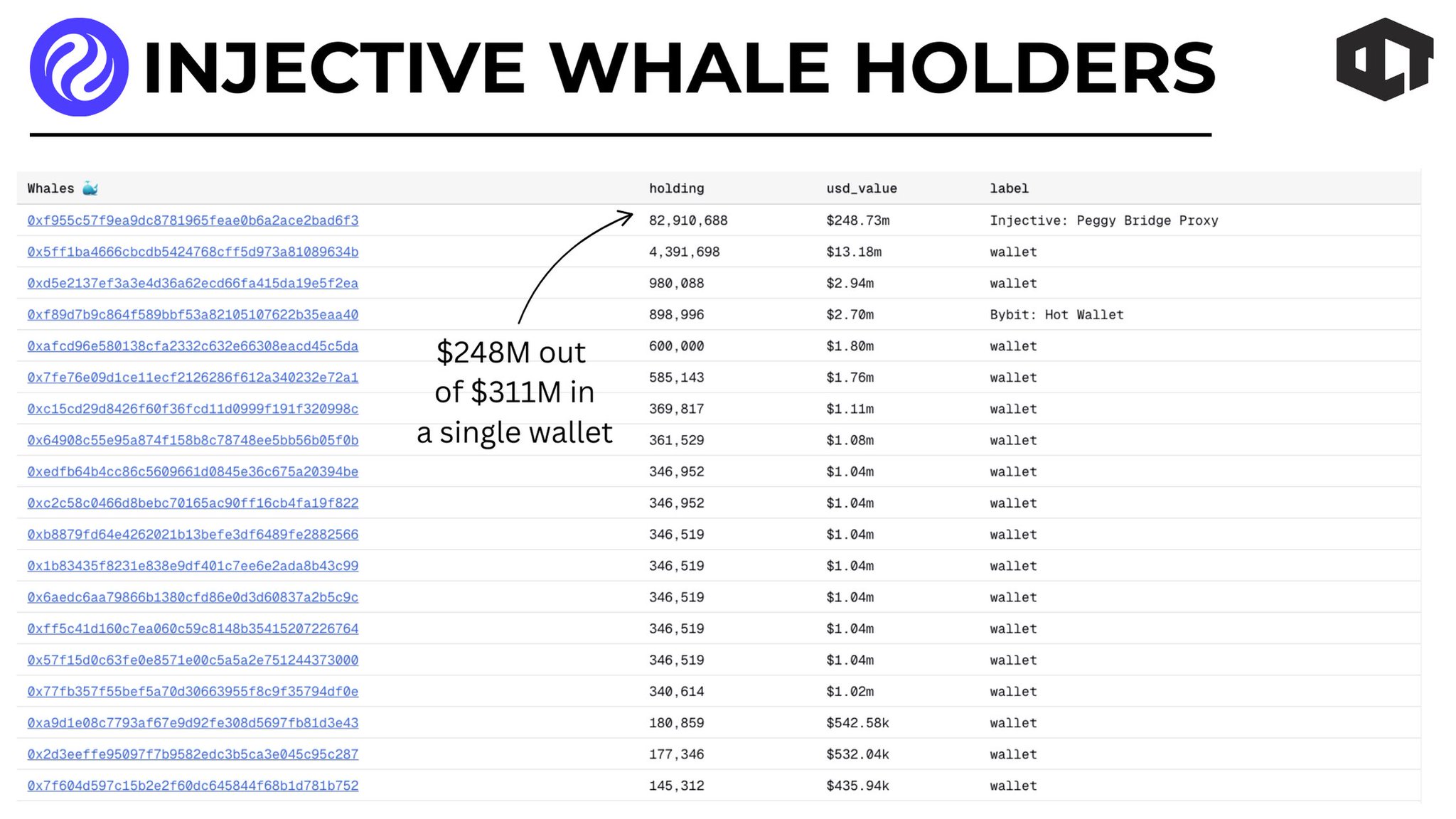

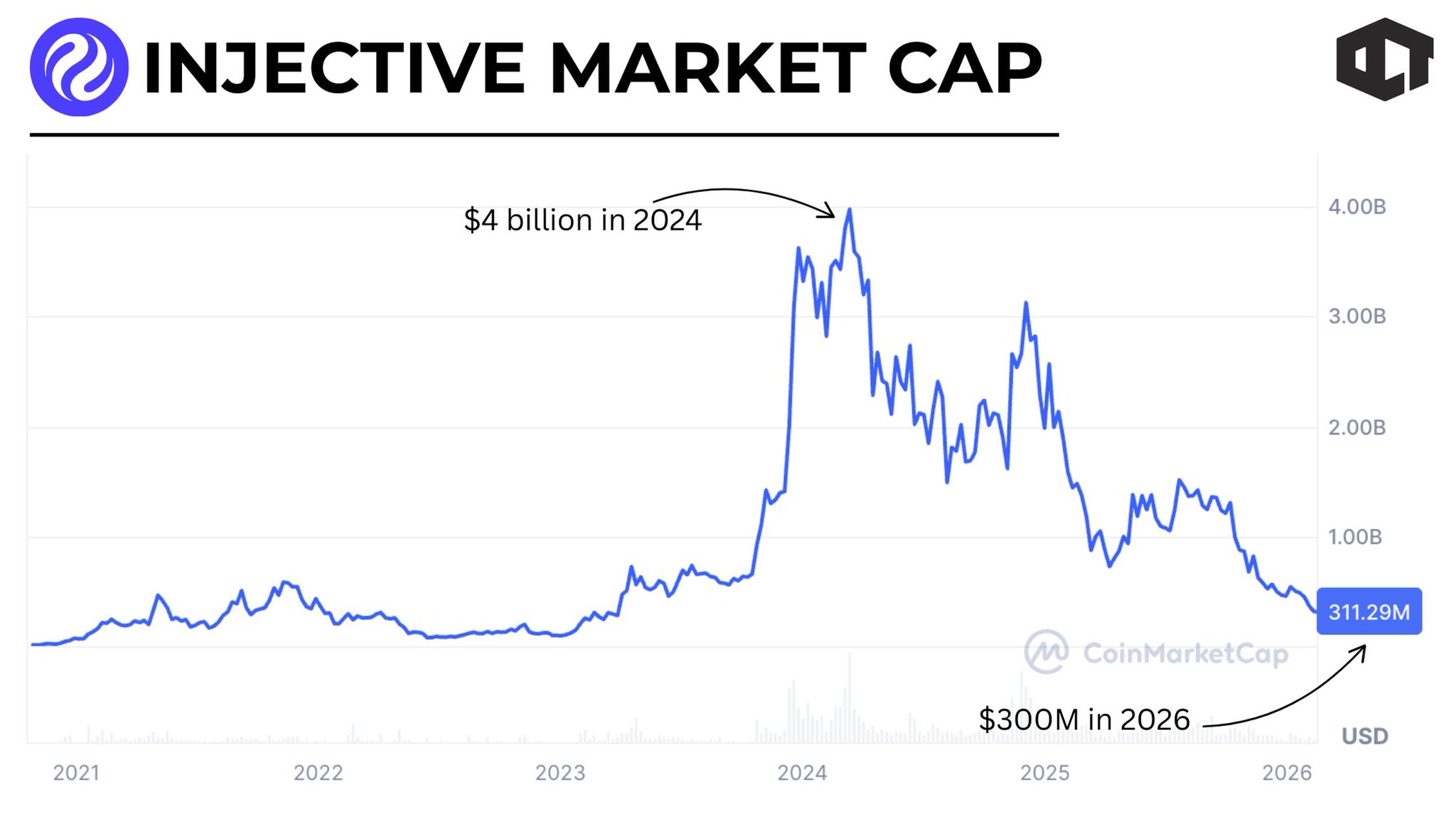

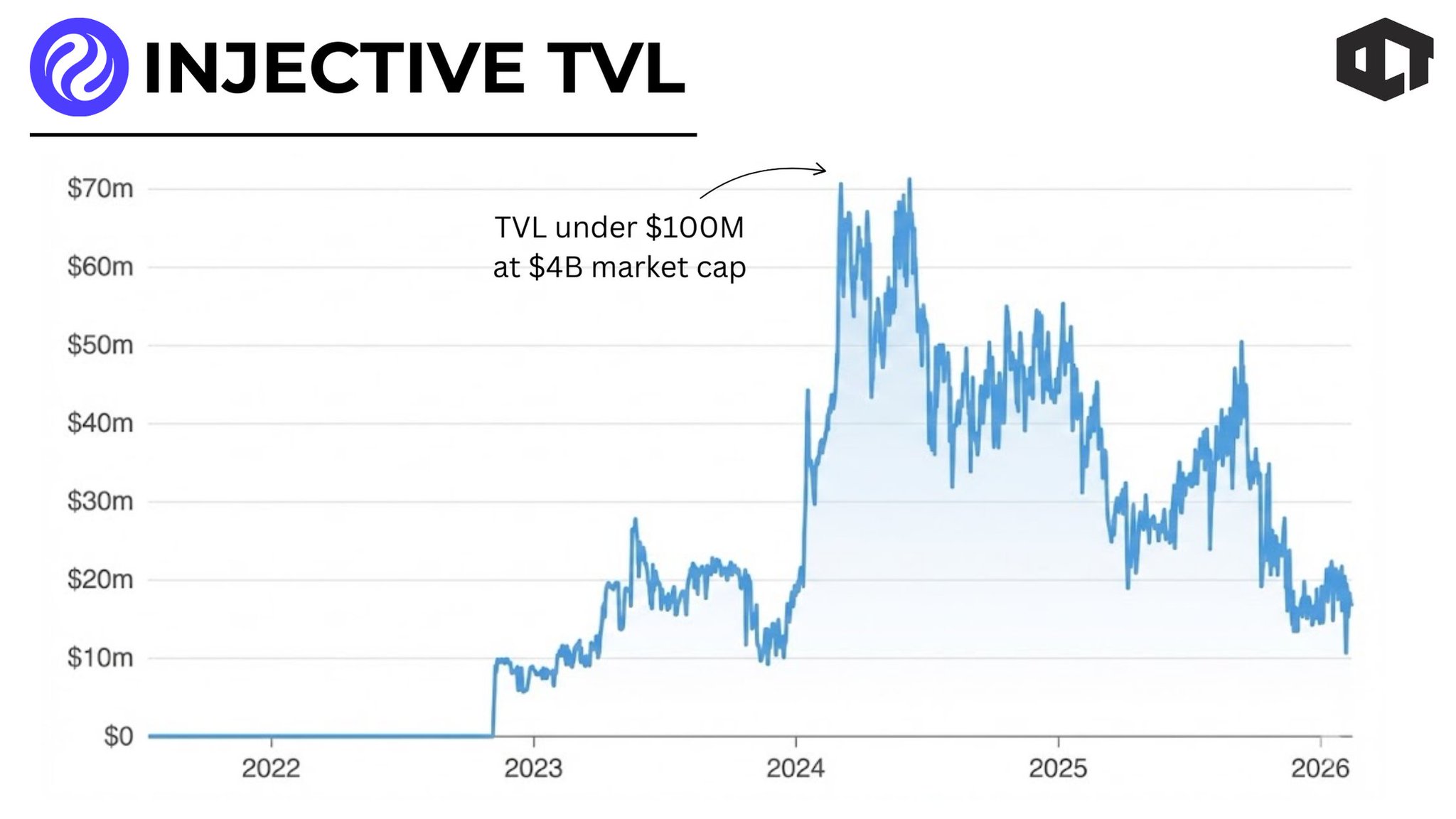

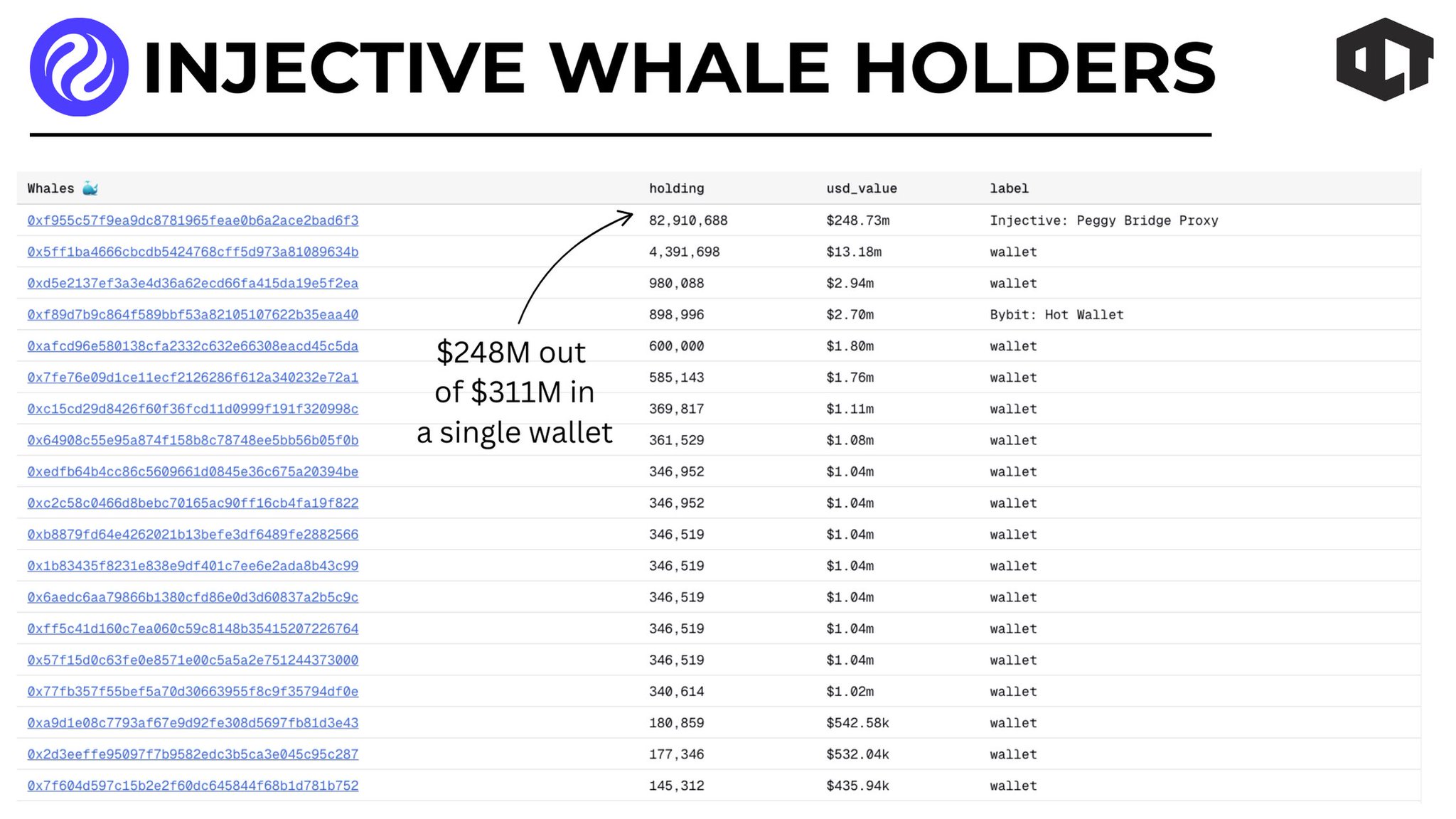

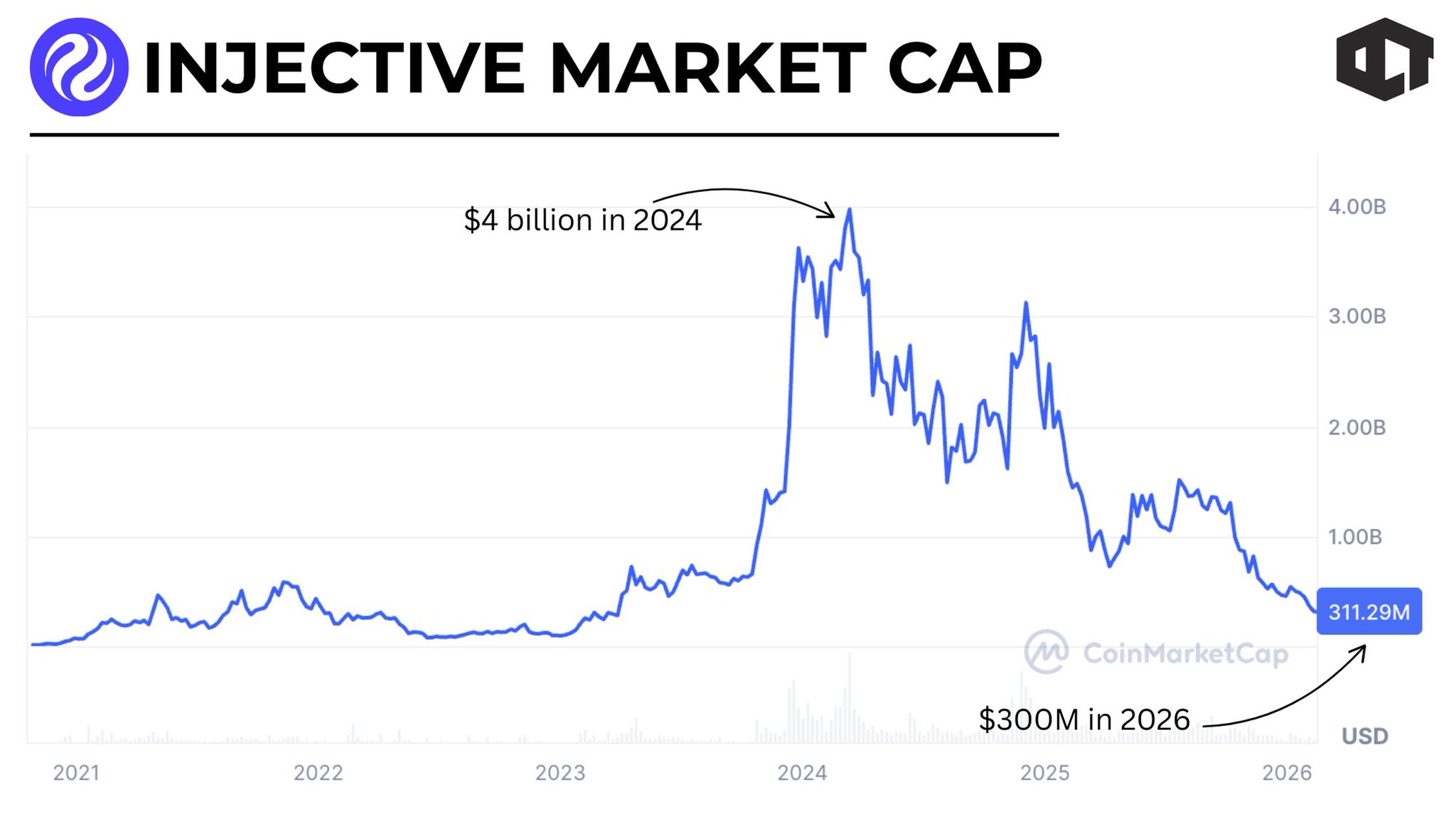

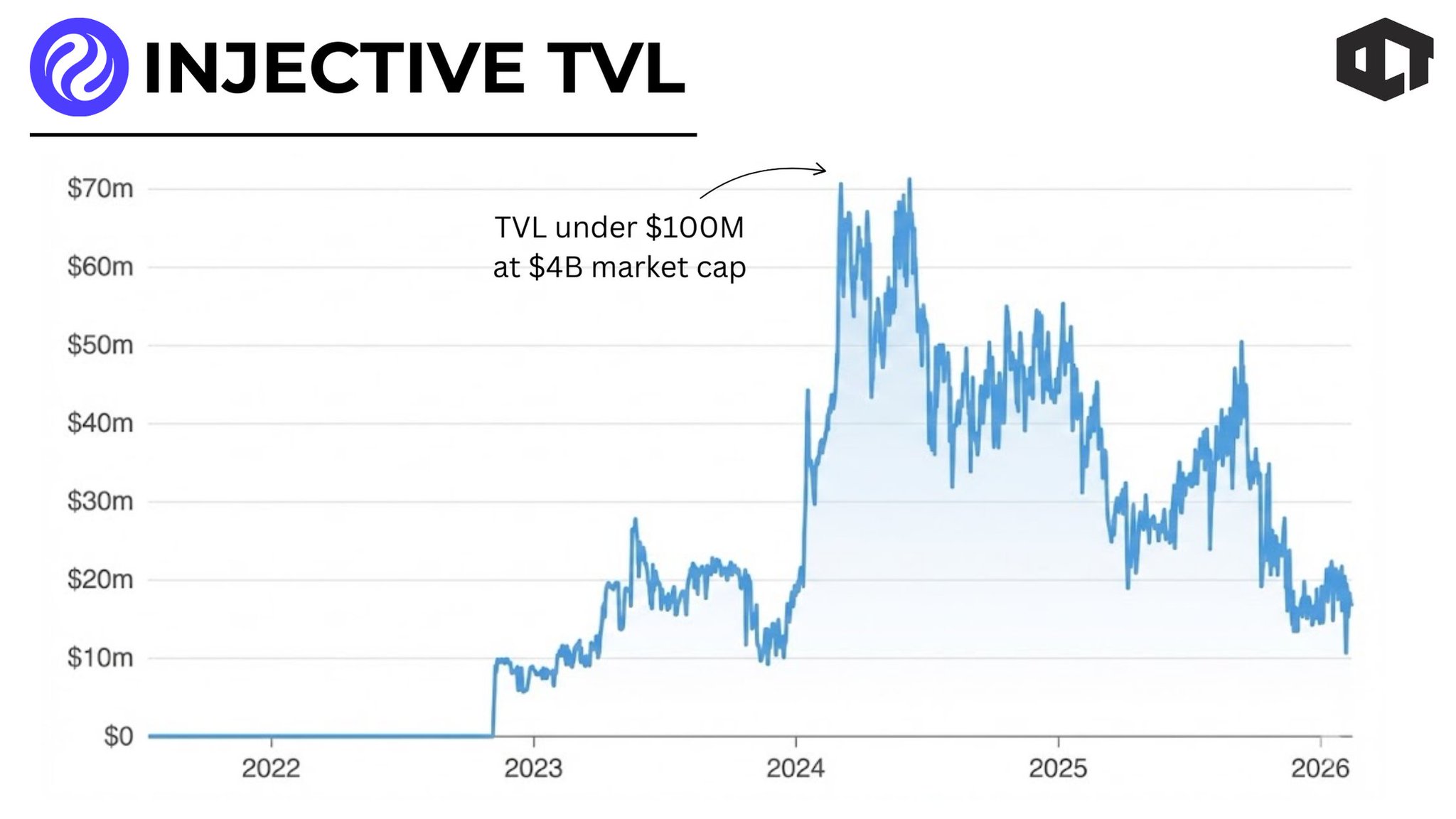

Our Crypto Talk Media Influencer C76.65K @ourcryptotalk$INJ lost 90% of its value > A $4B market cap. > Under $100M in TVL. > Now sitting near $300M. The warning signs were always there. Let's break them down 👇 1️⃣ THE VALUATION RAN TOO FAST In 2024, Injective’s market cap pushed close to $4 billion. The narrative was strong. On-chain derivatives. Fast execution. New integrations. It felt like the “next big thing” in DeFi. But when you zoom out, the move was vertical. And vertical moves usually need strong fundamentals underneath them. When liquidity dried up and risk appetite cooled off, the market started asking harder questions. Was usage deep enough? Was capital sticky enough? At $300M now, it’s clear the earlier valuation was pricing in a lot of future growth that simply didn’t show up fast enough. 2️⃣ PRICE STRUCTURE BROKE Look at the 2023 breakout zone on the price chart. That area acted as a base before the big rally. In late 2025, price tried to reclaim the $10 level and failed. That rejection mattered. When a token cannot hold or reclai

145 44 14.65K 閱讀原文 >釋出後INJ走勢極度看跌INJ’s market cap fell from $4 billion to $300 million, a 90% drop, with clear warning signals and a broken price structure.

145 44 14.65K 閱讀原文 >釋出後INJ走勢極度看跌INJ’s market cap fell from $4 billion to $300 million, a 90% drop, with clear warning signals and a broken price structure. OCT Trades TA_Analyst Trader B5.16K @oct_trades

OCT Trades TA_Analyst Trader B5.16K @oct_trades Our Crypto Talk Media Influencer C76.65K @ourcryptotalk

Our Crypto Talk Media Influencer C76.65K @ourcryptotalk$INJ lost 90% of its value > A $4B market cap. > Under $100M in TVL. > Now sitting near $300M. The warning signs were always there. Let's break them down 👇 1️⃣ THE VALUATION RAN TOO FAST In 2024, Injective’s market cap pushed close to $4 billion. The narrative was strong. On-chain derivatives. Fast execution. New integrations. It felt like the “next big thing” in DeFi. But when you zoom out, the move was vertical. And vertical moves usually need strong fundamentals underneath them. When liquidity dried up and risk appetite cooled off, the market started asking harder questions. Was usage deep enough? Was capital sticky enough? At $300M now, it’s clear the earlier valuation was pricing in a lot of future growth that simply didn’t show up fast enough. 2️⃣ PRICE STRUCTURE BROKE Look at the 2023 breakout zone on the price chart. That area acted as a base before the big rally. In late 2025, price tried to reclaim the $10 level and failed. That rejection mattered. When a token cannot hold or reclai

145 44 14.65K 閱讀原文 >釋出後INJ走勢極度看跌INJ market cap plummeted 90%, early overvaluation, price structure broken and TVL stagnant, warning risk.

145 44 14.65K 閱讀原文 >釋出後INJ走勢極度看跌INJ market cap plummeted 90%, early overvaluation, price structure broken and TVL stagnant, warning risk. Our Crypto Talk Media Influencer C76.65K @ourcryptotalk

Our Crypto Talk Media Influencer C76.65K @ourcryptotalk$INJ lost 90% of its value > A $4B market cap. > Under $100M in TVL. > Now sitting near $300M. The warning signs were always there. Let's break them down 👇 1️⃣ THE VALUATION RAN TOO FAST In 2024, Injective’s market cap pushed close to $4 billion. The narrative was strong. On-chain derivatives. Fast execution. New integrations. It felt like the “next big thing” in DeFi. But when you zoom out, the move was vertical. And vertical moves usually need strong fundamentals underneath them. When liquidity dried up and risk appetite cooled off, the market started asking harder questions. Was usage deep enough? Was capital sticky enough? At $300M now, it’s clear the earlier valuation was pricing in a lot of future growth that simply didn’t show up fast enough. 2️⃣ PRICE STRUCTURE BROKE Look at the 2023 breakout zone on the price chart. That area acted as a base before the big rally. In late 2025, price tried to reclaim the $10 level and failed. That rejection mattered. When a token cannot hold or reclai

145 44 14.65K 閱讀原文 >釋出後INJ走勢看跌INJ’s market cap fell from $4 billion to $300 million, a 90% drop, with clear warning signals and a broken price structure.

145 44 14.65K 閱讀原文 >釋出後INJ走勢看跌INJ’s market cap fell from $4 billion to $300 million, a 90% drop, with clear warning signals and a broken price structure. PRYNXX 🥷💚 Influencer OnChain_Analyst B8.42K @OguzieWisdom

PRYNXX 🥷💚 Influencer OnChain_Analyst B8.42K @OguzieWisdom. @injective just processed over 10M transactions in the last 24 hours and over 70M in the past 7 days, ranking it among the top 3 chains by transaction volume. This shows real users actively building, trading, and deploying on-chain. More usage means higher fees, stronger network economics, and greater potential for community buybacks over time. $INJ

39 2 292 閱讀原文 >釋出後INJ走勢極度看漲Injective's transaction volume is soaring, exceeding 10M in 24 hours and over 70M in 7 days, indicating a positive network economy.

39 2 292 閱讀原文 >釋出後INJ走勢極度看漲Injective's transaction volume is soaring, exceeding 10M in 24 hours and over 70M in 7 days, indicating a positive network economy.