Kite AI (KITE)

Kite AI (KITE)

- 71Индекс социальных настроений (SSI)- (24h)

- #16Рейтинг пульса рынка (MPR)0

- 1Упоминание в социальных сетях за 24 часа- (24h)

- 100%24-часовой бычий коэффициент лидеров мнений1 активный лидер мнений

- Краткое содержаниеKITE up 6.27% to 0.182, high 0.195, strong recommendation by BSKolClub, market sluggish yet breaking through.

- Бычьи сигналы

- Price up 6.27%

- High 0.195

- BSKolClub recommendation

- Market sluggish but still rising

- Alpha opportunity

- Медвежьи сигналы

- Overall market decline

- Social sentiment remains flat

- Possible overbought

- Trading activity still limited

- Short-term profit-taking risk

Индекс социальных настроений (SSI)

- Общие данные71SSI

- Тренд SSI (7 дн.)Цена (7 дн.)Распределение настроенийБычий (100%)Инсайты по SSIKITE social heat high (70.5/100, stable), activity full score 40/40, positive sentiment 27.5/30 driving, KOL attention only 3/30, boosted by BSKolClub recommendation and price rise.

Рейтинг пульса рынка (MPR)

- Инсайт ОповещениеKITE warning rank #16, social anomaly 100/100 highest, sentiment polarization 50/100, KOL attention shift only 3/100, corresponding to abnormal surge of 6.27% in a sluggish market.

Посты из X

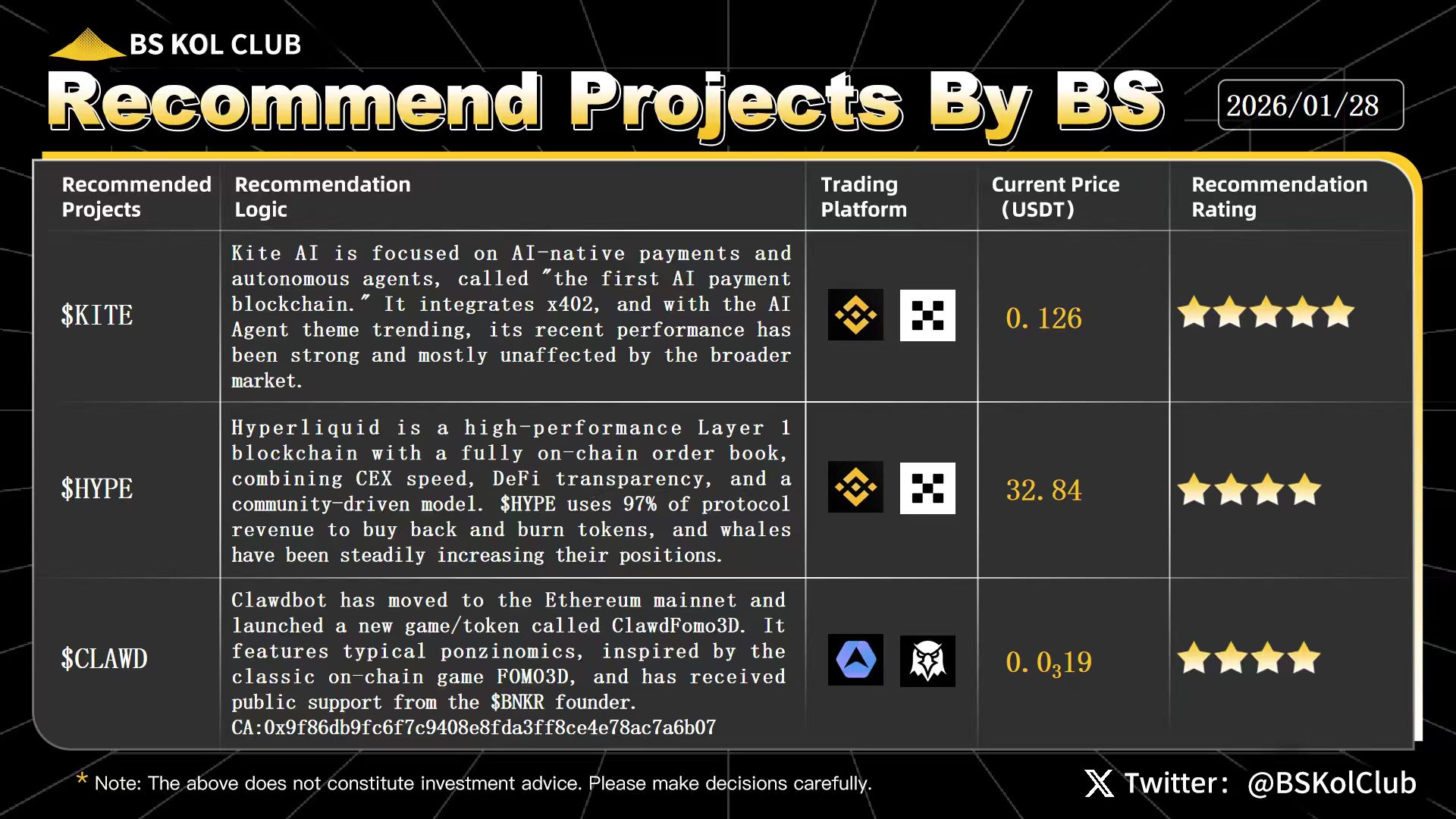

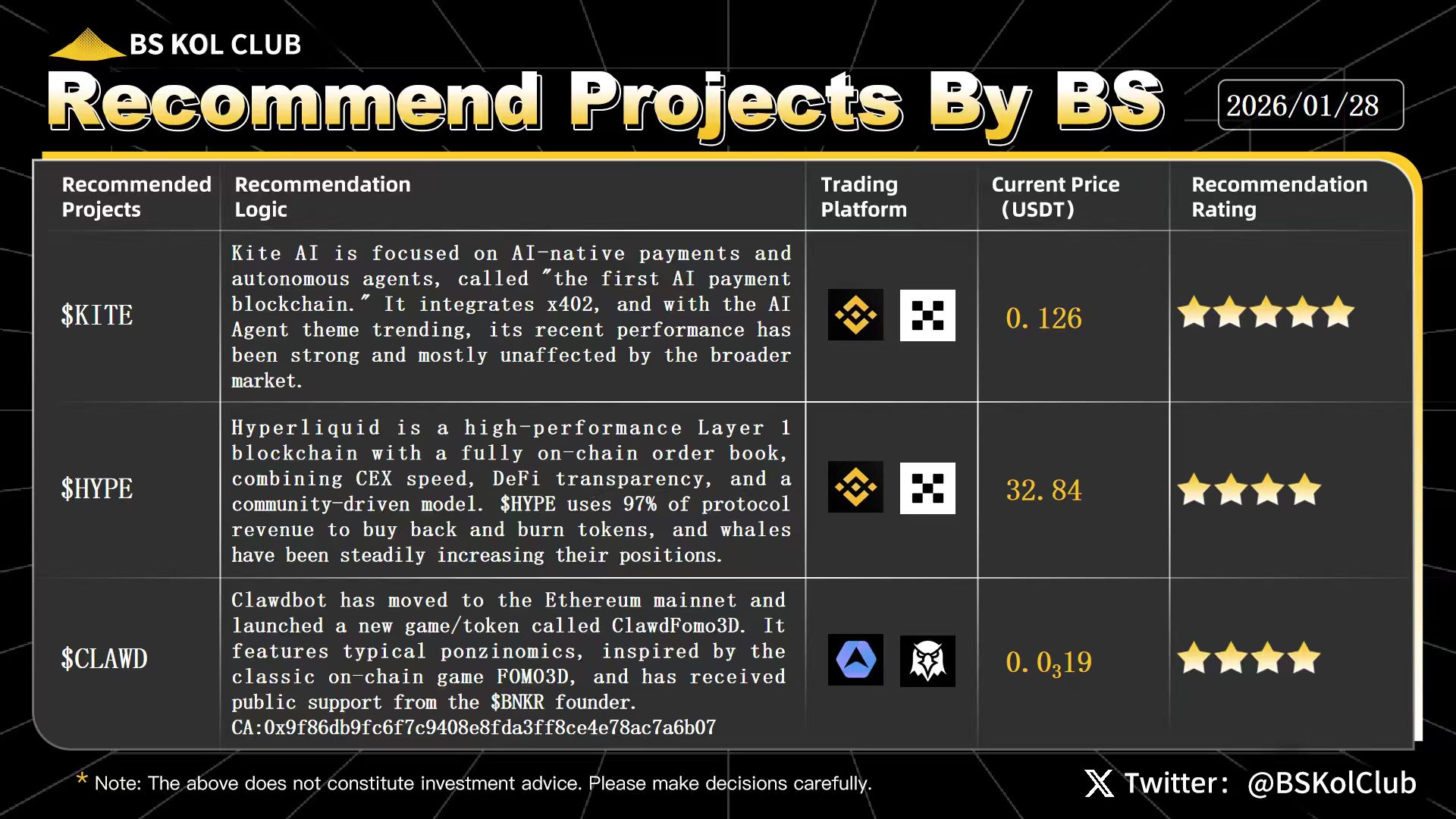

BS Kol Club Media Influencer A12.34K @BSKolClub

BS Kol Club Media Influencer A12.34K @BSKolClubBS recommended project continues to rise 📈 The project recommended in Issue #91 on January 28, $KITE, was priced at $0.126 at the time of recommendation. Today, it reached a high of $0.195, with a maximum gain of +54.8% 💰 Amid a market downturn and weakened sentiment, we remain committed to identifying true Alpha. Even in the cold winter, there are still those who break through; Even in a downtrend, opportunities still belong to a select few. Alpha always belongs to those who keep exploring. #KITE #Crypto #Alpha #Web3

BS Kol Club Media Influencer A12.34K @BSKolClub

BS Kol Club Media Influencer A12.34K @BSKolClub✨ BS KOL Club Weekly Recommended Projects|#Issue91 This week’s picks: $KITE, $HYPE, $CLAWD Overnight and into this morning, the crypto market extended its rebound, with Bitcoin holding above USD 89,000 and Ethereum breaking past USD 3,000. U.S. equities were mixed: the Dow fell 0.83%, while the S&P 500 rose 0.41% and the Nasdaq gained 0.91%. Crypto-related stocks showed divergence—treasury-focused firms MSTR (+0.62%), BMNR (+5.5%), and ALTS (+10.05%) advanced, while sector companies COIN (-1.24%), GEMI (-4.88%), and CRCL (-1.33%) declined. On-chain data shows Bitcoin’s network hashrate plunged from 1.16 ZH/s to 690 EH/s, marking the largest drop on record, before beginning to recover. Analysts attribute this to the U.S. winter storm “Fernand,” where extreme cold and widespread power outages forced multiple mining pools offline, causing a temporary hashrate decline. On the macro front, Wall Street’s Rick Rieder is seen as a potential driver of more market-oriented Fed policy. He previously advocated a 50-b

18 4 4.04K Оригинал >Тренд KITE после выпускаБычийBS KOL Club推荐的KITE项目在市场低迷中逆势上涨54.8%,同时BTC和ETH也出现反弹。

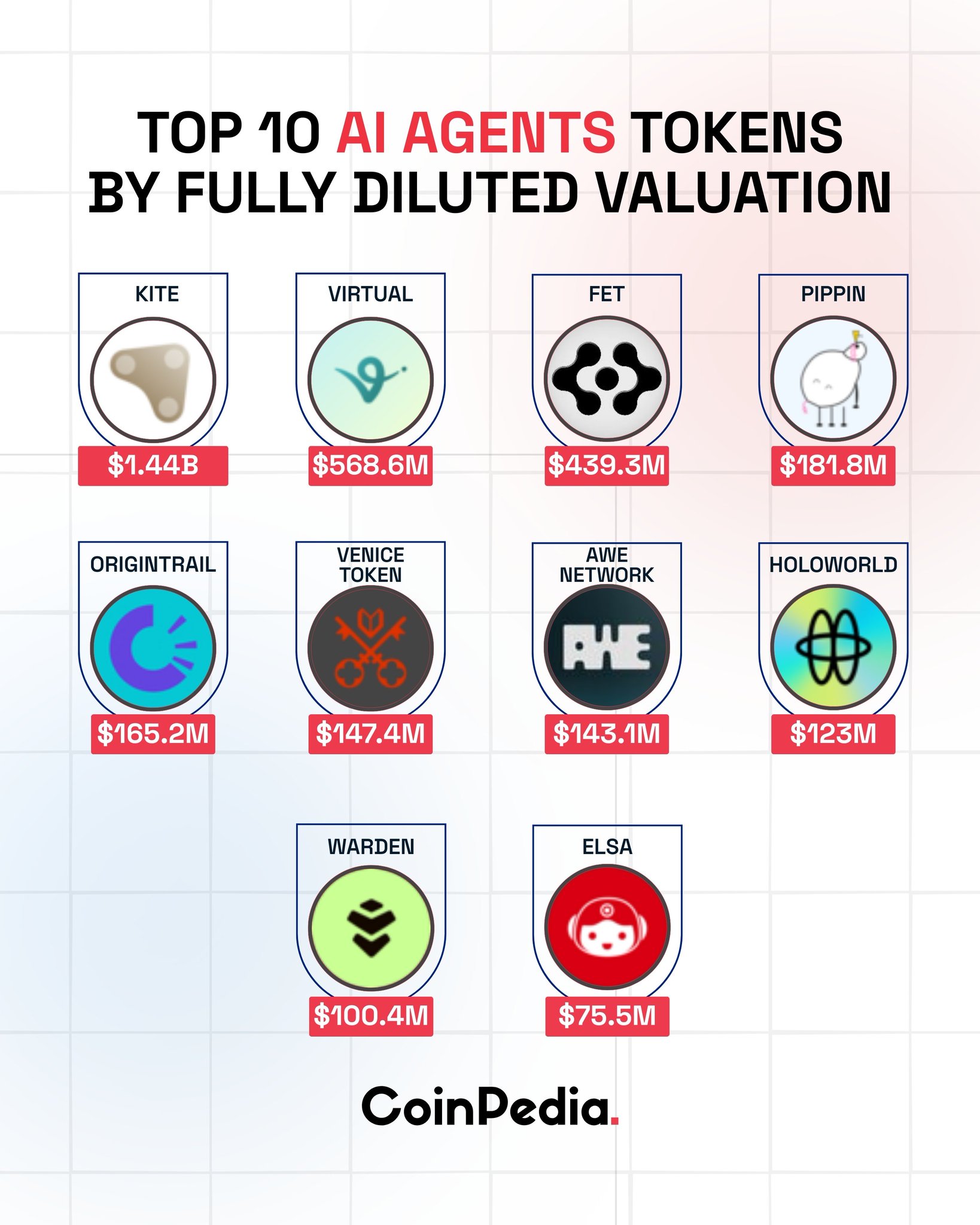

18 4 4.04K Оригинал >Тренд KITE после выпускаБычийBS KOL Club推荐的KITE项目在市场低迷中逆势上涨54.8%,同时BTC和ETH也出现反弹。 Coinpedia Media Researcher D15.69K @CoinpediaNews

Coinpedia Media Researcher D15.69K @CoinpediaNewsTop 10 AI Agents Tokens Ranked by FDV ➡️ @GoKiteAI leads the AI agents sector by FDV at $1.44B, followed by @virtuals_io and @Fetch_ai. ➡️ Mid-tier players like @ThePippinCo, @origin_trail, and @AskVenice token show growing traction. #CoinPedia #CryptoNews #Blockchain #CryptoMarket

4 0 196 Оригинал >Тренд KITE после выпускаНейтральноCoinpedia released the top 10 AI agent tokens ranked by FDV, with KITE leading at $1.44B.

4 0 196 Оригинал >Тренд KITE после выпускаНейтральноCoinpedia released the top 10 AI agent tokens ranked by FDV, with KITE leading at $1.44B. EnHeng嗯哼🔸BNB Influencer Tokenomics_Expert B91.75K @EnHeng456

EnHeng嗯哼🔸BNB Influencer Tokenomics_Expert B91.75K @EnHeng456There aren't many projects in the market that are seriously doing AI these days. The two tokens I carefully selected this time, Kite and Ub, barely dropped during market swings, further confirming one point: a good product deserves a good price. The rise of Moltbook actually shows that the autonomous agent internet is already materializing. AI is no longer just for chatting; it is now actually working, earning money, and collaborating. The underlying capability that supports all this is the call path of x402 plus ERC-8004. In plain terms, ERC-8004 provides AI with an ID card and credit record. Each AI is bound to an NFT that serves as its on‑chain identity; its work history, whether it has actually received payments, and user reviews are publicly recorded and can be queried by anyone. For important tasks, mandatory verification can be enforced to prevent misuse. When AI has an identity, credit, and can be verified, the autonomous agent internet can truly take off, and ERC-8004 is what Unibase has been working on recently.

Unibase D27.79K @Unibase_AI

Unibase D27.79K @Unibase_AIhttps://t.co/OhBcSxCHPi

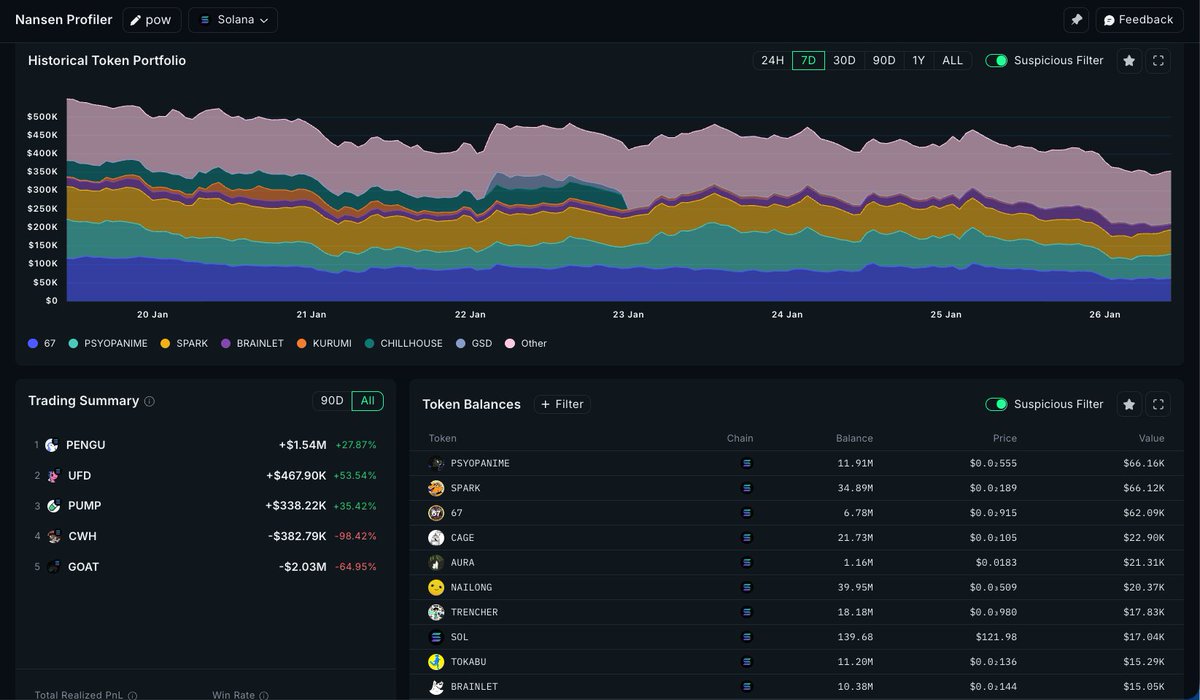

42 24 12.19K Оригинал >Тренд KITE после выпускаБычийKITE and UB, backed by AI underlying technology, demonstrate stable performance and are worth a bullish outlook. deathmage.x .edge🦭 DeFi_Expert OnChain_Analyst B2.46K @phanthanguss

deathmage.x .edge🦭 DeFi_Expert OnChain_Analyst B2.46K @phanthangussJust discovered a rarely mentioned perspective in @nansen_ai: Counterparty Reaction Lens (that's what I call it). It doesn't look at who is buying, but at “who reacts fastest, who is slow‑warm”, clustering labels by response latency, first‑move frequency, and follow‑up window. Looked at a small‑cap $KITE: - Fast‑reaction cohort (median latency ~6s) instantly exits the pool after oracle fluctuations. - Slow‑warm cohort (average follow‑up 6‑12h) steadily takes orders during price pull‑back. Conclusion: Within the same chain of actions, the tempo contrast can determine whether it’s a split‑second liquidity‑scraping cut or a later, slowly accumulated “clean” buying pressure. Playbook I ran: 1) Open Reaction Lens → filter label = market‑maker / grant / algo 2) Set threshold: first‑move latency <10s and follow‑ratio >0.6 as high‑tempo cohort alert 3) For the target, place three orders: first a very shallow maker (0.25%), set exchange‑inflow auto‑abort; rebuild the main position 50%/50% after the slow‑warm cohort kicks in 4) Attach the tempo alert to a shared Playbook for the team to vote on scaling up Live result: avoided a sudden pool‑clearing slippage, later captured an about 2.1% cleaner entry price in the slow‑warm entry window. Who is using response time / execution tempo to rhythmically adjust positions? Any latency thresholds you can share? #onchain #trading #risk

3 3 99 Оригинал >Тренд KITE после выпускаБычийIntroducing a new Nansen perspective, analyzing trader response speed, successfully applied to KITE to avoid slippage and earn 2.1% profit.

3 3 99 Оригинал >Тренд KITE после выпускаБычийIntroducing a new Nansen perspective, analyzing trader response speed, successfully applied to KITE to avoid slippage and earn 2.1% profit. BS Kol Club Media Influencer A12.34K @BSKolClub

BS Kol Club Media Influencer A12.34K @BSKolClub✨ BS KOL Club Weekly Recommended Projects|#Issue91 This week’s picks: $KITE, $HYPE, $CLAWD Overnight and into this morning, the crypto market extended its rebound, with Bitcoin holding above USD 89,000 and Ethereum breaking past USD 3,000. U.S. equities were mixed: the Dow fell 0.83%, while the S&P 500 rose 0.41% and the Nasdaq gained 0.91%. Crypto-related stocks showed divergence—treasury-focused firms MSTR (+0.62%), BMNR (+5.5%), and ALTS (+10.05%) advanced, while sector companies COIN (-1.24%), GEMI (-4.88%), and CRCL (-1.33%) declined. On-chain data shows Bitcoin’s network hashrate plunged from 1.16 ZH/s to 690 EH/s, marking the largest drop on record, before beginning to recover. Analysts attribute this to the U.S. winter storm “Fernand,” where extreme cold and widespread power outages forced multiple mining pools offline, causing a temporary hashrate decline. On the macro front, Wall Street’s Rick Rieder is seen as a potential driver of more market-oriented Fed policy. He previously advocated a 50-b

26 5 2.89K Оригинал >Тренд KITE после выпускаБычийBS KOL Club推荐的KITE项目在市场低迷中逆势上涨54.8%,同时BTC和ETH也出现反弹。

26 5 2.89K Оригинал >Тренд KITE после выпускаБычийBS KOL Club推荐的KITE项目在市场低迷中逆势上涨54.8%,同时BTC和ETH也出现反弹。 EnHeng嗯哼🔸BNB Influencer Tokenomics_Expert B91.75K @EnHeng456

EnHeng嗯哼🔸BNB Influencer Tokenomics_Expert B91.75K @EnHeng456I've continuously been holding some $Kite, and before its listing sister jiayi kept telling me it's a good project and to keep a close watch. I noticed it's the PayPal prince, and the last time it faced FUD I even added a bit more, holding it till now. Kite remains so resilient largely because the whole team keeps building. I also see founder @ChiZhangData still working on the front lines, not opting to rest. Kite has never really topped the gainers list, yet it rose 70% over the past month.

jiayi 加一 D22.41K @mscryptojiayi

jiayi 加一 D22.41K @mscryptojiayiKite has never topped the gainers list, but it jumped 70% in a month. Who understands this even higher surge? https://t.co/nmScz5tOgL

59 42 10.20K Оригинал >Тренд KITE после выпускаБычийKITE up 70% this month, team continues building, recommend bullish holding OCT Gems FA_Analyst Influencer C11.47K @oct_gems

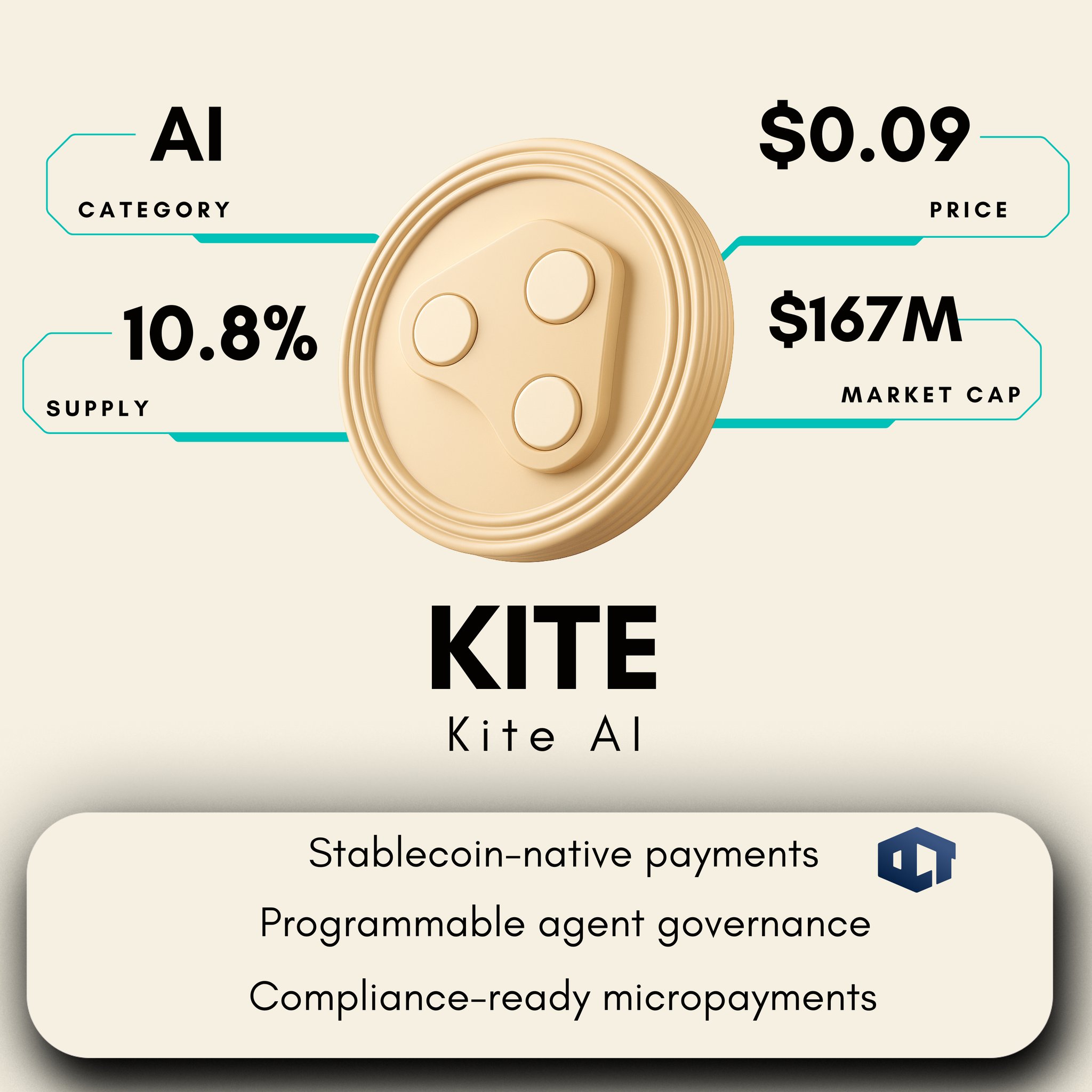

OCT Gems FA_Analyst Influencer C11.47K @oct_gems🚨 $KITE REVIEW: 1⃣ Introduction: • @GoKiteAI is the first AI payment blockchain, designed as a foundational Layer 1 infrastructure for the autonomous economy, enabling AI agents to discover, negotiate, and transact securely with cryptographic identities, programmable governance, and native stablecoin access. • It addresses limitations in agentic commerce by providing verifiable provenance, low-fee payments, and interoperability across chains, backed by investors like PayPal Ventures, General Catalyst, and Coinbase Ventures, with integrations for ecosystems like Avalanche and BNB Chain. • Kite AI pioneers x402 standards for modular security and agent-to-agent transactions, fostering an open, trustless environment for AI-driven payments and aiming to capture the multi-billion-dollar agent economy by 2030. 2⃣ How Does Kite AI Work? • Kite AI functions as a Proof of Artificial Intelligence (PoAI) Layer 1 blockchain, where agents receive cryptographic passports for identity verification, programmable rules for governance, and seamless stablecoin lanes for instant, low-cost transactions across protocols. • It supports autonomous operations through on-chain logging, ZK proofs for verifiability, and cross-chain bridges (e.g., via Stargate Finance), allowing agents to handle tasks like payments, collaborations, and executions without human intervention. Kite AI operates through a multi-component architecture: • The Chain Backbone: A PoAI consensus Layer 1 with 1-second block times and sub-$0.000001 fees for scalable AI operations. • The Identity Layer: Provides Agent Passports with ERC-8004-like cryptographic IDs for traceability and provenance. • The Governance Layer: Programmable constraints for permissions, spending limits, and behavior controls. • The Payment Layer: Native stablecoin rails with x402 for agentic, multi-protocol transactions. By structuring its operations in this way, Kite AI aims to provide a scalable, verifiable payment experience that minimizes trust issues and enhances autonomy for AI agents. 3⃣ Key Features: • Agentic Network: World's first platform for discovering and listing AI agents to perform autonomous tasks like e-commerce or services. • Verifiable Identity: Cryptographic passports ensuring traceability, provenance, and reputation for AI entities. • Programmable Governance: Custom rules for permissions, limits, and automated blocks on suspicious activities. • Instant Payments: Near-zero fee stablecoin transfers with x402 compatibility for cross-chain interoperability. 4⃣ Tokenomics: 𝑷𝒓𝒊𝒄𝒆: $0.09 𝑴𝒂𝒓𝒌𝒆𝒕 𝑪𝒂𝒑: $163 million 𝑪𝒊𝒓𝒄𝒖𝒍𝒂𝒕𝒊𝒐𝒏 𝒔𝒖𝒑𝒑𝒍𝒚: 1.8 billion 𝑴𝒂𝒙 𝒔𝒖𝒑𝒑𝒍𝒚 : 10 billion 5⃣ Conclusion: • Kite AI transforms payments for AI agents with a dedicated blockchain focused on security, scalability, and autonomy through x402 and PoAI. • Its layered architecture and ecosystem integrations position it as a leader in agentic commerce, with tools for identity, governance, and seamless transactions. • With strong backing, exchange listings, and utility in fees, staking, and governance, $KITE drives value in the emerging autonomous economy.

9 0 362 Оригинал >Тренд KITE после выпускаЧрезвычайно бычийKite AI, as an AI payment blockchain, its innovative technology and strong backing make it highly promising.

9 0 362 Оригинал >Тренд KITE после выпускаЧрезвычайно бычийKite AI, as an AI payment blockchain, its innovative technology and strong backing make it highly promising. OCT Gems FA_Analyst Influencer C11.47K @oct_gems

OCT Gems FA_Analyst Influencer C11.47K @oct_gems🚨 𝐆𝐞𝐦 𝐀𝐥𝐞𝐫𝐭 🚨 💎 $KITE 💎 @GoKiteAI 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰 : 👉 Kite is building a Al payment blockchain, a foundational infrastructure where autonomous Al agents can operate with verifiable identity and programmable governance, with native access to stablecoin payments. 👉 They present the SPACE framework as the complete solution: Stablecoin-native: Every transaction settles in stablecoins with predictable sub-cent fees. Programmable constraints: Spending rules enforced cryptographically, not through trust. Agent-first authentication: Hierarchical wallets with cryptographic principal binding. Compliance-ready: Immutable audit trails with privacy-preserving selective disclosure. Economically viable micropayments: True pay-per-request economics at global scale. 🪙 𝐓𝐨𝐤𝐞𝐧𝐨𝐦𝐢𝐜𝐬 : 🔺 𝑪𝒖𝒓𝒓𝒆𝒏𝒕 𝒑𝒓𝒊𝒄𝒆: $0.092 🔺𝑻𝒐𝒌𝒆𝒏 𝑻𝒊𝒄𝒌𝒆𝒓: $KITE 🔺𝑴𝒂𝒓𝒌𝒆𝒕 𝒄𝒂𝒑: $167M 🔺𝑪𝒊𝒓𝒄𝒖𝒍𝒂𝒕𝒊𝒐𝒏 𝒔𝒖𝒑𝒑𝒍𝒚: 1.8B 🔺𝑻𝒐𝒕𝒂𝒍 𝑺𝒖𝒑𝒑𝒍𝒚: 10B "Always take whatever you read on the internet with a pinch of salt, do your own research, NFA"

10 1 836 Оригинал >Тренд KITE после выпускаБычийKITE作为AI支付区块链潜力币被推荐。

10 1 836 Оригинал >Тренд KITE после выпускаБычийKITE作为AI支付区块链潜力币被推荐。- Тренд KITE после выпускаНейтральноOnly mentions KITE, no specific viewpoint or sentiment

Naveed Influencer Educator B23.67K @navex_eth

Naveed Influencer Educator B23.67K @navex_ethAI agents need a way to pay and transact @GoKiteAI is building a Layer 1 blockchain designed for agentic payments, where AI agents can operate with clear identity and rules. Kite separates users, agents, and sessions, making automation safer and more controlled $KITE #KITE https://t.co/514z4nTsS7

Naveed Influencer Educator B23.67K @navex_eth

Naveed Influencer Educator B23.67K @navex_ethThe network is EVM-compatible and built for real-time activity $KITE powers the ecosystem, starting with participation incentives and later adding staking, governance, and fees Built for AI-first economies #KITE

6 3 227 Оригинал >Тренд KITE после выпускаБычийKITE builds L1 blockchain payments for AI agents, with the token empowering the ecosystem.